Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

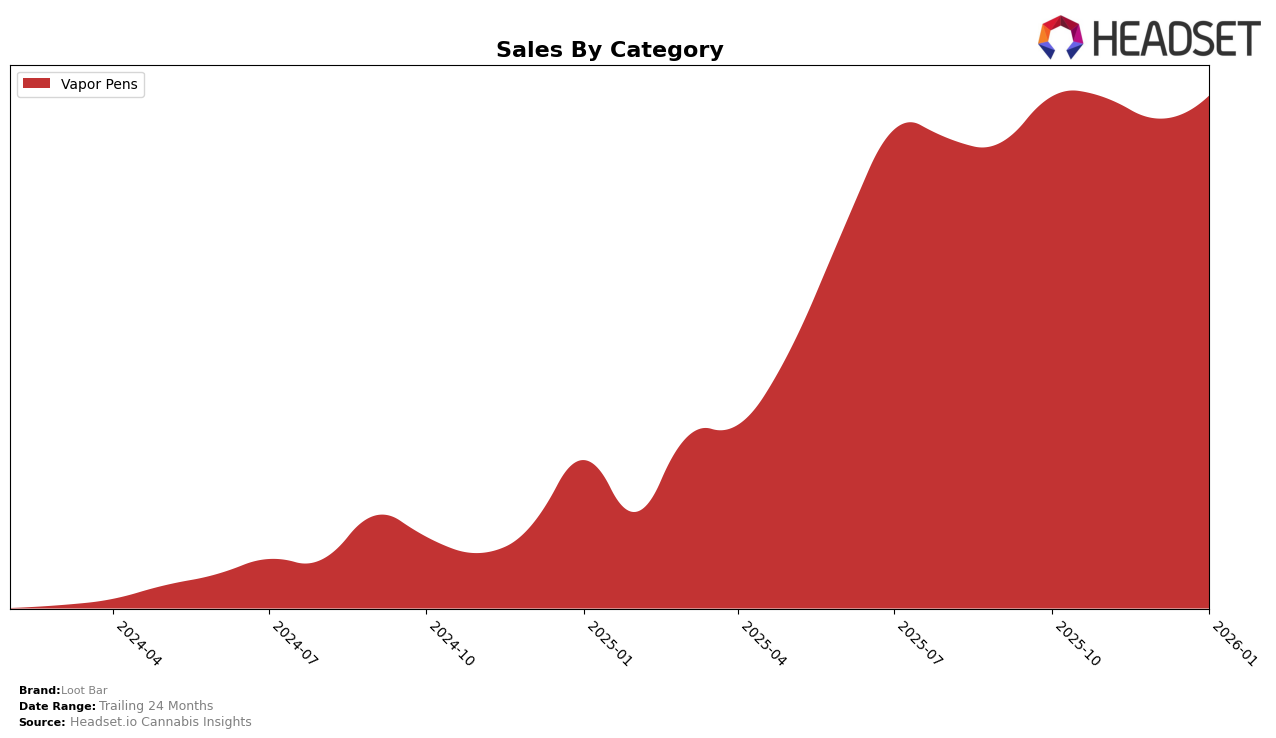

In the state of Oregon, Loot Bar has consistently maintained its position in the Vapor Pens category, holding steady at rank 8 from October 2025 through January 2026. This stable performance suggests a strong foothold in the market, despite a slight dip in sales in December 2025. The sales figures reflect a minor fluctuation, with a decrease in December, followed by a recovery in January 2026, indicating resilience and customer loyalty in the region.

While Loot Bar's performance in Oregon is noteworthy, the absence of rankings in other states or categories within the top 30 indicates areas for potential growth or challenges in market penetration. The consistent ranking in Oregon highlights the brand's established presence in the Vapor Pens category, but the lack of visibility in other regions or categories could suggest either a strategic focus or untapped opportunities for expansion. This insight into Loot Bar's market dynamics provides a glimpse into its current standing and potential avenues for growth.

Competitive Landscape

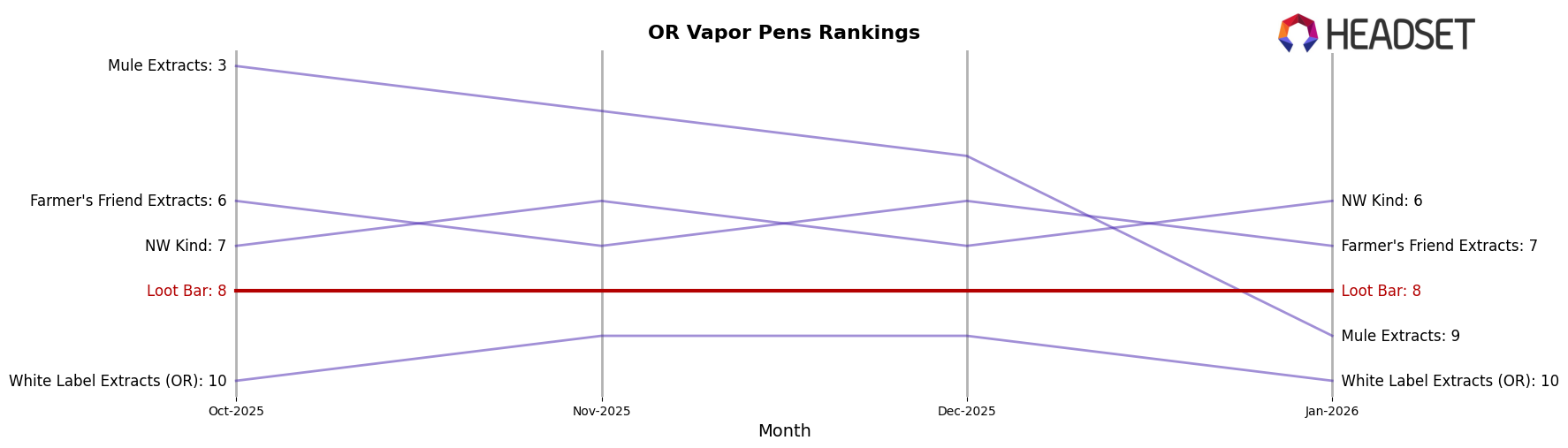

In the competitive landscape of vapor pens in Oregon, Loot Bar has maintained a consistent rank of 8th from October 2025 through January 2026. Despite this stability, the brand faces stiff competition from other players in the market. NW Kind and Farmer's Friend Extracts have been trading places between the 6th and 7th ranks, indicating a dynamic rivalry just above Loot Bar. Meanwhile, Mule Extracts experienced a notable decline from 3rd to 9th place over the same period, which could provide an opportunity for Loot Bar to climb the ranks if they capitalize on this shift. Additionally, White Label Extracts (OR) has remained close behind Loot Bar, fluctuating between 9th and 10th place, suggesting that maintaining their current position will require strategic efforts. Overall, while Loot Bar's sales have shown slight fluctuations, the brand's stable ranking amidst these competitive dynamics highlights both the challenges and opportunities present in the Oregon vapor pen market.

Notable Products

In January 2026, the top-performing product from Loot Bar was Lemon Grenade Lights Liquid Diamonds Cannabis Terpenes Disposable (2g) in the Vapor Pens category, securing the first rank with sales of 1371 units. Following closely in second place was the Blackberry Kush Liquid Diamonds Cannabis Terpenes Blend Disposable (2g), with 1358 units sold. Desert Diesel Liquid Diamonds Cannabis Terpenes Blend Disposable (2g) held the third position, showing strong performance with 1333 units. Polynesian Cookies Liquid Diamonds Cannabis Terpenes Disposable (2g) dropped to third rank from its previous top position in December, despite consistent sales of 1333 units. Marionberry Pie Liquid Diamonds Cannabis Terpenes Disposable (2g) entered the top five, ranking fourth, demonstrating steady demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.