Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

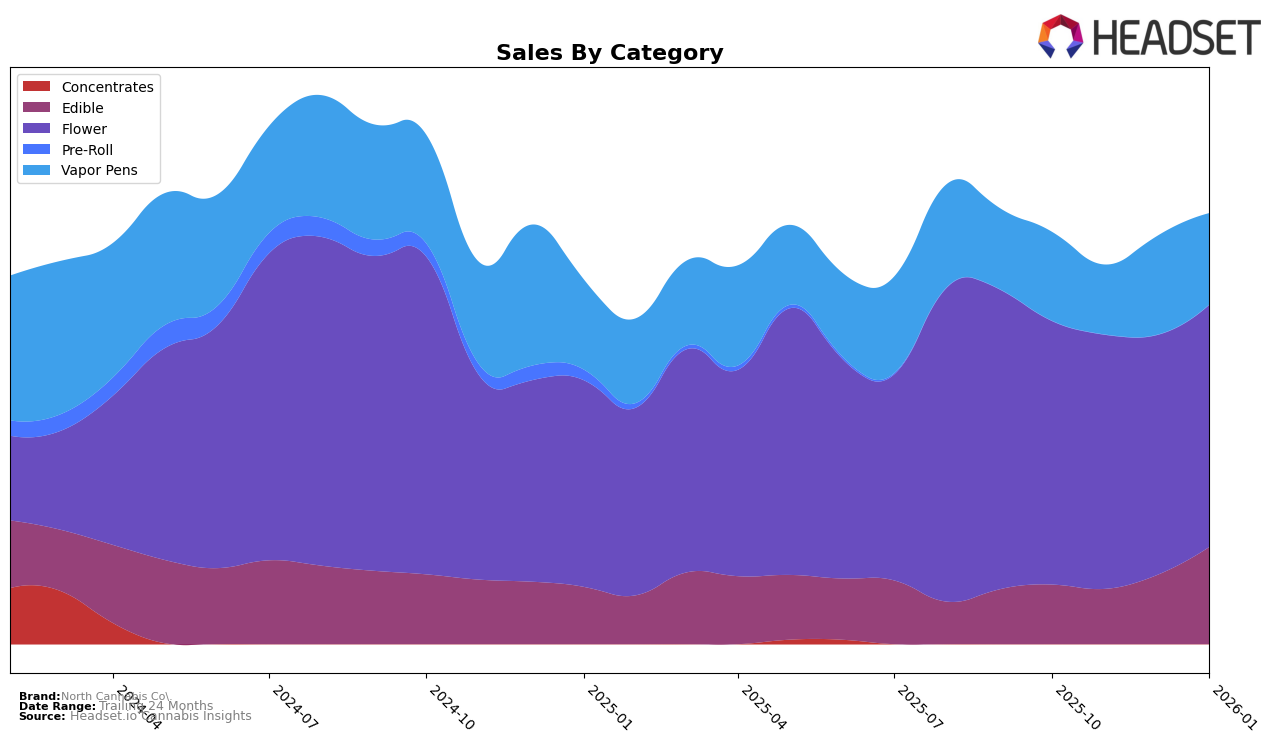

North Cannabis Co. has shown noteworthy performance across various product categories in Michigan. In the Edible category, the brand has demonstrated a strong upward trend, moving from the 34th position in October 2025 to an impressive 20th by January 2026. This significant climb suggests a growing consumer preference or effective marketing strategies that have enhanced their presence in this category. However, their performance in the Flower category has been less consistent, as they started at the 31st position in October 2025, briefly slipped out of the top 30 in December, and then recovered to the 29th position in January 2026. This fluctuation indicates potential challenges in maintaining a steady market share in the Flower category.

In the Vapor Pens category, North Cannabis Co. experienced some variability, beginning at the 32nd position in October 2025, dropping to 39th in November, and then climbing back to the 29th position by January 2026. This rebound could reflect a strategic adjustment or seasonal factors influencing consumer demand. It's important to note that the brand's absence from the top 30 in November highlights an area for potential growth and stabilization. Despite these fluctuations, the brand's overall sales trajectory in the Vapor Pens category has been positive, suggesting that the market reception is favorable when they are able to secure a spot in the rankings.

Competitive Landscape

In the competitive landscape of the Michigan flower category, North Cannabis Co. has shown a promising upward trend in rankings, moving from 31st in October 2025 to 29th by January 2026. This improvement is notable when compared to competitors like Dog House, which experienced a decline from 14th to 31st in the same period, and Six Labs, which fluctuated significantly but ended slightly ahead at 27th. Light Sky Farms maintained a relatively stable position, ending at 28th, just one spot ahead of North Cannabis Co. The entry of Glo Farms into the rankings in January 2026 at 30th adds further competition. Despite these challenges, North Cannabis Co.'s steady sales figures and slight rank improvement suggest resilience and potential for growth in a competitive market.

Notable Products

In January 2026, North Cannabis Co.'s top-performing product was Wild Raspberry Vegan Gluten-Free Gummies 10-Pack, maintaining its position as the leading product for four consecutive months with sales reaching 14,612 units. Sour Michigan Cherry Vegan Gluten-Free Gummies 10-Pack climbed to the second position, showing a significant increase in sales from previous months. Strawberry Rhubarb Gummies 10-Pack, which was consistently ranked second in November and December 2025, moved to the third position in January. Red Haven Peach Vegan GF Gummies 10-Pack made an impressive entry into the top five, ranking fourth, after not being ranked in December. Sour Green Apple Gummies held steady at fifth place, demonstrating consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.