Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

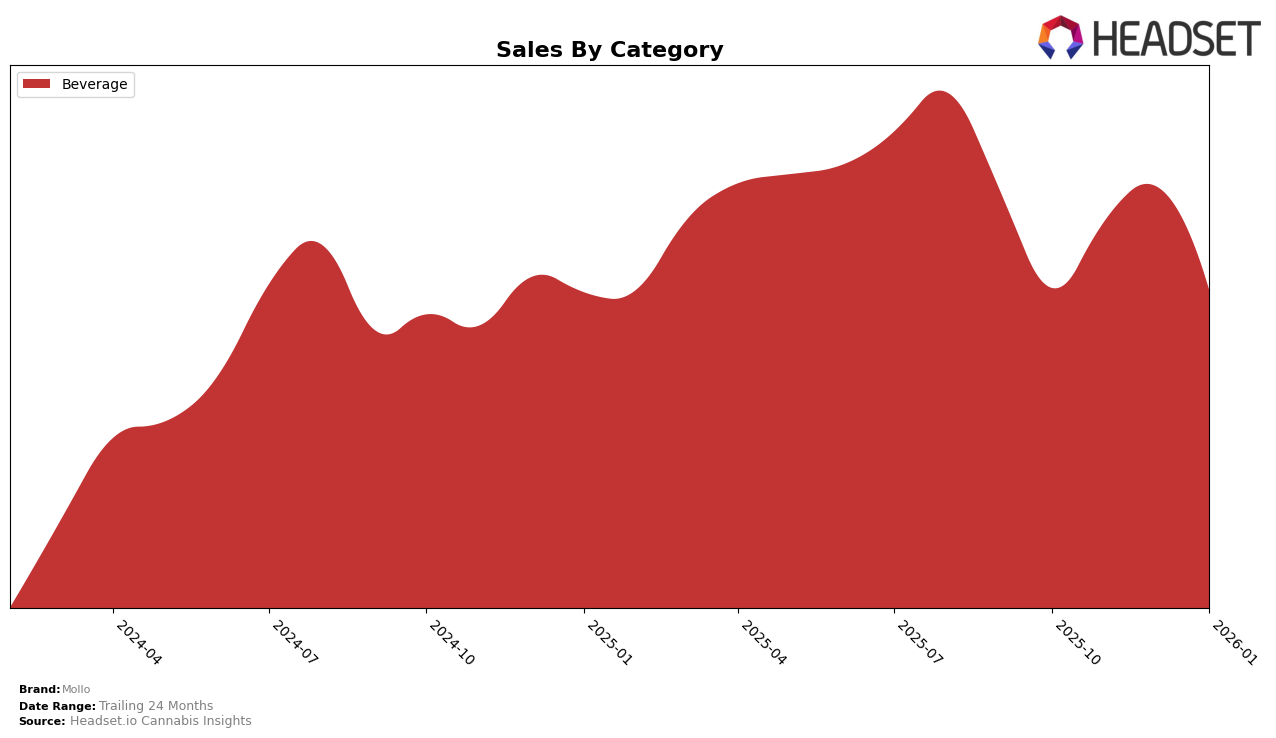

Market Insights Snapshot

In the Canadian cannabis beverage market, Mollo has demonstrated consistent performance across several provinces. In Alberta, Mollo maintained a steady ranking, consistently placing third over the past few months, despite a slight dip in sales from October to January. This stability suggests a strong brand presence and loyal customer base in the province. Similarly, in Ontario, Mollo has consistently held the third position, indicating a robust market position in one of Canada's largest provinces. However, the brand experienced a noticeable decrease in sales from December to January, which may warrant further investigation into seasonal trends or competitive actions.

In British Columbia, Mollo experienced a slight drop in ranking from third to fourth between October and November, but maintained the fourth position through January. This suggests some competitive pressure in the province, which could be an area of focus for the brand. Meanwhile, in Saskatchewan, Mollo consistently held the third position, but similar to other provinces, saw a gradual decline in sales over the same period. This trend of stable rankings but declining sales could indicate a broader market contraction or increased competition, highlighting the need for strategic adjustments to maintain sales momentum.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Mollo consistently held the third rank from October 2025 to January 2026, showcasing a stable position amidst fluctuating sales figures. Despite a dip in sales from November to January, Mollo maintained its rank, indicating a strong brand presence and customer loyalty. The top competitor, XMG, consistently held the first rank with significantly higher sales, while Versus maintained the second position with sales figures slightly above Mollo's. Meanwhile, Sweet Justice and Phresh Cannabis Beverages trailed behind Mollo, with Sweet Justice consistently in fourth place and Phresh Cannabis Beverages fluctuating between fifth and seventh. This competitive stability suggests that while Mollo faces strong competition from XMG and Versus, it remains a formidable player in the Ontario beverage market.

Notable Products

In January 2026, the top-performing product for Mollo was the CBG/THC 2:1 Blackberry Seltzer (20mg CBG, 10mg THC, 355ml), maintaining its number one rank consistently from October 2025 through January 2026, with sales reaching 15,674 units. The CBG/THC 2:1 Mango Seltzer (20mg CBG, 10mg THC, 355ml) secured the second spot, holding this position since November 2025. The CBG/THC 2:1 Watermelon Lime Seltzer (20mg CBG, 10mg THC, 12oz, 355ml) remained steady at the third rank, showing consistent performance over the months. The CBG/THC 2:1 Pineapple Seltzer (20mg CBG, 10mg THC, 355ml) improved slightly to fourth place in January 2026, up from fifth in December 2025. Meanwhile, the THC/CBG 1:1 Orchard Chill'r Apple Cider Sparkling Beverage (10mg CBG, 10mg THC, 355ml) dropped to fifth place, a slight decline from its fourth-place position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.