Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

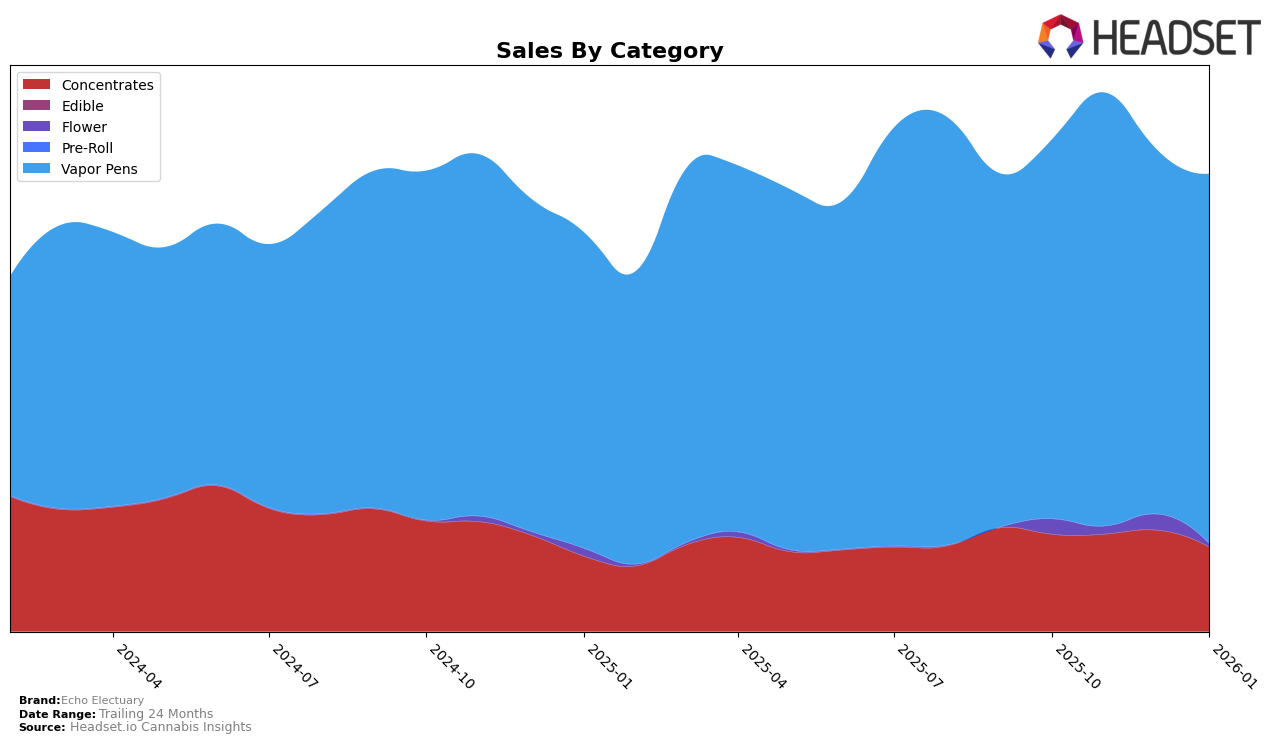

Echo Electuary has shown varied performance across different categories in the state of Oregon. In the Concentrates category, the brand experienced a slight decline in its ranking, moving from 11th in October and November 2025 to 15th by January 2026. This shift could indicate increasing competition or changing consumer preferences in the Concentrates market. Despite this downward trend in ranking, the sales figures experienced a peak in December 2025 before dropping in January 2026, suggesting a temporary surge in demand or a successful promotional period that was not sustained into the new year.

In contrast, Echo Electuary maintained a more stable presence in the Vapor Pens category within Oregon. The brand consistently held the 11th position from October to November 2025, briefly dropping to 12th in December before regaining its 11th place in January 2026. This consistency in ranking, coupled with fluctuations in sales figures, suggests a stable consumer base with periodic variations in purchasing behavior. Notably, the sales figures for Vapor Pens took a dip in December, which could be attributed to seasonal factors or shifts in consumer spending habits during the holiday season.

Competitive Landscape

In the Oregon Vapor Pens category, Echo Electuary has demonstrated a relatively stable performance, maintaining a consistent rank of 11th in October, November, and January, with a slight dip to 12th in December 2025. This stability suggests a resilient market presence despite fluctuating sales figures, which peaked in November 2025. In contrast, White Label Extracts (OR) consistently outperformed Echo Electuary, holding a higher rank and experiencing stronger sales, particularly in November 2025. Meanwhile, Mule Extracts showed a downward trend from 3rd to 9th place, indicating potential market volatility that Echo Electuary could capitalize on. Higher Cultures and Gem Carts trailed behind Echo Electuary, suggesting that while Echo Electuary faces stiff competition from some brands, it maintains a competitive edge over others in the Oregon market.

Notable Products

In January 2026, Echo Electuary's top-performing product was Cherry Pie Live Nectar Cartridge (1g) from the Vapor Pens category, achieving the number one rank with sales of 784 units. Following closely, Modified Grapes Live Nectar Cartridge (1g) secured the second spot with 733 units sold. Detroit Muscle Live Nectar Cartridge (1g) ranked third, while Dutch Treat Live Nectar Cartridge (1g) and Lift Ticket Live Nectar Cartridge (1g) rounded out the top five. This marks a significant debut for these products, as they were not ranked in the preceding months of October, November, or December 2025. The introduction of these new high-performing products suggests a strategic shift or expansion in Echo Electuary's Vapor Pens lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.