Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

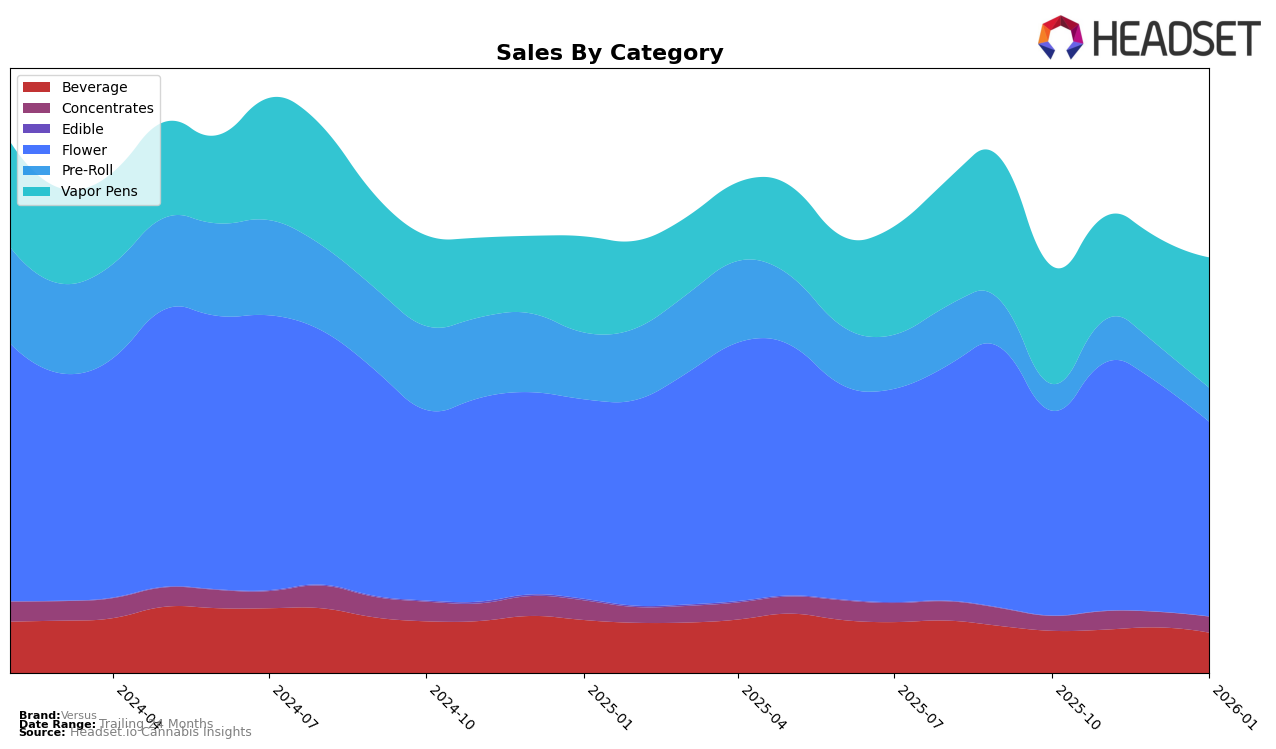

In the flower category, Versus demonstrated notable performance in British Columbia, climbing from the 13th position in October 2025 to a commendable 10th place by January 2026. This upward trend indicates a strengthening presence in the province's highly competitive market. Meanwhile, in Alberta, Versus faced challenges, as it remained outside the top 30 rankings for most months, only breaking into the 31st position by January 2026. This suggests fluctuating demand or competitive pressures in Alberta's flower market. Interestingly, in Ontario, Versus maintained a stronghold on the 8th position for three consecutive months before slipping to 11th place, highlighting potential market shifts or competitive entries affecting their ranking.

Versus showed consistent strength in the beverage category in Ontario, maintaining a steady 2nd place ranking across all months, indicating a robust consumer base and effective product offerings. In the vapor pens category, Versus had mixed results: they improved their position in Alberta from 30th to 28th, suggesting a modest gain in market share. However, in Ontario, their rankings fluctuated, peaking at 8th before dropping and then climbing back to 9th, which may reflect volatile consumer preferences or competitive dynamics. Notably, Versus entered the vapor pens market in Saskatchewan in January 2026, debuting at 12th place, indicating a promising start in this new market.

Competitive Landscape

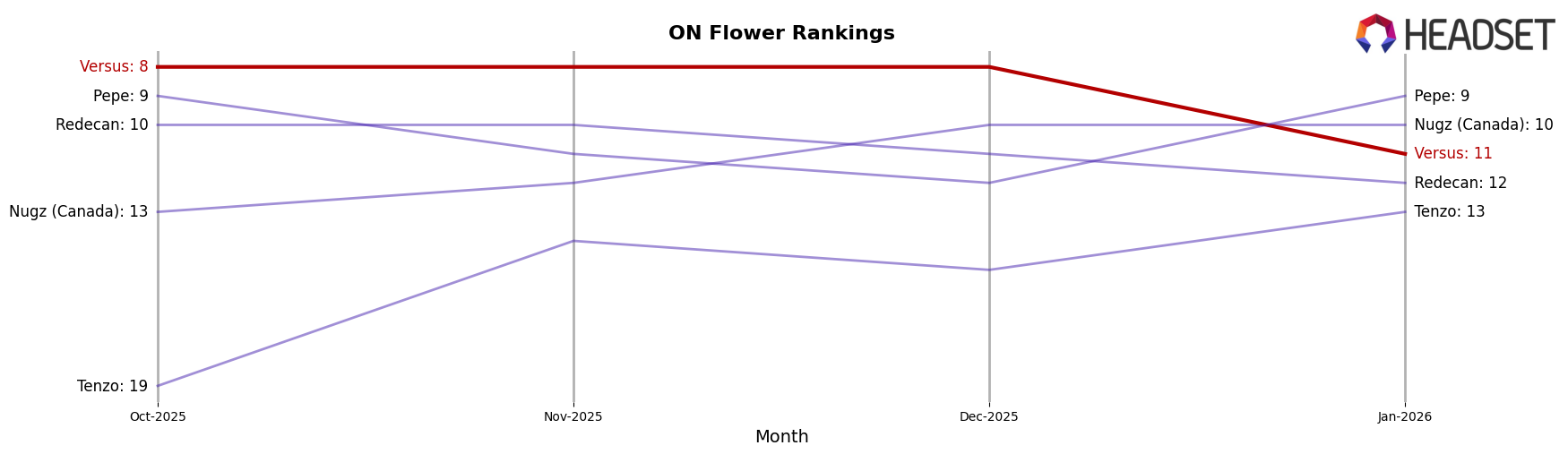

In the competitive landscape of the Flower category in Ontario, Versus has experienced notable shifts in its ranking and sales performance from October 2025 to January 2026. Versus maintained a steady position at rank 8 from October to December 2025, but saw a decline to rank 11 in January 2026. This drop in rank coincided with a decrease in sales, suggesting increased competition and potential market challenges. Meanwhile, Nugz (Canada) showed resilience, improving its rank from 13 in October to 10 in December and maintaining it in January, indicating a positive sales trajectory. Tenzo also demonstrated upward momentum, climbing from rank 19 in October to 13 by January, reflecting a significant increase in sales. Redecan and Pepe experienced fluctuations, with Redecan dropping from rank 10 in October to 12 in January, while Pepe saw a recovery from rank 12 in December to 9 in January. These dynamics highlight the competitive pressures Versus faces, underscoring the importance of strategic marketing and product differentiation to regain its standing in the Ontario Flower market.

Notable Products

In January 2026, the top-performing product from Versus was the CBD/THC 1:1 Neon Rush Carbonated Soda (10mg CBD, 10mg THC, 355ml) in the Beverage category, maintaining its consistent first-place ranking from previous months with sales reaching 24,382 units. The Black Cherry Rapid Seltzer (10mg THC, 355ml) also held its position at second place, showing steady performance. White Widow (28g) in the Flower category remained in third place, indicating stable demand despite a slight decrease in sales compared to December. The Key Lime Rapid Seltzer (10mg THC, 355ml) continued to rank fourth, although it experienced a minor drop in sales figures. Notably, the Dank Berry Distillate Cartridge (1g) entered the rankings at fifth place, marking its debut in the top five products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.