Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

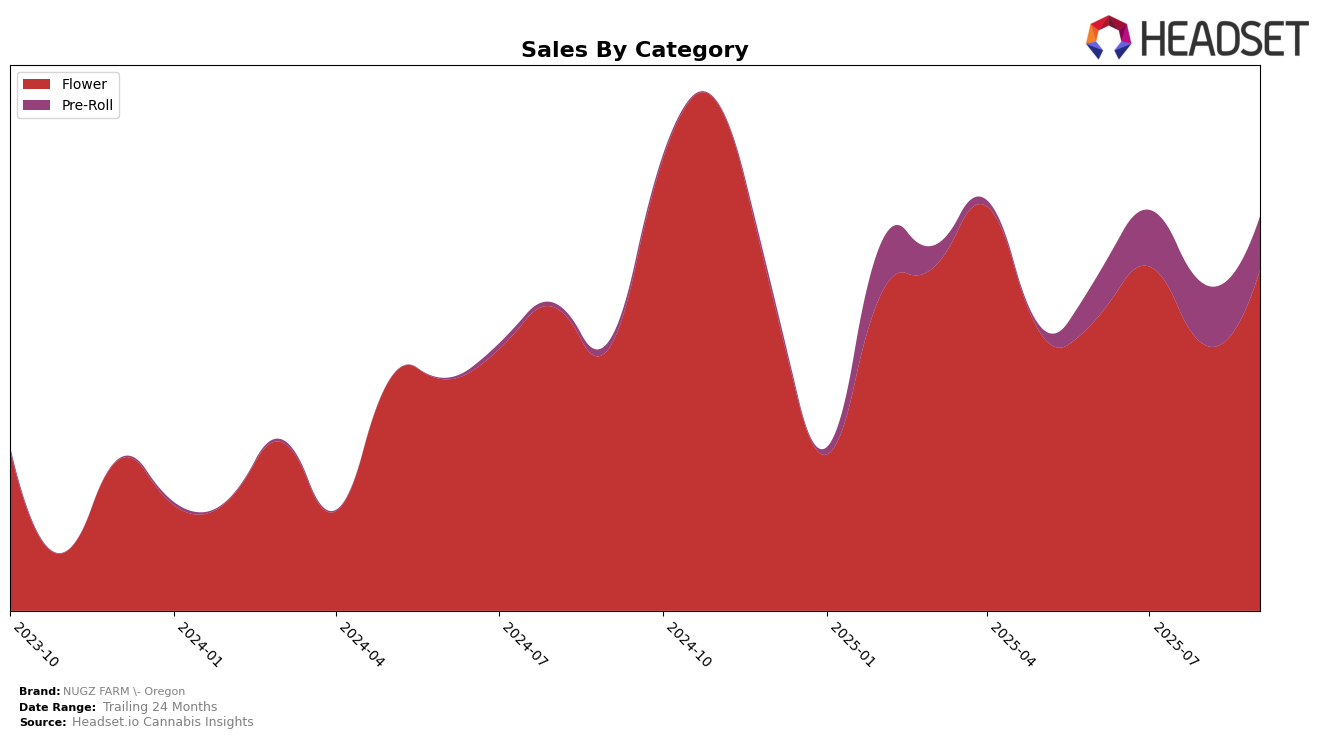

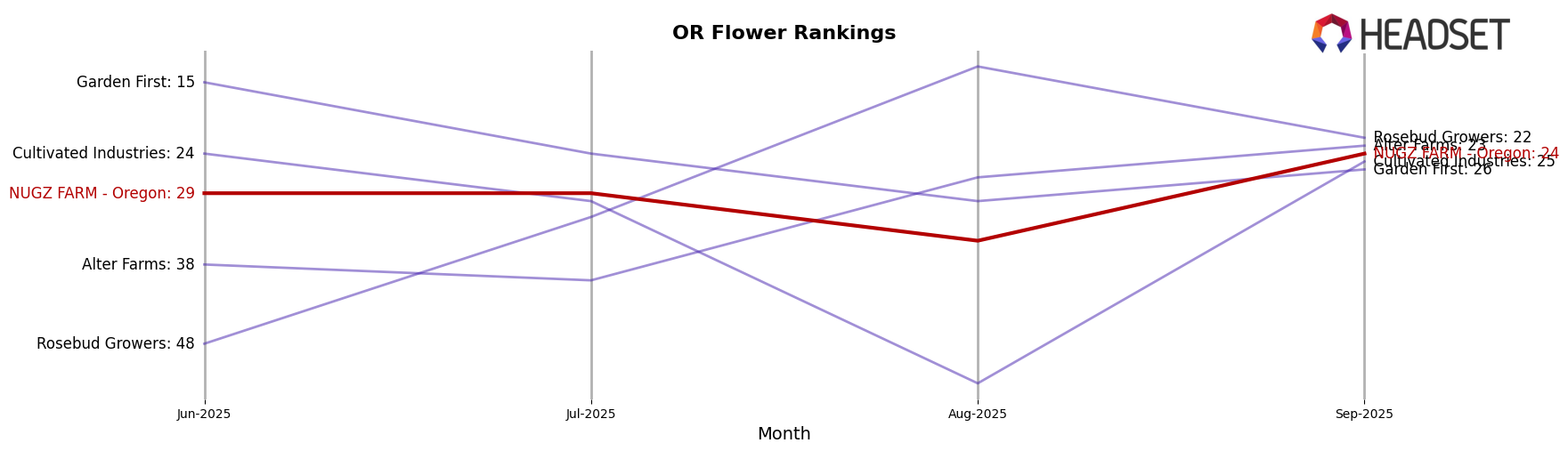

In the state of Oregon, NUGZ FARM - Oregon has shown notable fluctuations in its performance across different cannabis categories. Within the Flower category, the brand experienced a significant improvement in its ranking, moving from 29th position in June 2025 to 24th by September 2025. This upward trajectory indicates a positive reception and growing consumer interest in their flower products, despite a dip in August when they fell out of the top 30. Their sales figures reflect this trend, with September sales nearly matching the peak seen in July. This suggests that NUGZ FARM is effectively capitalizing on consumer preferences and maintaining a strong presence in Oregon's competitive market.

In contrast, the Pre-Roll category shows a more gradual yet consistent improvement for NUGZ FARM - Oregon. Starting from a rank of 72 in June 2025, the brand climbed to 58 by September 2025, consistently improving its position each month. The steady rise in ranking, despite not breaking into the top 30, suggests a growing acceptance and potential for future growth in this category. The sales figures for Pre-Rolls also indicate a stable demand, with a peak in August followed by a slight decrease in September. This stability, coupled with the upward trend in rankings, positions NUGZ FARM as a brand to watch in Oregon's Pre-Roll market.

Competitive Landscape

NUGZ FARM - Oregon has experienced fluctuations in its competitive positioning within the Oregon flower category from June to September 2025. Notably, its rank improved from 35th in August to 24th in September, indicating a positive trend in sales performance. This improvement is significant when compared to competitors like Rosebud Growers, which saw a decline from 13th in August to 22nd in September, and Garden First, which also dropped from 15th in June to 26th in September. Meanwhile, Alter Farms showed a steady climb from 38th in June to 23rd in September, suggesting a competitive environment where NUGZ FARM - Oregon must continue to innovate and capture market share. Despite these competitive pressures, NUGZ FARM - Oregon's ability to rebound in September highlights its resilience and potential for growth in the dynamic Oregon flower market.

Notable Products

In September 2025, NUGZ FARM - Oregon's top-performing product was Khronic F$!king Cookies (Bulk) in the Flower category, securing the first rank with sales figures reaching 1479. Hog Wash (Bulk) followed closely, dropping one spot to second place compared to its top position in August. Detroit Muscle (Bulk), which previously held the first rank in June and July, settled at third place in September. Garlic Cocktail Pre-Roll (1g) made its debut in the rankings at fourth place, highlighting a strong performance in the Pre-Roll category. Cadillac Candy (Bulk) rounded out the top five, indicating stable demand for Flower products from NUGZ FARM - Oregon.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.