Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

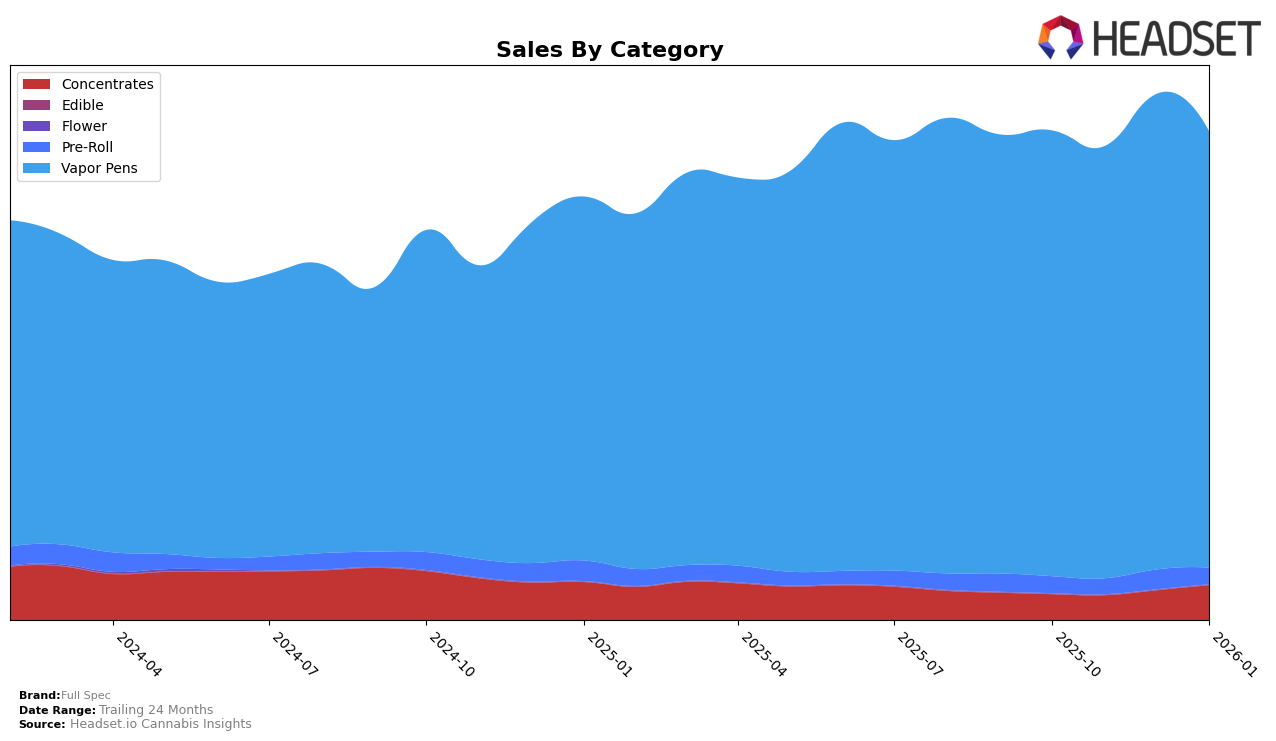

Full Spec has shown varied performance across different product categories in Washington. In the Concentrates category, the brand has demonstrated a positive trajectory, climbing from the 23rd position in October 2025 to the 17th position by January 2026. This upward movement indicates a strengthening presence in the Concentrates market, likely driven by strategic adjustments or product innovations. In contrast, their performance in the Pre-Roll category has not been as robust, as they have not broken into the top 30, maintaining a ranking outside this range throughout the observed months. This consistent exclusion from the top 30 suggests potential areas for improvement or increased competition in the Pre-Roll sector.

In the Vapor Pens category, Full Spec has maintained a strong and stable presence, consistently holding the 4th position from November 2025 through January 2026, following a slight dip from 6th place in October. This stability in a competitive category highlights Full Spec's solid market share and possibly indicates customer loyalty or a well-received product lineup. The brand's performance across these categories suggests a strategic focus on maintaining and enhancing its position in the Vapor Pens market, while there may be opportunities for growth or realignment in other sectors such as Pre-Rolls. For further insights into the dynamics of the Washington market, one might consider exploring additional data trends or competitive analyses.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Full Spec has demonstrated a consistent performance, maintaining its rank at 4th place from November 2025 through January 2026. This stability is noteworthy, especially when compared to competitors like Plaid Jacket and Micro Bar, which have experienced fluctuations in their rankings. Notably, Crystal Clear has shown a strong upward trend, surpassing Full Spec by moving from 3rd to 2nd place in January 2026. Despite this, Full Spec's sales figures have remained robust, indicating a loyal customer base and effective market strategies. The brand's ability to maintain its position amidst such dynamic competition suggests a solid market presence and potential for future growth.

Notable Products

In January 2026, the top-performing product from Full Spec was the Elite - Twilight Twinkle Liquid Live Resin Cartridge (1g) in the Vapor Pens category, reclaiming its number one position with sales of 3549 units. Following closely was the Elite - Alien Candy Live Resin Cartridge (1g), which moved up to the second position with a notable increase in sales from the previous month. The Elite - Slippery Pear Live Resin Cartridge (1g) dropped to third place after leading in December 2025. Elite - Hippodrome Live Resin Cartridge (1g) secured the fourth spot, maintaining a consistent presence in the top rankings. New to the top five is the Angel Food Cake Live Resin Cartridge (1g), debuting at fifth place, suggesting a positive reception among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.