Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

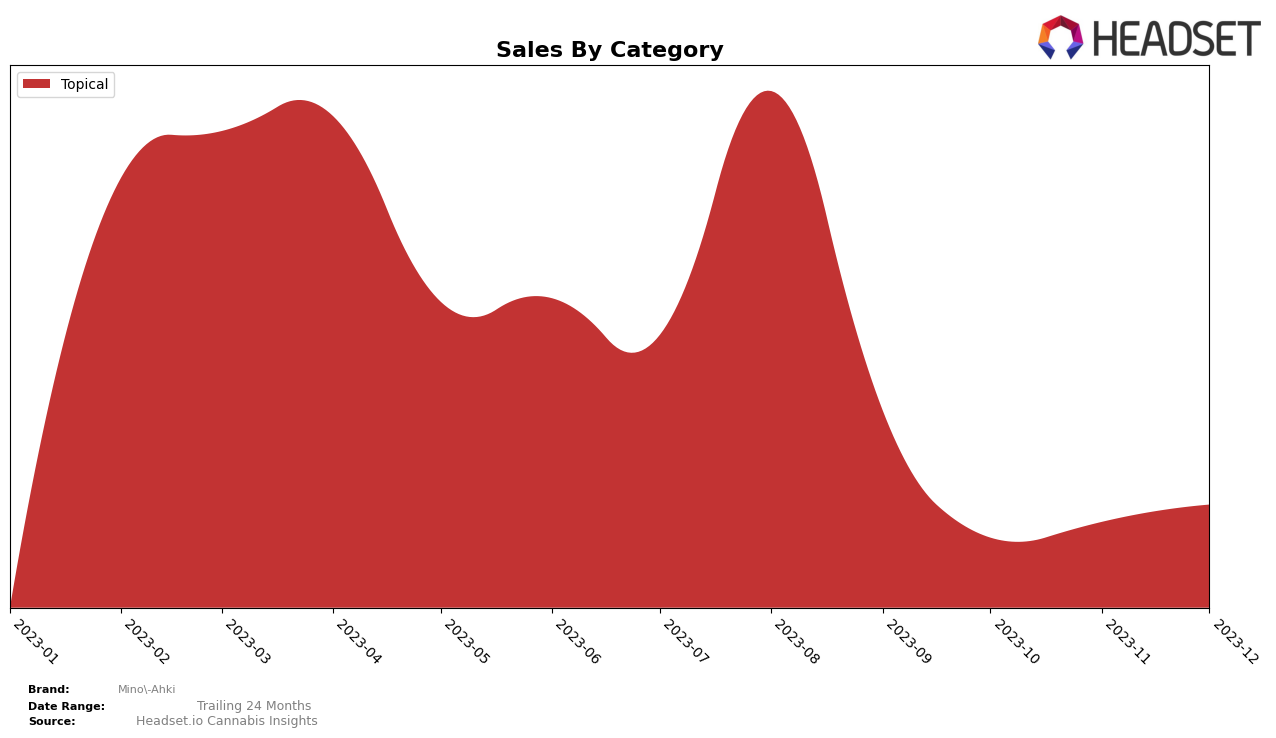

In the Topical category, Mino-Ahki has been performing well in Alberta and Saskatchewan, remaining within the top 20 brands in both states from September to December 2023. In Alberta, the brand started at rank 13 in September 2023 and has shown a positive trend, moving up to rank 11 by December 2023. However, the sales figures have seen some fluctuations during this period, with a significant drop in October, followed by a steady rise in November and December.

On the other hand, in Saskatchewan, Mino-Ahki has maintained a fairly steady position in the Topical category, hovering around the 10th to 12th rank from September to December 2023. The sales trend in this state has been somewhat different from Alberta, with a decrease in sales from September to November, and then remaining stable in December. Despite these fluctuations, Mino-Ahki's consistent presence in the top 20 brands in both states indicates its strong foothold in the Topical category in these markets.

Competitive Landscape

In the Topical category within the Alberta market, Mino-Ahki has been facing stiff competition from brands such as Müv / MUV, Dosecann, Emprise Canada, and RHO Phyto. Mino-Ahki's rank has fluctuated between 13th and 11th place over the last four months of 2023, indicating a moderate performance in the market. Notably, while Mino-Ahki's sales have seen an upward trend, it is still trailing behind its competitors. For instance, Dosecann and Emprise Canada consistently rank higher, with Dosecann even reaching 7th place in October and November. However, it's worth noting that Dosecann experienced a significant drop in sales by December, potentially opening up opportunities for Mino-Ahki to climb the ranks. Müv / MUV and RHO Phyto, despite having lower ranks in some months, have shown resilience with Müv / MUV improving its rank and RHO Phyto maintaining a steady performance.

Notable Products

In December 2023, the top-performing product from Mino-Ahki was the CBD Traditional Sweetgrass Lotion (300mg CBD, 200ml), which falls under the Topical category. This product maintained its number one rank throughout the last quarter of the year, showcasing consistent high performance. Notably, sales for this product in December reached 86 units, a slight increase from the previous month. This product's sustained top ranking and robust sales figures demonstrate its popularity among consumers. It's important to note that the rankings of other products may have shifted during this period, but the CBD Traditional Sweetgrass Lotion remained the consistent leader.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.