Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

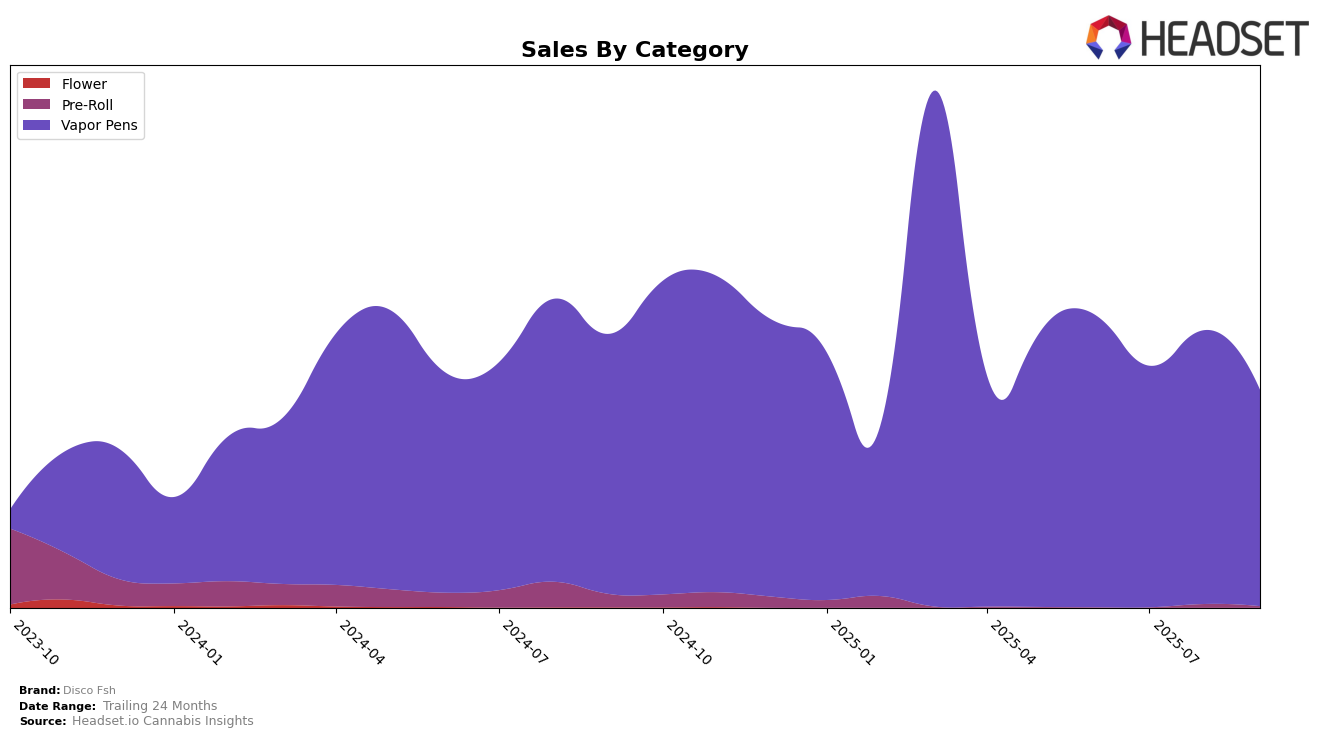

Disco Fsh has shown a varied performance across different Canadian provinces, particularly in the Vapor Pens category. In Alberta, the brand has maintained a consistent presence, securing the 30th rank in both June and September 2025, despite a dip to 36th in July. This fluctuation indicates a resilient comeback, suggesting a strong consumer base in the province. However, in British Columbia, Disco Fsh did not make it into the top 30, with its highest ranking being 51st in June, which could be a point of concern for the brand's market penetration in this region.

In Ontario, Disco Fsh's performance in the Vapor Pens category has seen a downward trend, with its rank slipping from 74th in June to 100th by September. This decline might be indicative of increasing competition or changing consumer preferences in the province, which could impact their strategy moving forward. Despite these challenges, Disco Fsh's sales figures in Alberta reveal a promising trend, with a notable increase from July to August 2025, before a slight decrease in September. This suggests that while there are hurdles, there are also opportunities for growth and recovery in certain markets.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Disco Fsh has shown resilience despite facing stiff competition. Over the months from June to September 2025, Disco Fsh maintained a relatively stable ranking, hovering around the 30th position. Notably, Vox and Trippy Sips experienced a decline in their rankings, with Vox dropping from 22nd to 32nd and Trippy Sips from 18th to 31st, indicating potential vulnerabilities that Disco Fsh could capitalize on. Meanwhile, Frootyhooty and GORILLA GARDEN CRAFT CANNABIS & EXTRACTS have shown a more stable or improving trend, with the latter climbing from 53rd to 28th. Despite these dynamics, Disco Fsh's sales have shown a slight upward trend from July to August, suggesting a potential for growth if strategic adjustments are made to leverage the shifting market positions of its competitors.

Notable Products

In September 2025, the top-performing product for Disco Fsh was the Gucci - Juicy Fruit & Sour Green Apple Distillate Dual Chamber Disposable 2-Pack (1.2g) in the Vapor Pens category, maintaining its number one rank from August with sales of 1081 units. The Orange Crush & Blue Ice Raspberry Distillate Dual Chamber Disposable 2-Pack (1.2g) held the second position, showing a slight decrease from its leading position in August. Nerds - Orange Crush & Blue Ice Raspberry Distillate Dual Chamber Disposable 2-Pack (1.2g) consistently ranked third throughout the observed months. The Nerds Distillate Dual Chamber Disposable 2-Pack (1.2g) remained steady at rank four, while the Shlaughter Melon Co2 Cartridge (1g) held its fifth position since it was introduced in August. Overall, the rankings for these products have shown stability, with only minor shifts in positions over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.