Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

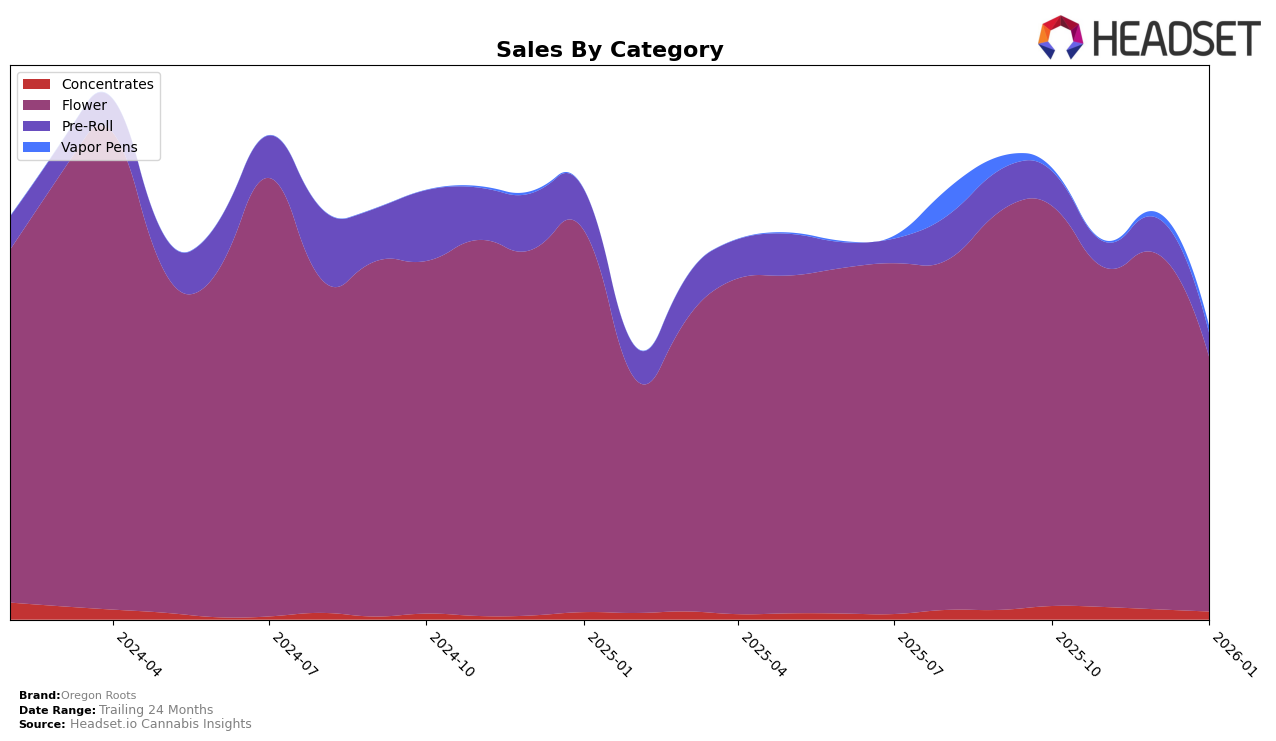

Oregon Roots has shown varied performance across different product categories in the state of Oregon. In the Flower category, the brand maintained a strong foothold, starting at a 9th rank in October 2025 but experienced a gradual decline to the 23rd position by January 2026. This downward trend, despite fluctuations in sales, indicates increasing competition or shifting consumer preferences. On the other hand, Oregon Roots did not make it to the top 30 in the Concentrates category during the same period, which could suggest an area needing strategic focus or improvement to enhance their market presence.

In the Pre-Roll category, Oregon Roots experienced a stable yet modest performance, with rankings oscillating between 57th and 63rd from October 2025 to January 2026. This consistency, albeit outside the top 30, suggests a steady demand but also highlights potential for growth if targeted efforts are made. The brand's overall sales figures in these categories reveal certain trends, such as the Flower category witnessing a significant drop in sales from December 2025 to January 2026, which might reflect seasonal variations or market saturation. For those interested in deeper insights into Oregon Roots' performance, a closer examination of their strategic initiatives and competitive landscape in Oregon could provide valuable context.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Oregon Roots has experienced notable fluctuations in its ranking and sales over recent months. In October 2025, Oregon Roots held a strong position at rank 9, but by January 2026, it had slipped to rank 23, indicating a significant decline in its standing. This downward trend is mirrored in its sales figures, which decreased from October's peak. In contrast, Emerald Fields Cannabis maintained a more stable presence, consistently ranking within the top 20, albeit with a slight dip in December. Meanwhile, Midnight Fruit Company showed a positive trajectory, climbing from rank 36 in October to 22 in January, suggesting a growing market presence. True Care Farms also made a noteworthy leap from rank 58 in October to 25 by January, highlighting a significant improvement. These shifts in rankings and sales dynamics suggest that Oregon Roots faces increasing competition, necessitating strategic adjustments to regain its former market position.

Notable Products

In January 2026, the top-performing product from Oregon Roots was Blue Dream (Bulk) in the Flower category, achieving the number one rank with sales of 1824 units. Following closely, Tomahawk Pre-Roll (1g) ranked second, showing a drop from its first-place position in December 2025. Cinderella 99 (Bulk) secured the third spot, making its appearance in the rankings for the first time. Blue Magoo (Bulk) slipped from third place in December 2025 to fourth in January 2026, while Blue Magoo (14g) entered the rankings at fifth place. These shifts indicate a dynamic sales environment for Oregon Roots, with notable changes in consumer preferences from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.