Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

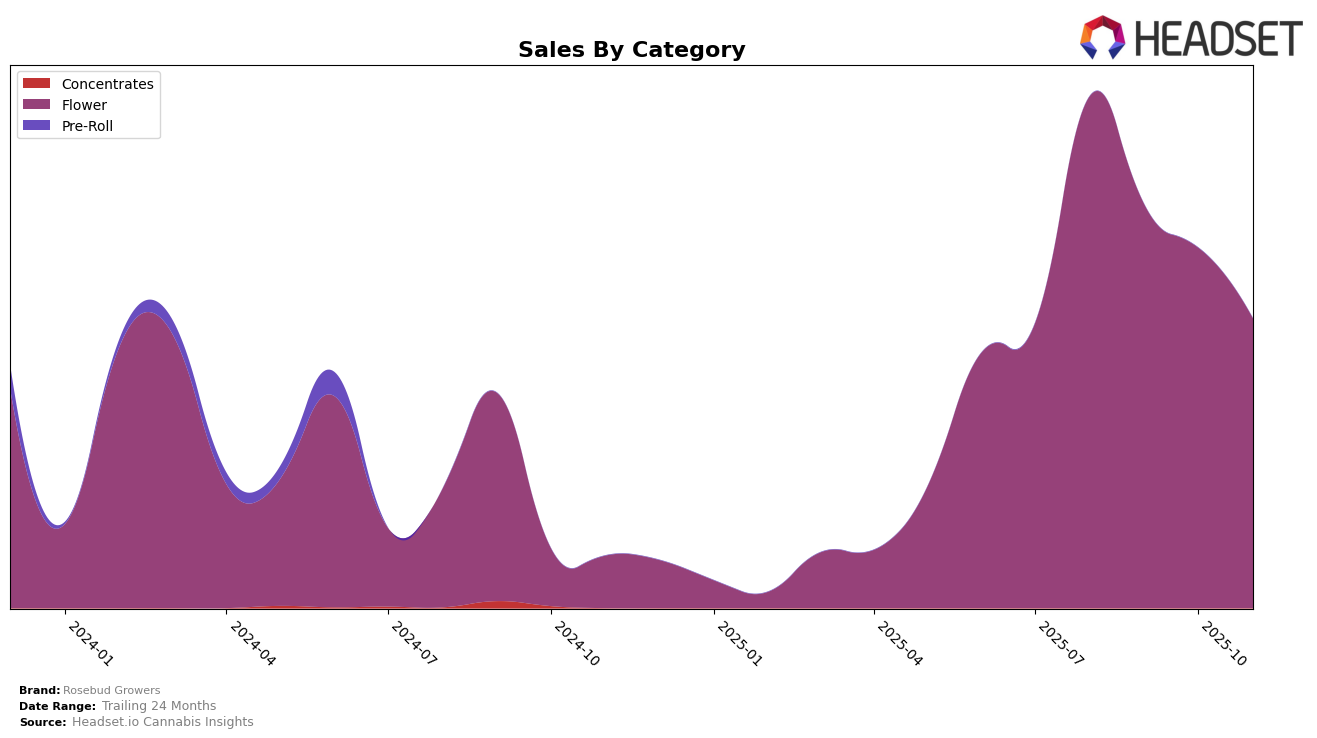

In the state of Oregon, Rosebud Growers has experienced a notable decline in their ranking within the Flower category over the past few months. Starting from a respectable 13th position in August 2025, they have gradually dropped to 27th by November 2025. This downward trajectory suggests challenges in maintaining market share, potentially due to increased competition or changes in consumer preferences. The sales figures reflect this trend, with a consistent decrease from August to November, indicating potential areas for strategic reassessment.

Interestingly, Rosebud Growers has not appeared in the top 30 brands in any other state or category during this period, which might suggest a concentration of their efforts predominantly in Oregon. This regional focus could be a double-edged sword; while it allows for targeted marketing and operations, it also exposes the brand to risks associated with market fluctuations in a single area. The absence from other state rankings highlights an opportunity for expansion and diversification, which could help mitigate these risks and drive future growth.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Rosebud Growers has experienced a notable decline in its rank from 13th in August 2025 to 27th by November 2025. This downward trend in ranking is mirrored by a decrease in sales, which could be attributed to the rising competition from brands like Cosmic Treehouse and Cannabis Nation INC. Notably, Cosmic Treehouse made a significant leap from 41st in August to 20th in October, before settling at 26th in November, indicating a strong upward trajectory that may have captured some of Rosebud's market share. Meanwhile, Cannabis Nation INC maintained a higher rank than Rosebud Growers throughout this period, despite its own fluctuations, suggesting a robust competitive presence. Other competitors like Evan's Creek Farms and Derby's Farm also showed varying degrees of improvement, further intensifying the competitive environment. These dynamics underscore the importance for Rosebud Growers to reassess its strategies to regain its competitive edge in the Oregon flower market.

Notable Products

In November 2025, Orange Candy (1g) maintained its position as the top-performing product for Rosebud Growers, despite a decrease in sales to 1784 units. Purple Payton (1g) and Rosebud Kush (Bulk) both debuted strongly in the second rank. Zotti Fuel (1g) held steady in third place, consistent with its October ranking. Lumpy Space Princess (Bulk), which was ranked first in September and second in October, fell to fourth place in November. This shift indicates a dynamic competitive landscape with new entries affecting the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.