Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

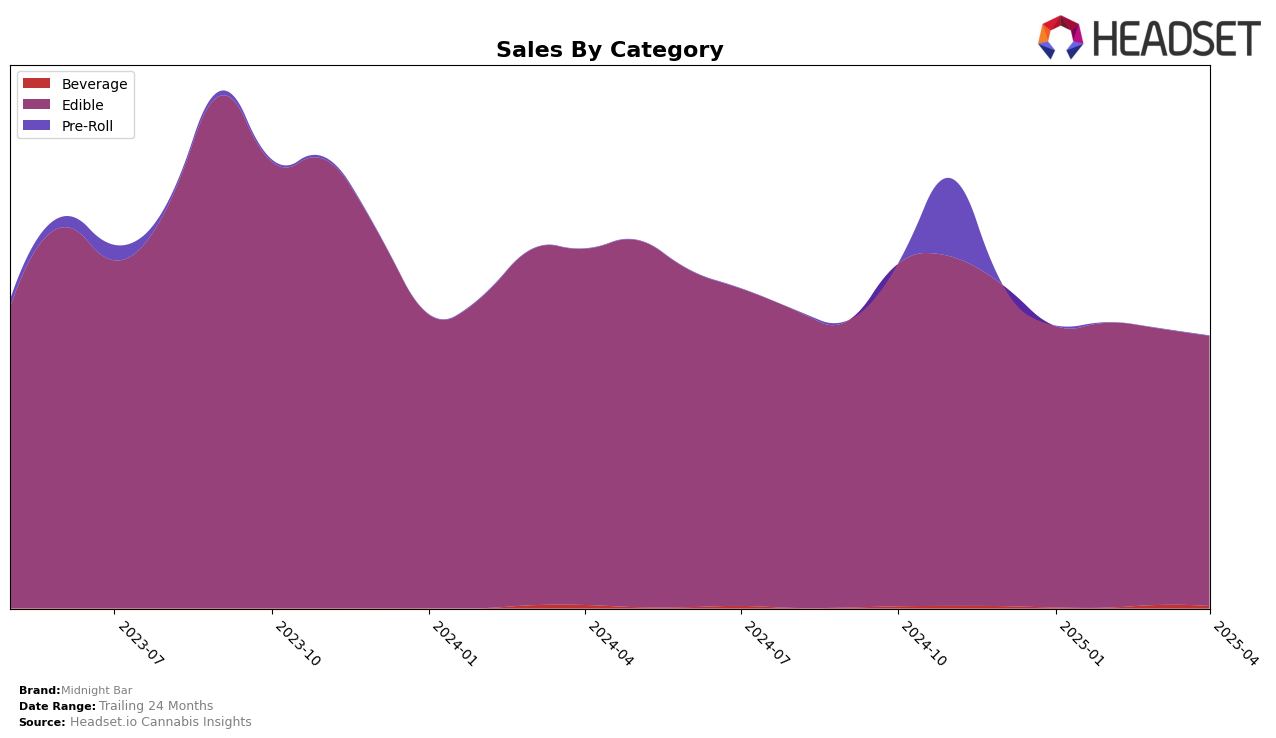

Midnight Bar has shown a consistent presence in the Michigan edible market, though it has faced challenges in breaking into the top 30 brands. Starting January 2025, the brand was ranked 38th and saw a slight decline, moving to 41st by April. Despite the drop in rankings, the brand's sales have remained relatively stable, with a minor decrease from $140,087 in January to $134,448 in April. This stability in sales amidst fluctuating rankings suggests a loyal customer base, but also highlights the competitive nature of the Michigan edible market, where many brands vie for top positions.

Notably, Midnight Bar's absence from the top 30 in any month indicates a need for strategic improvements to capture more market share. The brand's consistent ranking outside the top 30 could be seen as an opportunity for growth, particularly if they can leverage their existing customer base to expand their reach. The Michigan market, accessible through Michigan, presents both challenges and potential for Midnight Bar to enhance its positioning. Further analysis into consumer preferences and competitor strategies could provide insights into how Midnight Bar might improve its ranking and sales performance.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Midnight Bar has experienced a slight decline in rank from January to April 2025, moving from 38th to 41st position. This shift is indicative of a competitive market where brands like Sauce Essentials and Terra have shown more dynamic movement, with Sauce Essentials maintaining a relatively stable position and Terra improving its rank from 49th to 39th over the same period. Despite the decline in rank, Midnight Bar's sales figures have remained relatively stable, suggesting a loyal customer base. However, the increase in sales for Wonder Wellness Co. and Terra indicates a growing consumer interest in alternative brands, which could be a factor in Midnight Bar's rank changes. The competitive pressure from these brands highlights the need for Midnight Bar to innovate and potentially adjust its marketing strategies to maintain and improve its market position.

Notable Products

In April 2025, Midnight Bar's top-performing product was Full Moon - Thin Mint Dark Chocolate (200mg), maintaining its first-place ranking from previous months with a notable sales figure of 6,230 units. Full Moon - Strawberry Milkshake Chocolate Coin (200mg) consistently held the second position across all months, demonstrating stable performance. The Sugar Free Milk Chocolate Bar 10-Pack (200mg) remained in third place, while Cookies N Cream White Chocolate Bar (200mg) improved its ranking to fourth, up from fifth in March. Meanwhile, the Strawberry Milkshake White Chocolate Bar (200mg) saw a slight decline, moving from fourth in March to fifth in April. Overall, these rankings indicate a stable product lineup with minimal fluctuations in sales positions over the evaluated months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.