Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

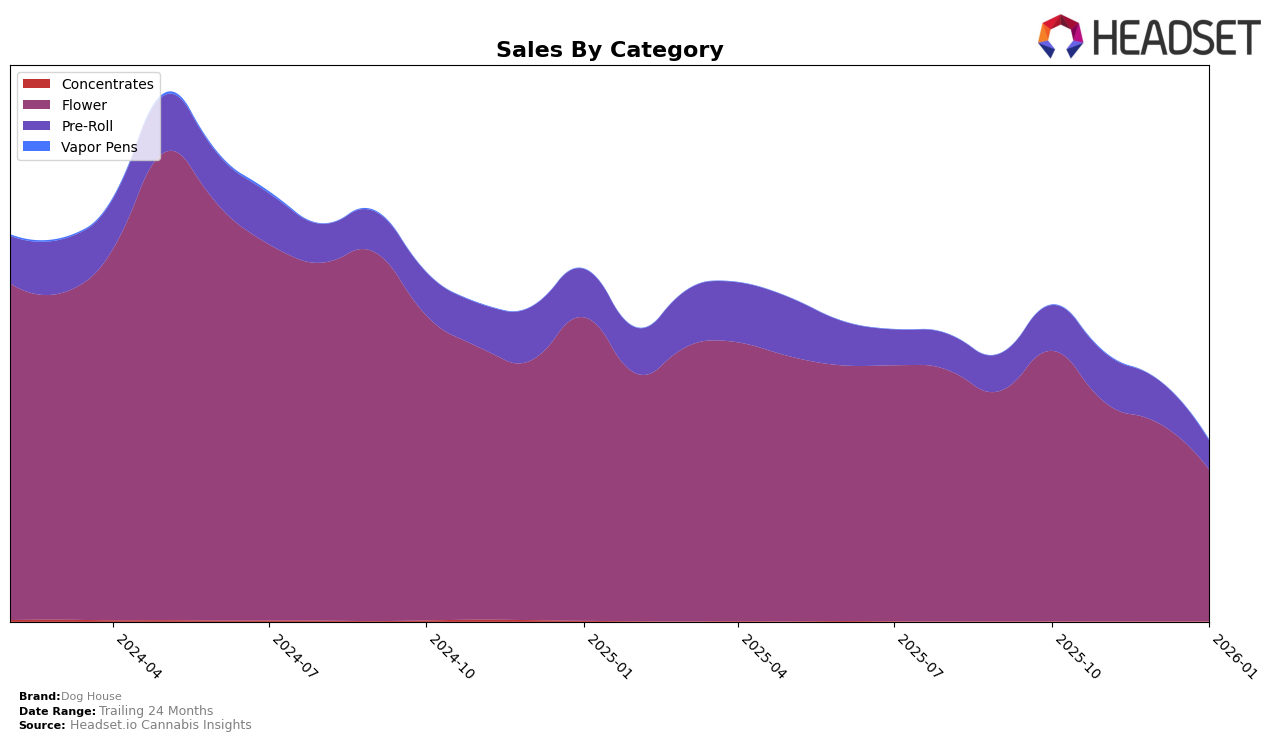

Dog House has demonstrated varying performance across different states and product categories over recent months. In Michigan, the brand's presence in the Flower category has seen a decline, dropping from 14th place in October 2025 to 31st by January 2026. This downward trend is accompanied by a significant decrease in sales, which fell from approximately $1.49 million to $685,838 during the same period. Meanwhile, in the Pre-Roll category within Michigan, Dog House has not managed to break into the top 30, with rankings fluctuating between 46th and 69th, indicating challenges in gaining a stronger foothold in this segment.

In Oregon, Dog House's performance in the Flower category has shown some resilience, with the brand starting at 22nd in October 2025, dipping to 39th in December, and then recovering to 25th by January 2026. This suggests a potential rebound and an ability to adapt in this market. However, the Pre-Roll category tells a different story, as the brand has consistently remained outside the top 30, ending at 38th in January 2026. In Washington, while Dog House's Flower category ranking has improved from 82nd to 66th over the same period, it remains a challenge for the brand to break into the higher echelons of the market. These movements highlight the brand's varied success across states and categories, with some areas showing promise and others indicating room for growth.

Competitive Landscape

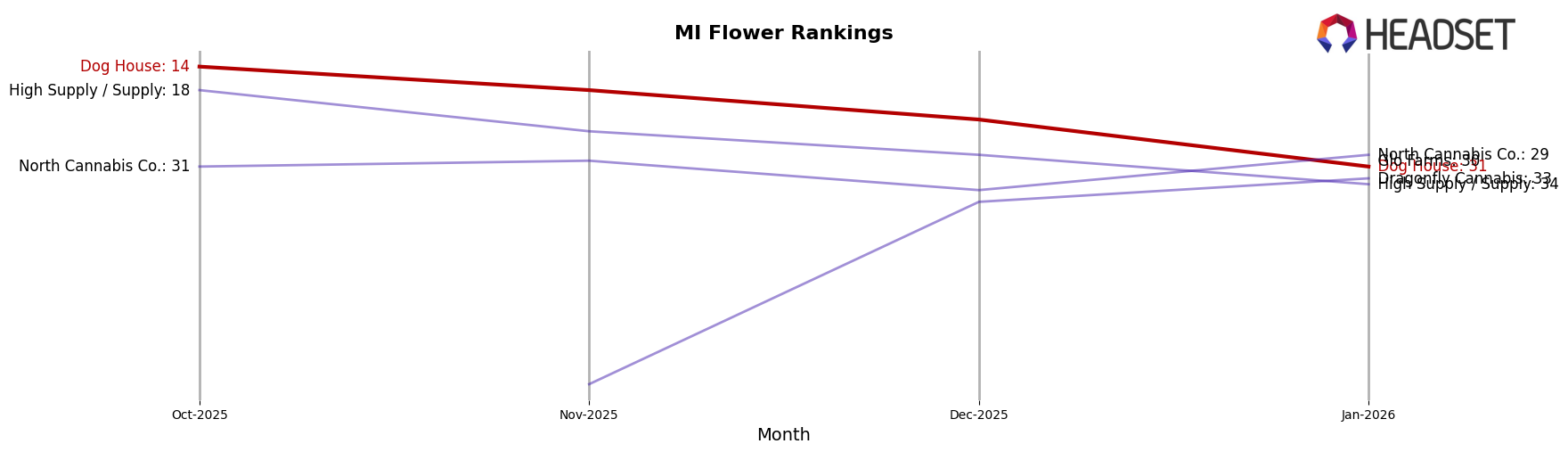

In the competitive landscape of the Michigan flower category, Dog House has experienced a notable decline in rankings from October 2025 to January 2026, moving from 14th to 31st place. This downward trend in rank is mirrored by a consistent decrease in sales over the same period. In contrast, High Supply / Supply also saw a decline, though they remained slightly ahead of Dog House in January 2026 at 34th place. Meanwhile, North Cannabis Co. showed resilience by improving their rank to 29th in January 2026, despite initially being lower than Dog House in October 2025. Additionally, Dragonfly Cannabis and Glo Farms have emerged as potential threats, with Dragonfly Cannabis climbing to 33rd and Glo Farms entering the top 30 by January 2026. These shifts suggest a dynamic market where Dog House must strategize effectively to regain its competitive edge and stabilize sales.

Notable Products

In January 2026, the top-performing product for Dog House was Sex Tape (Bulk) in the Flower category, which reclaimed its number one rank despite a sales decline to 6572 units. Blue Runtz (Bulk) rose impressively to the second position from fifth in December 2025, showing a positive trend. Papa Burger (Bulk) debuted in third place, indicating strong market entry. Jokerz Candy (Bulk) also entered the rankings at fourth, suggesting growing consumer interest. Pink Passion (28g) slipped from third to fifth place, reflecting a notable decrease in sales performance compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.