Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

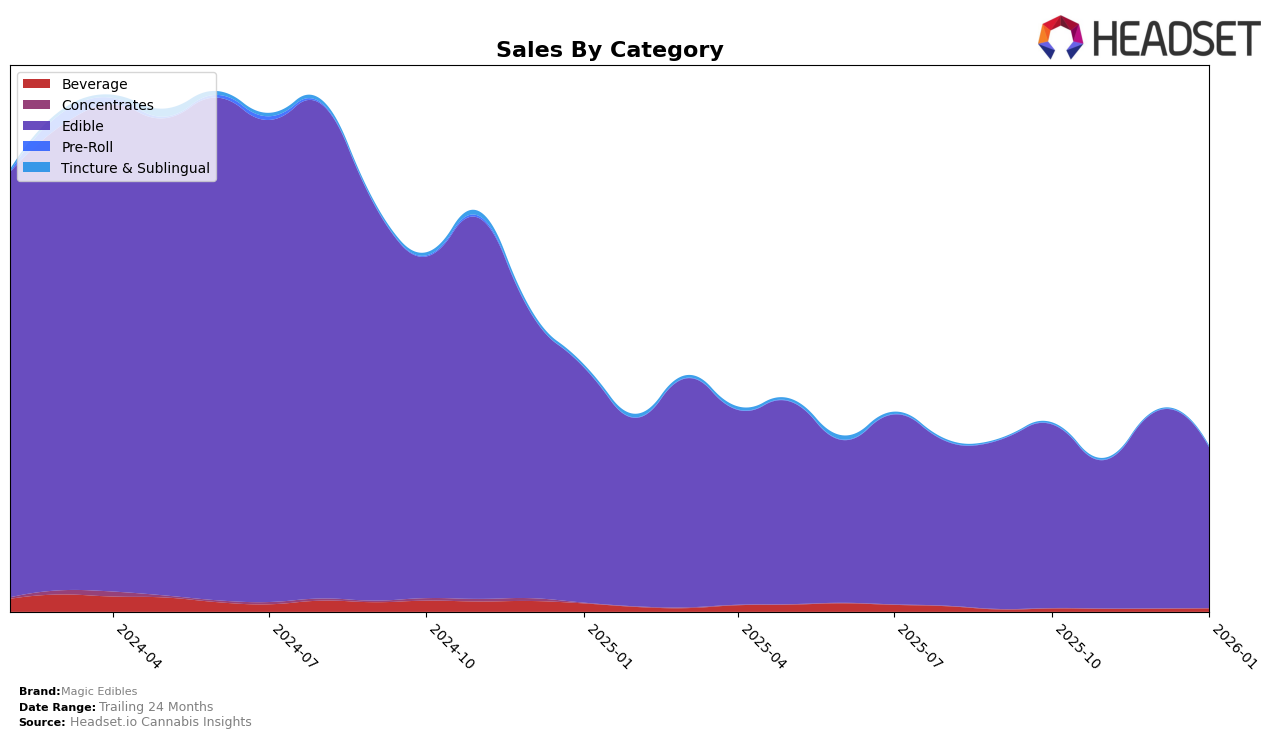

Magic Edibles has shown a fluctuating performance across different states and categories, with notable activity in the Michigan market. In the Edible category, Magic Edibles experienced a dip in their ranking from 26th in October 2025 to 32nd in November 2025, before rebounding to 27th in December 2025 and maintaining that position into January 2026. This indicates a recovery after a brief setback, reflecting their resilience in the competitive landscape of Michigan's edible market. The sales figures corroborate this trend, with a notable increase from November to December, suggesting a successful strategy or product launch during the holiday season.

However, the absence of Magic Edibles from the top 30 rankings in certain states and categories could be seen as a missed opportunity or an area for improvement. The fact that they were not ranked in the top 30 in some markets highlights the competitive nature of the cannabis industry and the challenges brands face in maintaining a strong presence across all regions. These insights suggest that while Magic Edibles has a foothold in Michigan, there is potential for expansion or increased focus in other states to improve their market position and overall brand performance.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Magic Edibles has experienced fluctuations in its ranking over the past few months, indicating a dynamic market environment. In October 2025, Magic Edibles held the 26th position, but by November, it had dropped to 32nd, before recovering slightly to 27th in December and maintaining that rank in January 2026. This volatility contrasts with competitors like Platinum Vape and Mitten Extracts, which have shown more consistent rankings, with Platinum Vape improving from 30th to 25th and Mitten Extracts maintaining a stable rank around 24th before a slight dip in January. Meanwhile, PC Pure and Petra have generally outperformed Magic Edibles, with PC Pure reaching as high as 18th and Petra maintaining a rank in the low 20s before a decline in January. These trends suggest that while Magic Edibles has potential for growth, it faces stiff competition from brands that are either steadily climbing or maintaining stronger positions in the market.

Notable Products

In January 2026, Lemonade Gummies 4-Pack (200mg) maintained its position as the top-selling product for Magic Edibles, with sales reaching 18,320 units. Orange Chews 4-Pack (200mg) held steady in the second spot, reflecting consistency in its popularity since November 2025. Watermelon Gummies 4-Pack (200mg) emerged as a new entrant, ranking third, indicating a strong debut in the market. Fruit Punch Gummies 4-Pack (200mg) followed closely in fourth place, showcasing a promising start. Pineapple Chews (200mg) saw a decline, slipping to fifth place from its second position in October 2025, suggesting a decrease in consumer preference over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.