Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

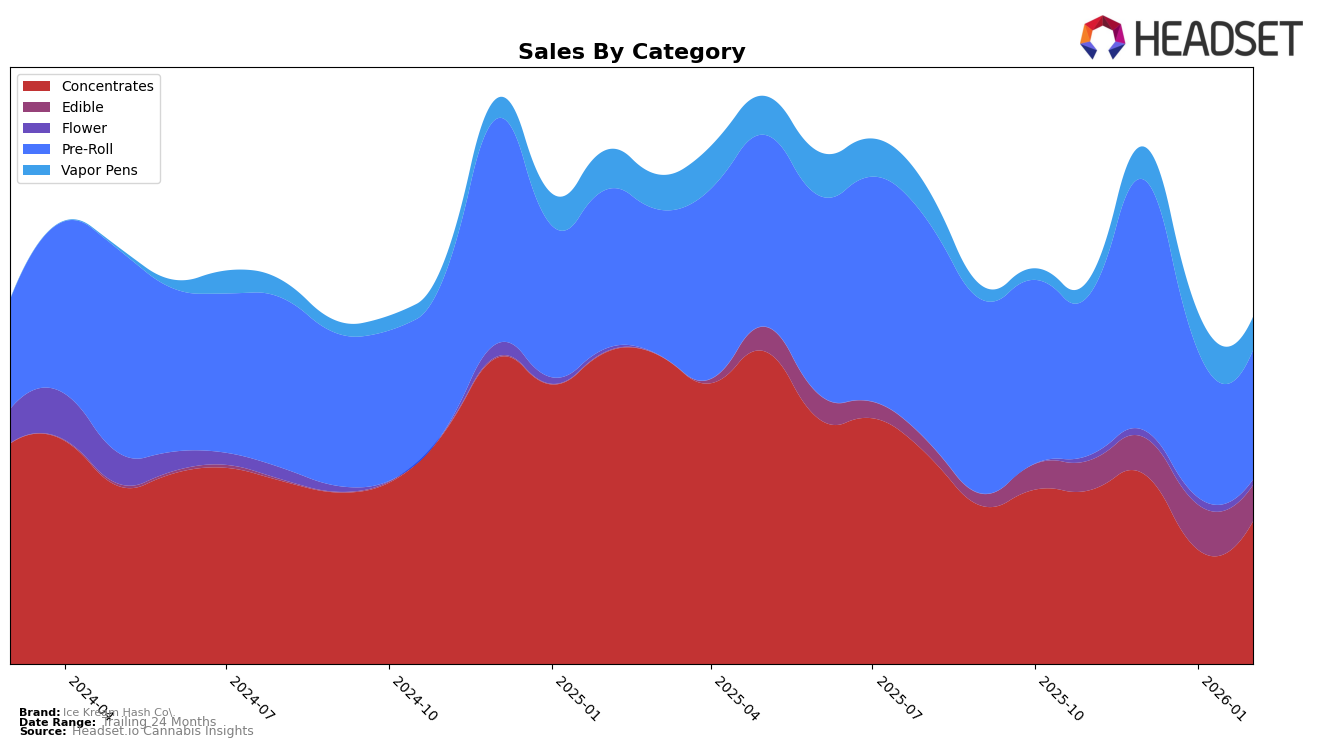

Ice Kream Hash Co. has shown varied performance across different product categories in Michigan. In the Concentrates category, the brand maintained a strong presence, with rankings fluctuating between 9th and 14th from November 2025 to February 2026. Although there was a dip in sales in January 2026, the brand managed to climb back to the 11th spot by February. This indicates a resilient market position despite the competitive landscape. In contrast, the brand's performance in the Vapor Pens category highlights challenges, as they were not even in the top 30 brands in November 2025, but managed to enter the rankings by December, albeit at a lower position, suggesting a potential area for growth or increased marketing efforts.

In the Edibles category, Ice Kream Hash Co. showed a steady improvement in rankings, starting at 68th in November 2025 and reaching 53rd by January 2026, although there was a slight decline to 59th in February. This upward trend in the earlier months could indicate successful product launches or promotional campaigns that resonated well with consumers. The Pre-Roll category, however, presented a mixed bag of results. The brand peaked at 23rd in December 2025 but faced a decline in subsequent months, settling at 38th by February. This volatility might suggest fluctuating consumer preferences or increased competition in this segment. Overall, while Ice Kream Hash Co. shows strengths in certain areas, there are clear opportunities for strategic improvements across various product lines.

Competitive Landscape

In the competitive landscape of the concentrates category in Michigan, Ice Kream Hash Co. has experienced fluctuating rankings over the past few months, with its position shifting from 9th in November 2025 to 11th by February 2026. This indicates a slight downward trend in rank, although its sales figures have shown resilience, particularly with a notable increase from January to February 2026. In contrast, Old School Hash Co. consistently outperformed Ice Kream Hash Co., maintaining a higher rank throughout the same period, despite a decline in sales from December 2025 to February 2026. Meanwhile, Rocket Fuel has shown a remarkable improvement in rank, climbing from 15th in November 2025 to 9th in February 2026, which could pose a competitive threat to Ice Kream Hash Co. if this upward trajectory continues. Additionally, High Minded and Exotic Matter have experienced more volatility, with Exotic Matter dropping out of the top 20 in January 2026, suggesting potential opportunities for Ice Kream Hash Co. to capitalize on any market instability among its competitors.

Notable Products

In February 2026, the top-performing product for Ice Kream Hash Co. was the Strawberry Live Rosin Gummies 20-Pack (200mg) in the Edible category, maintaining its position at rank 1 from December 2025. It achieved notable sales figures of 1744. The CBD/THC 1:2 Cherry Live Hash Rosin Gummies 10-Pack (100mg CBD, 200mg THC) showed a significant improvement, climbing to rank 2 from rank 4 in the previous two months. Super Boof Live Rosin (1g) debuted strongly at rank 3 in the Concentrates category. The Ice Kream Hash x True Organics- Single Scoop - Nastiest Cake Rosin Infused Pre-Roll (0.5g) re-entered the rankings at position 4, while the Watermelon Rosin Gummies 20-Pack (200mg) dropped to rank 5 from rank 3 in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.