Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

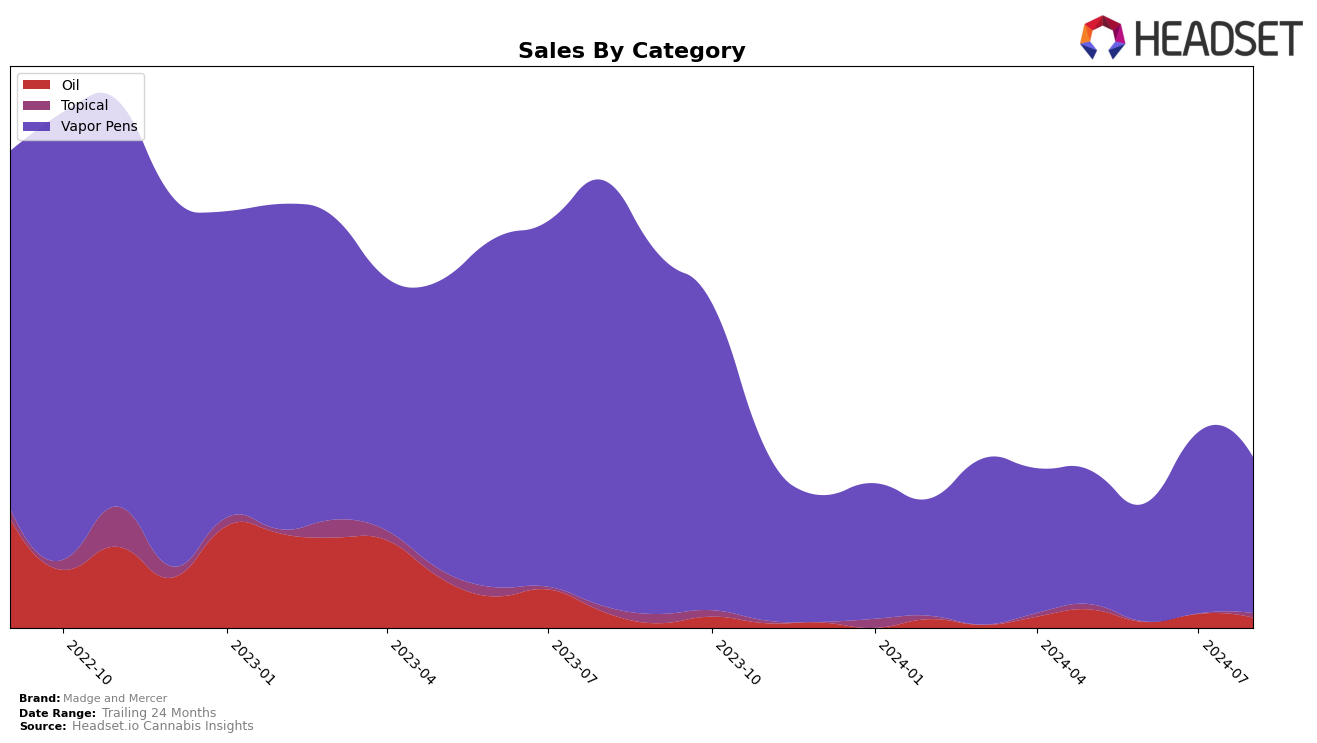

Madge and Mercer has shown fluctuating performance across various categories and states. In the Vapor Pens category in Ontario, the brand did not rank within the top 30 brands for the months of May, June, and July 2024. However, there was a noticeable shift in August 2024, where Madge and Mercer entered the rankings at the 100th position. This entry, although not within the top 30, indicates a potential upward trend in market presence and sales volume. The sales figures for August 2024 were recorded at $14,105, showing a decrease from previous months but suggesting that the brand is gaining some traction in the competitive landscape.

Despite the challenges in maintaining a top 30 ranking, the brand's performance in the Vapor Pens category reveals important insights. The lack of a ranking in the earlier months could be seen as a drawback, but the consistent sales figures suggest a loyal customer base and steady demand. The data highlights the importance of monitoring market trends and consumer preferences, as Madge and Mercer’s entry into the rankings in August could signal a strategic pivot or increased marketing efforts. This movement is crucial for stakeholders to consider as it reflects the brand's potential for growth and resilience in a dynamic market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Ontario, Madge and Mercer has experienced notable fluctuations in its market position over the recent months. Despite entering the top 100 in July 2024, Madge and Mercer maintained its rank at 100 in August 2024, indicating a struggle to gain significant traction. In contrast, Feather has seen a downward trend, dropping from rank 63 in May 2024 to 97 in August 2024, which could suggest a potential opportunity for Madge and Mercer to capture some of Feather's market share. Meanwhile, Disco Fsh has also shown a decline, moving from rank 75 in May 2024 to 96 in August 2024. The top-tier brand, Cookies, was notably absent from the top 20 rankings in the same period, which may indicate a shift in consumer preferences or market dynamics. For Madge and Mercer, these insights highlight both challenges and opportunities in the competitive Vapor Pens market in Ontario, suggesting a need for strategic adjustments to improve rank and sales performance.

Notable Products

In August 2024, the top-performing product from Madge and Mercer was CBD MM 002 El Alevio Menta Co2 Disposable Pen (0.5g) in the Vapor Pens category, maintaining its number one rank from July with sales of 201 units. Following closely was CBD:THC 2:1 La Pasion Co2 Cartridge (1g), also in the Vapor Pens category, which held the second position with a significant increase in sales from 105 units in July to 185 units in August. CBD MM_001 La Calma Lemongrass Ginger Oil (25ml) in the Oil category improved its rank to third place from fourth, although its sales figures were lower compared to the top two products. CBN CBD MM 005 Bonne Nuit Co2 Cartridge (1g) dropped to fourth place from third, experiencing a notable decline in sales. Lastly, CBD:THC MM 004 L'Émollient Meadowfoam Seed Facial Serum (350mg CBD, 17.50mg THC, 25ml) re-entered the rankings in fifth place with 10 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.