Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

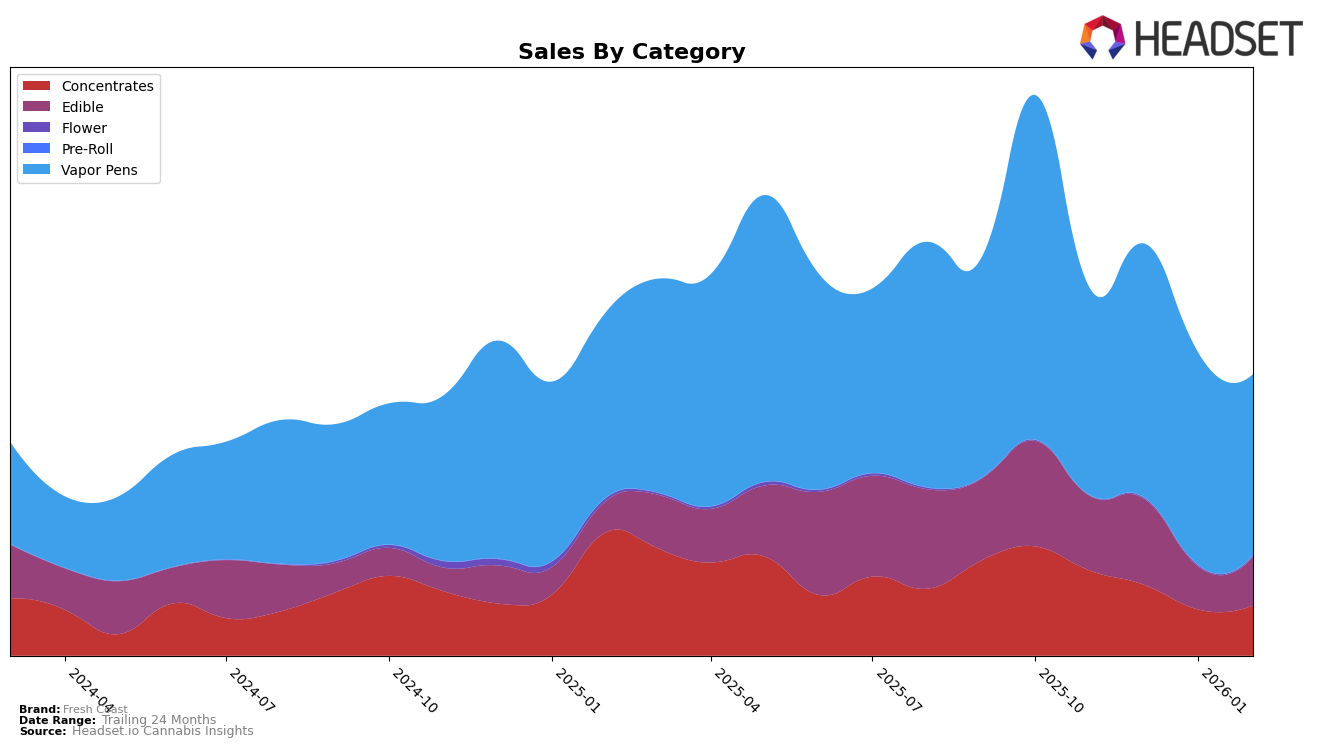

In the Michigan market, Fresh Coast has demonstrated varied performance across different product categories. In the Concentrates category, the brand has shown a fluctuating presence, starting at rank 11 in November 2025, dropping to 30 in January 2026, and then improving to rank 22 by February 2026. This indicates some volatility in consumer preferences or competitive pressures within the market. The Vapor Pens category, however, has been a relatively stable area for Fresh Coast, maintaining a consistent presence in the top 20, with a slight improvement from rank 18 in November 2025 to 17 by February 2026. This stability suggests a strong foothold in the Vapor Pens segment, which could be a strategic focus for the brand moving forward.

On the other hand, Fresh Coast's performance in the Edible category in Michigan presents a different narrative. The brand consistently ranked at 29 in the closing months of 2025 but dropped out of the top 30 in January 2026, only to slightly recover to rank 37 in February 2026. This decline out of the top 30 suggests challenges in maintaining a competitive edge in the Edible market, possibly due to increased competition or shifting consumer tastes. Despite these challenges, the brand's ability to regain some ground by February indicates potential areas for strategic improvements to regain a stronger market position.

Competitive Landscape

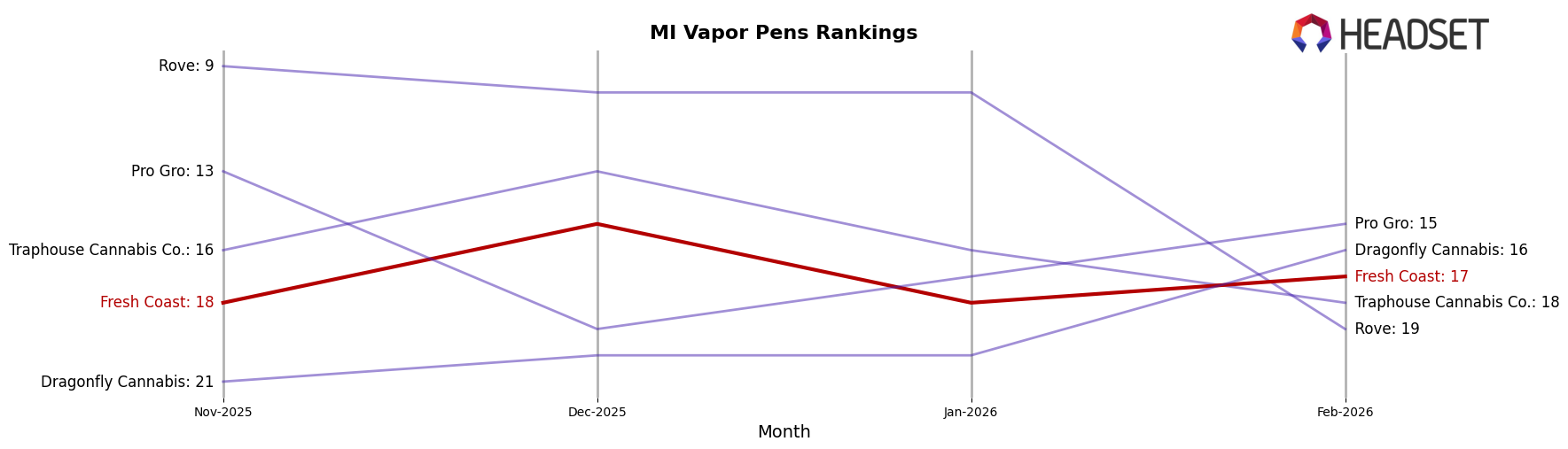

In the competitive landscape of vapor pens in Michigan, Fresh Coast has shown a steady improvement in its ranking from November 2025 to February 2026. Initially ranked 18th in November 2025, Fresh Coast climbed to 15th by December 2025, before slightly fluctuating to 18th in January 2026 and finally securing the 17th spot in February 2026. This upward trend in rank is indicative of a positive trajectory in sales performance, as Fresh Coast's sales figures increased from November to December 2025, despite a slight dip in January 2026. Notably, Fresh Coast outperformed Dragonfly Cannabis, which started outside the top 20 in November and only reached 16th by February 2026. However, Fresh Coast faces stiff competition from brands like Rove, which, despite a decline in rank from 9th to 19th over the same period, still commanded higher sales figures. Additionally, Pro Gro and Traphouse Cannabis Co. have shown competitive sales figures, with Pro Gro improving its rank to 15th in February 2026. These dynamics suggest that while Fresh Coast is gaining ground, it must continue to innovate and capture market share to maintain its upward momentum in the competitive Michigan vapor pen market.

Notable Products

In February 2026, the top-performing product for Fresh Coast was Splash - THCV/THC 1:4 Pineapple Gummies 10-Pack, which climbed from a rank of 4 in January to the number 1 spot with sales of 2,663 units. Splash - CBN/THC 1:2 Blue Raspberry Gummies emerged as the second top-seller, entering the rankings for the first time. Ritual - Blueberry Haze Liquid Diamonds Disposable maintained its position at rank 3, despite a slight decrease in sales from 2,723 units in January to 2,355 units in February. Splash - THCV/THC 1:4 Strawberry Kiwi Gummies debuted at rank 4, while Ritual - Grape Ape Liquid Diamonds Disposable dropped from rank 2 in January to rank 5 in February. This shift in rankings highlights a growing preference for edibles among consumers, as evidenced by the strong performance of Splash gummy products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.