Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

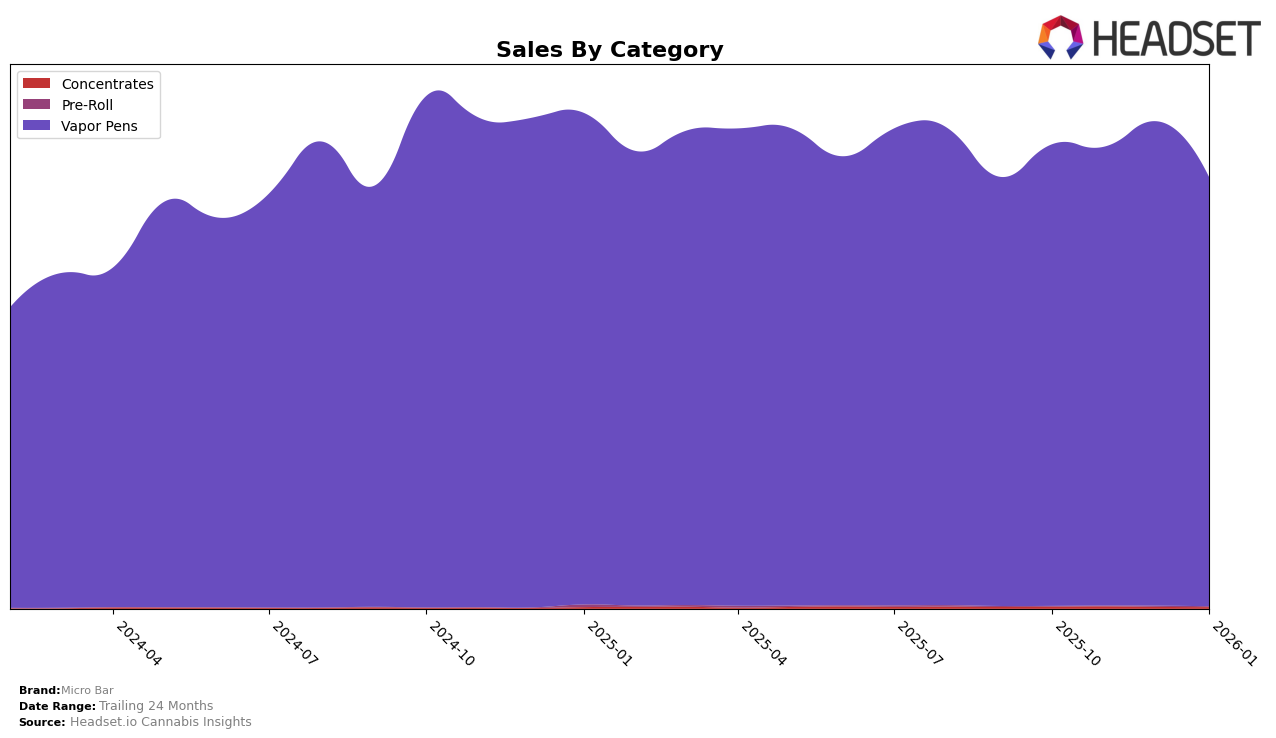

Micro Bar has shown varying performance across different states and categories, particularly in the Vapor Pens category. In Arizona, the brand has seen a positive trajectory, moving from the 30th position in October 2025 to 23rd in November before stabilizing at 24th in December and January 2026. This upward movement indicates a growing presence in the Arizona market, although the slight dip in sales from December to January suggests some challenges in maintaining momentum. In contrast, California has shown a more stable ranking, hovering around the 18th to 20th positions throughout the months, with notable sales fluctuations, especially a decrease in January 2026. This stability in rank, despite sales variability, could point to consistent competition in California's market.

Meanwhile, Washington presents a slightly different picture, with Micro Bar maintaining a strong presence in the top 10, although experiencing a gradual decline from 4th to 6th place by January 2026. Despite this drop in ranking, the brand's sales figures remain robust, suggesting that while competition may be increasing, Micro Bar still holds a significant market share in Washington. The absence of Micro Bar from the top 30 in any state or category would be a concern, but this is not the case here, indicating a broad yet varied market presence. These trends highlight the brand's differing strategies and market dynamics across states, offering insights into its regional performance without revealing all the underlying factors.

Competitive Landscape

In the Washington Vapor Pens category, Micro Bar has experienced a notable shift in its competitive positioning from October 2025 to January 2026. Initially ranked 4th in October, Micro Bar saw a decline to 6th place by January 2026. This downward trend in rank corresponds with a decrease in sales, suggesting potential challenges in maintaining market share. Meanwhile, Full Spec consistently held a strong position, improving from 6th to 4th place, indicating robust sales performance and possibly capturing some of Micro Bar's market share. Plaid Jacket also showed resilience, maintaining a competitive edge by fluctuating between 5th and 6th place, ultimately securing the 5th spot in January. In contrast, Dabstract and Flipside remained stable at 7th and 8th positions respectively, suggesting a steady but less aggressive market presence compared to Micro Bar's more dynamic competitors. These shifts highlight the competitive pressures Micro Bar faces and underscore the importance of strategic adjustments to regain its earlier standing.

Notable Products

In January 2026, the top-performing product for Micro Bar was the Strawberry Mochi Flavored Distillate Disposable (1g) in the Vapor Pens category, which ascended to the number one rank with sales reaching 7168 units. The Pineapple Express Distillate Disposable (1g) followed closely in second place, marking a notable rise from its previous fourth position in December 2025. The White Razz Flavored Distillate Disposable (1g), despite leading in December 2025, dropped to third place in January 2026. Blue Hawaiian Punch Flavored Distillate Disposable (1g) maintained a steady presence, holding the fourth rank consistently since December 2025. Meanwhile, the Blueberry Kush Distillate Disposable (1g) made its debut in the rankings at fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.