Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

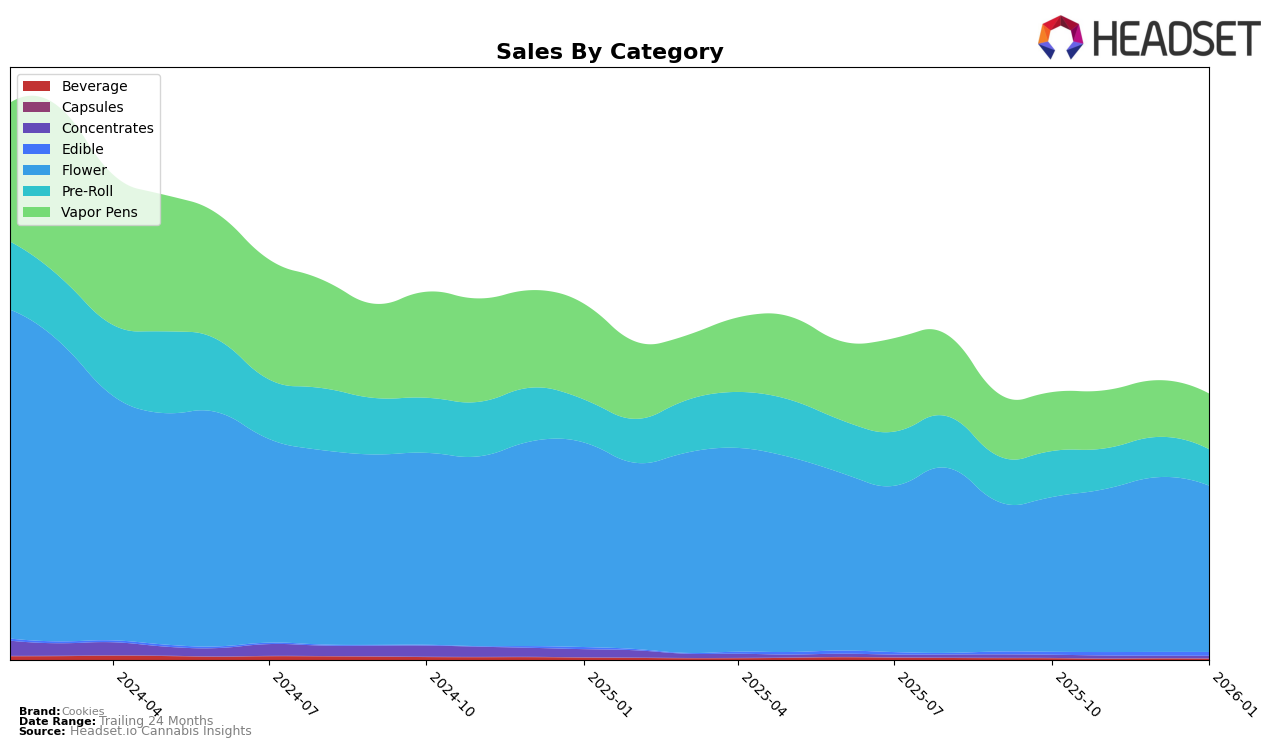

In the dynamic landscape of cannabis brands, Cookies has shown varied performance across different states and categories. In California, the brand has faced challenges in maintaining its rankings, particularly in the Flower and Pre-Roll categories, where it fell out of the top 30 by January 2026. This decline is mirrored in their sales figures, which have also decreased over the months. In contrast, Illinois presents a more stable picture for Cookies, especially in the Vapor Pens category, where the brand improved its ranking from 38 to 25 between October 2025 and January 2026, reflecting a positive trend in consumer demand.

Meanwhile, the performance of Cookies in New Jersey is noteworthy, especially in the Flower category, where the brand climbed from 22nd to 15th place over the same period, accompanied by a significant increase in sales. However, in Massachusetts, Cookies experienced a dip in their Flower category ranking, dropping to 72nd place in December 2025 before recovering to 54th in January 2026. It's also important to note the brand's absence from the top 30 in certain categories and states, such as Vapor Pens in Nevada and New York, which highlights areas where Cookies could potentially focus on improving their market presence.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Cookies has demonstrated a notable upward trajectory in brand rank from October 2025 to January 2026. Initially positioned at rank 27, Cookies has climbed to rank 16 by January 2026, showcasing a consistent improvement in market presence. This upward movement is particularly significant when compared to competitors like Good Green, which fluctuated between ranks 16 and 20, and Appalachian Pharm, which experienced a decline from rank 13 in December to rank 18 in January. Meanwhile, Meigs County Grown maintained a stronger position, consistently ranking between 14 and 15, and Herbal Wellness Center held steady at ranks 17 and 19. Despite the competitive pressure, Cookies' sales have shown a robust increase, particularly from November to December 2025, indicating a successful strategy in capturing market share and enhancing brand visibility in Ohio's flower market.

Notable Products

In January 2026, Cookies' top-performing product was Blue Raz (2.83g) in the Flower category, which rose to the number one rank with sales reaching 5549. Gary Payton Pre-Roll (1g) maintained its strong performance, holding steady at the second rank with sales of 4749. Ridgeline Lantz Pre-Roll (1g) emerged as a new contender, securing the third position. Blue Suede Pre-Roll (1g) also made its debut in the rankings at fourth place. Notably, Cinnamon Milk (3.5g), which had consistently held the top spot in previous months, dropped to fifth place with a significant decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.