Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

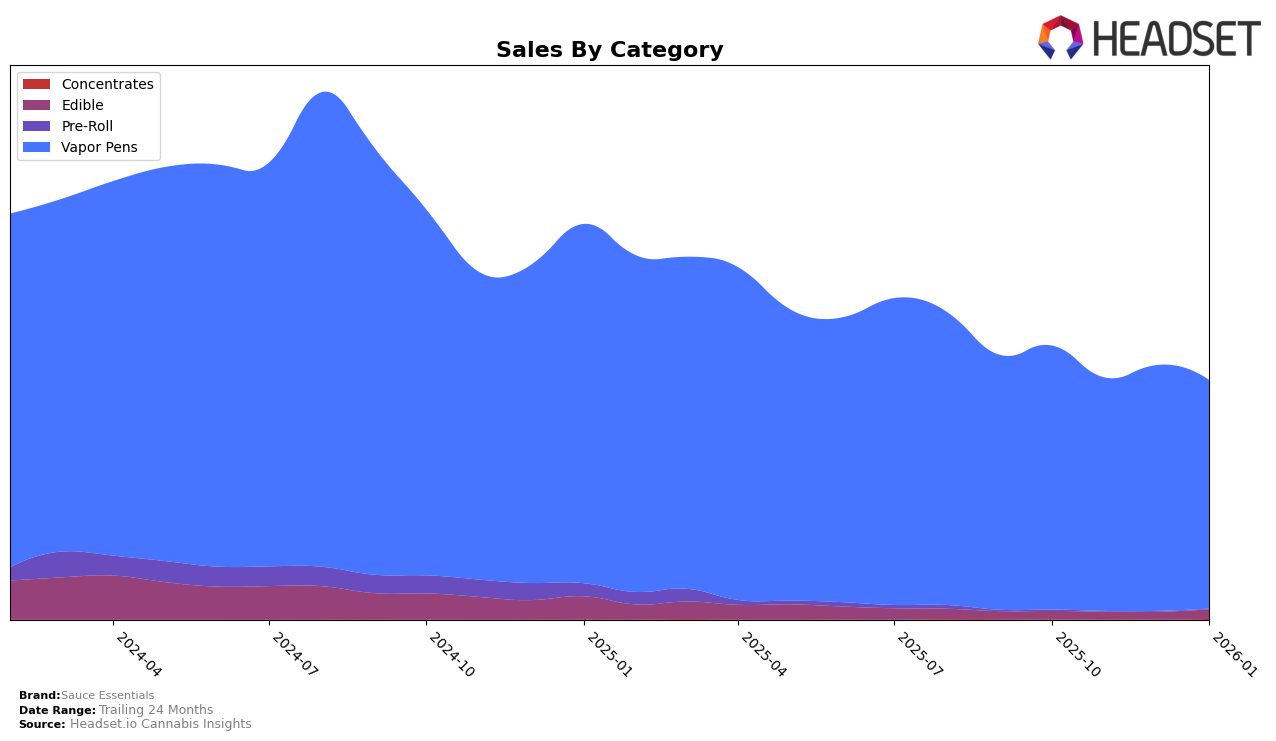

Sauce Essentials has shown varied performance across different states and categories. In California, the brand maintained a steady presence in the Vapor Pens category, consistently ranking at 28th from October 2025 to January 2026. However, the sales figures indicate a downward trend with a notable drop in sales from October to January. In contrast, the brand demonstrated a stronger performance in Colorado, where it improved its ranking from 18th to 13th in the same category, highlighting a positive trend despite some fluctuations. Meanwhile, in Nevada, Sauce Essentials experienced a slight decline in the Vapor Pens category, moving from 8th to 11th, yet the sales figures remained relatively stable, suggesting a consistent consumer base.

In Michigan, Sauce Essentials faced challenges in the Edible category, with rankings hovering around the 60s, although a slight improvement was seen in January 2026 as they climbed to 52nd. Their performance in the Vapor Pens category in Michigan was more stable, albeit with a gradual decline in rankings from 24th to 30th over the observed period. Notably, in Ohio, the brand showed a promising upward trend in the Vapor Pens category, improving from 16th to 12th, which coincided with a steady increase in sales. However, in Oregon, Sauce Essentials did not maintain a top 30 position in the last two months of the period, indicating potential market challenges or shifts in consumer preferences in that region.

Competitive Landscape

In the competitive landscape of Vapor Pens in California, Sauce Essentials has maintained a relatively stable position, consistently ranking 28th from November 2025 through January 2026, despite a slight dip from 27th in October 2025. This steadiness in rank contrasts with the more volatile performance of competitors such as Gramlin, which experienced a significant drop from 7th in November 2025 to 26th by January 2026. Meanwhile, Almora Farms and Alien Labs have shown a more consistent upward trend, with Claybourne Co. making a notable leap from 35th in December 2025 to 29th in January 2026. Sauce Essentials' sales figures reflect a decrease from October 2025 to January 2026, which might suggest a need for strategic adjustments to regain momentum against these dynamic competitors. This analysis highlights the importance of monitoring competitive movements and adapting strategies to maintain or improve market position in the rapidly evolving cannabis industry.

Notable Products

In January 2026, Sauce Essentials' top-performing product was the Kings Kush Live Resin Disposable (1g) in the Vapor Pens category, which rose to the number one rank with sales of 5,290 units. The Jack Diesel Live Resin Disposable (1g) followed closely as the second-ranked product, showing a slight improvement from its fifth position in December 2025. Gelato Live Resin Disposable (1g) maintained a strong presence, ranking third, although it dropped from the second spot in the previous month. The Apple Fritter Live Resin Disposable (1g) made a notable debut in January, securing the fourth rank. Lastly, the Strawberry Cough Distillate Disposable (1g) experienced a drop to the fifth position, down from its top rank in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.