Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

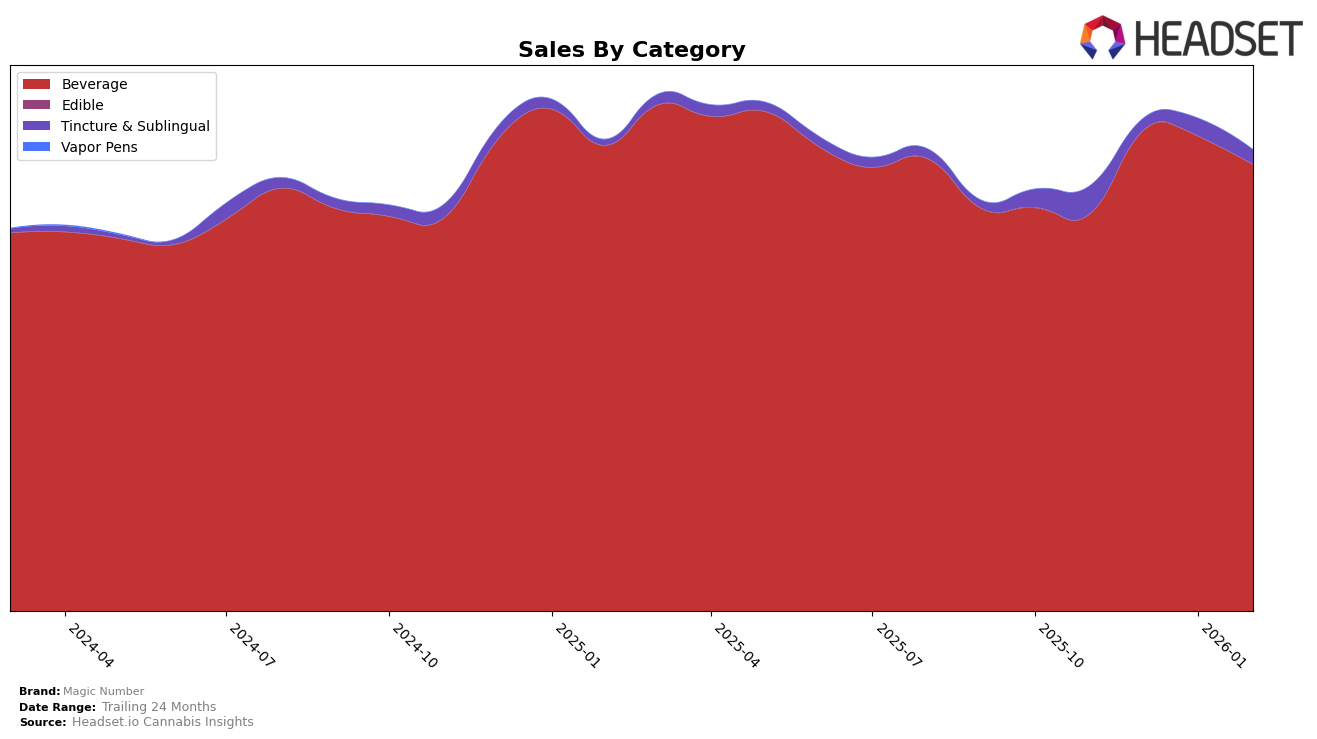

Magic Number has demonstrated a strong and consistent performance in the Oregon market, particularly within the Beverage category. The brand has maintained a solid first-place ranking from November 2025 through February 2026, indicating a dominant position in this category. This consistent top ranking, coupled with a notable sales figure of $458,434 in February 2026, underscores their stronghold in the beverage market. The brand's ability to sustain such high standings over multiple months suggests a robust consumer base and effective market strategies. However, it's worth noting that their performance in other categories may not mirror this success.

In contrast, Magic Number's performance in the Tincture & Sublingual category in Oregon shows more variability. The brand's ranking fluctuated from 6th place in November 2025 to 15th in December 2025, before improving to 9th place in both January and February 2026. This movement indicates a less stable position compared to their dominance in the Beverage category. The fluctuation suggests potential challenges or increased competition in the Tincture & Sublingual market segment. The absence of a top 5 ranking in this category may point to opportunities for Magic Number to enhance their strategies or product offerings to better capture market share.

Competitive Landscape

In the Oregon beverage category, Magic Number has consistently maintained its top position from November 2025 through February 2026, showcasing its strong market presence and customer preference. Despite the steady performance of competitors like Keef Cola, which held the second rank throughout the same period, Magic Number's sales figures have consistently outpaced those of its rivals. Notably, Mary Jones has shown some upward momentum, climbing from fourth to third place by February 2026, yet it still trails significantly behind Magic Number in terms of sales volume. This consistent leadership by Magic Number in both rank and sales highlights its dominance and suggests a robust brand loyalty and effective market strategy in Oregon's competitive cannabis beverage sector.

Notable Products

For February 2026, the top-performing product for Magic Number was Sasparilla Soda (100mg THC, 12oz), maintaining its leading position from January with sales of 3364. Blue Raspberry Live Resin Soda (100mg THC, 355ml) showed a notable rise in the rankings, moving from fifth in January to second place in February. Artisan Series - Old Fashioned Lemonade (100mg THC, 237ml, 8oz) slipped from first in January to third in February, despite previous months of strong performance. Bright and Citrusy Limeade (100mg THC, 8oz, 237ml) held steady at fourth place, showing consistent sales figures. Classic Cola Live Resin Soda (100mg THC, 355ml) dropped to fifth position, indicating a slight decline compared to its third-place ranking in December and January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.