Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

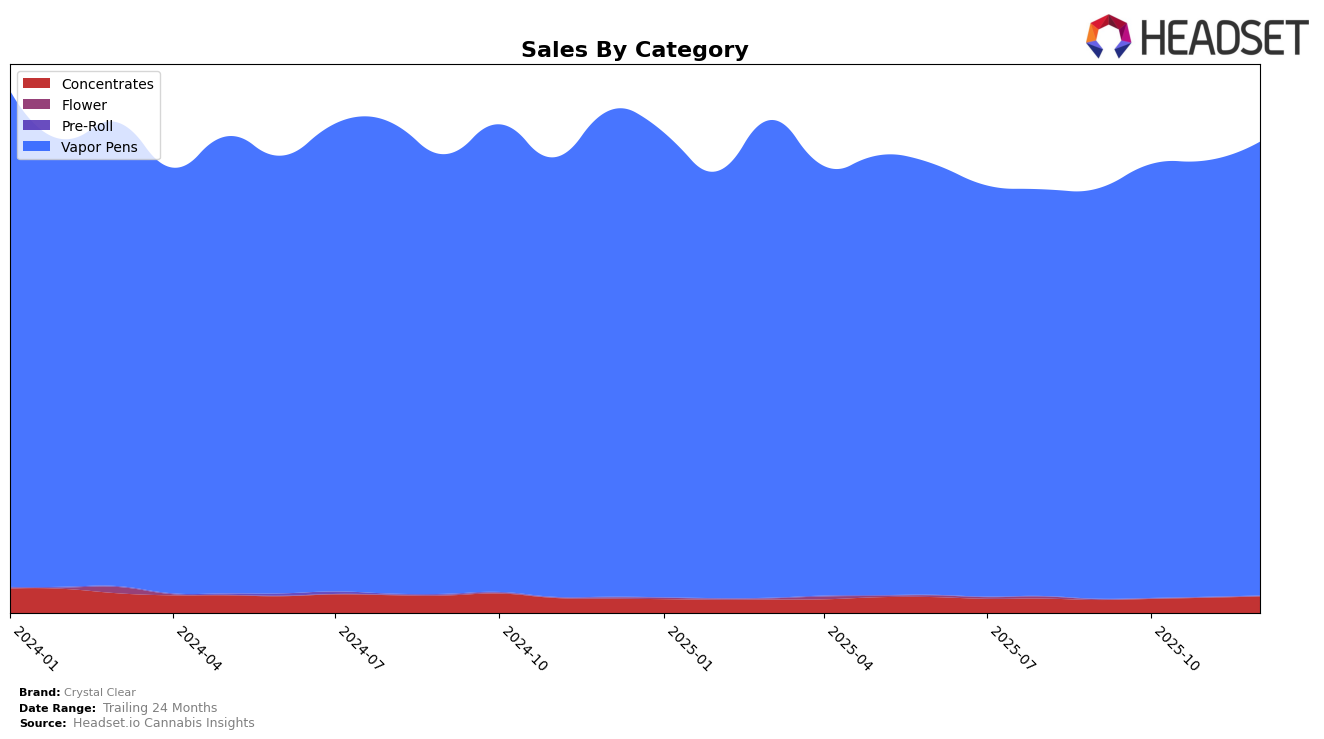

In the California market, Crystal Clear's performance in the Vapor Pens category has shown a steady improvement. Despite not breaking into the top 30 brands earlier in the year, they have made significant strides, climbing from a rank of 52 in September to 43 by December. This upward trend is indicative of growing consumer interest and market penetration in the state. Meanwhile, in Illinois, Crystal Clear maintained a strong presence within the top 15 for Vapor Pens, although there was a slight dip in December to rank 13. This suggests a highly competitive market environment where maintaining position requires constant innovation and engagement.

In Massachusetts, Crystal Clear's rank in the Vapor Pens category remained stable at 14 throughout the last quarter of 2025, which may indicate a consistent consumer base or effective brand loyalty strategies. On the other hand, in Washington, the brand has shown remarkable consistency in the Vapor Pens category, holding the third position consistently from September through December. Their performance in the Concentrates category also improved slightly, moving from rank 15 in September to 14 in December, highlighting a potential area for growth. The data suggests that while Crystal Clear is a strong contender in certain states, there is room for improvement and expansion in others.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, Crystal Clear consistently maintains its position as the third-ranked brand from September to December 2025. Despite strong competition, Crystal Clear's sales trajectory shows a positive trend, culminating in December with sales figures nearly matching those of Sticky Frog, the second-ranked brand. Meanwhile, Mfused continues to dominate the top spot with a significant lead in sales. Notably, Full Spec and Micro Bar fluctuate between the fourth and fifth positions, indicating a competitive environment just below Crystal Clear. This stability in ranking, coupled with a robust growth in sales, suggests that Crystal Clear is effectively capitalizing on market opportunities and consumer preferences, positioning itself as a formidable player in the Washington Vapor Pens market.

Notable Products

In December 2025, Crystal Clear's top-performing product was the Blue Dream Terp Sauce Cartridge (1g) in the Vapor Pens category, ascending to the first rank with notable sales of 5222. The Maui Wowie Distillate Cartridge (1g) followed closely in second place, showing a significant improvement from its third rank in November. The Northern Lights Distillate Cartridge (1g) also climbed to third place from fourth, indicating a steady increase in popularity. Meanwhile, the Maui Wowie Distillate Disposable (1g) experienced a drop to fourth place, contrasting its previous first-place position in November. Lastly, the Northern Lights Distillate Disposable (1g) maintained its fifth-place rank, consistent with its performance in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.