Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

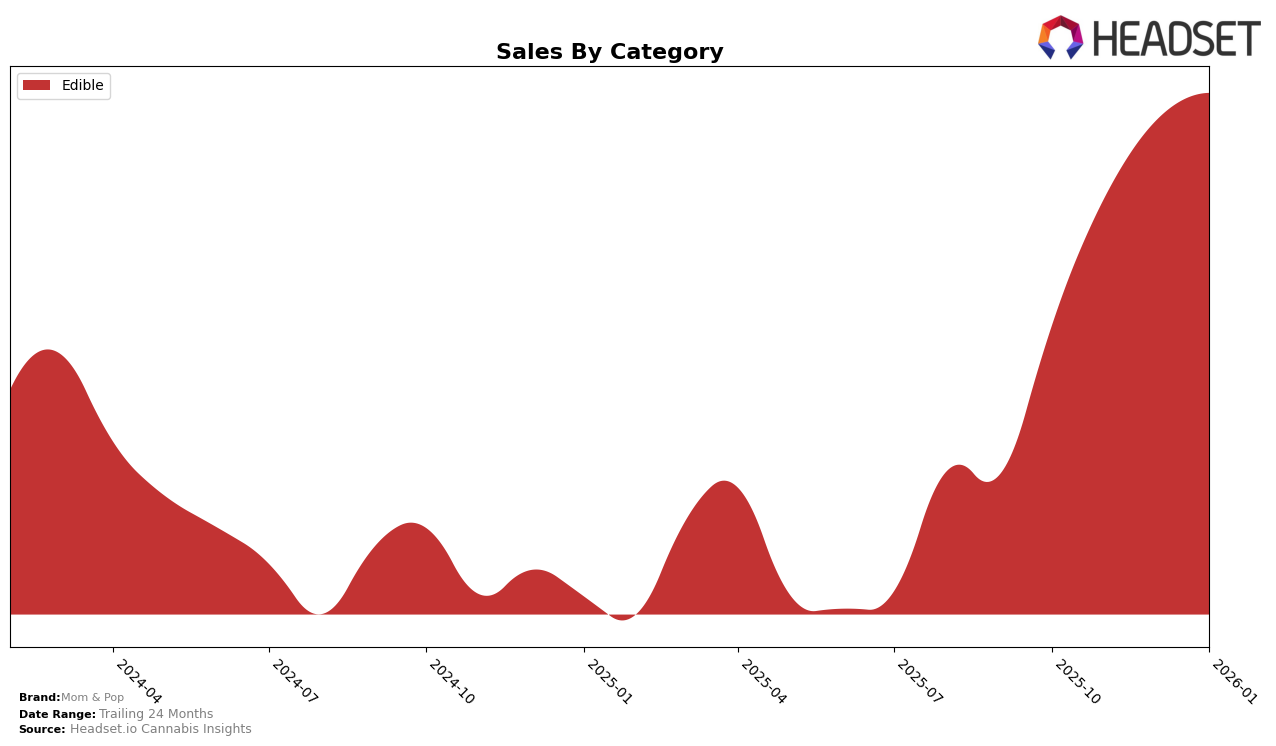

Mom & Pop has shown consistent performance in the Edible category within Arizona. Over the past few months, the brand has maintained a steady improvement in its ranking, moving from 16th position in October 2025 to 13th position by January 2026. This stability in ranking suggests a growing consumer preference and a solid foothold in the market. Notably, their sales figures have shown a positive upward trend, with a significant increase from October to January, indicating effective strategies in retaining and growing their customer base in Arizona.

While Mom & Pop has secured a stable position in Arizona's Edible category, it's important to note that their presence in other states and categories is not as prominent, as they are not listed in the top 30 brands elsewhere. This absence could indicate either a strategic focus on the Arizona market or potential areas for growth and expansion. For those interested in the broader performance of Mom & Pop, examining their strategies in Arizona might provide insights into their operational strengths and potential areas for development in new markets.

Competitive Landscape

In the competitive landscape of the Arizona edible cannabis market, Mom & Pop has shown a consistent presence, maintaining a rank of 13th from November 2025 through January 2026, after an initial rise from 16th in October 2025. This steady positioning indicates a stable market performance, although it trails behind brands like Good Tide, which consistently ranks higher, maintaining a position within the top 12. Notably, Jams has demonstrated a strong upward trajectory, surpassing Mom & Pop by moving from 13th in October to 11th in January. Meanwhile, Zenzona has held a steady 14th rank, closely trailing Mom & Pop. The absence of Dialed In Gummies from the top 20 until January 2026, when it entered at 15th, suggests a potential emerging competitor. These dynamics highlight the competitive pressure on Mom & Pop to innovate and capture more market share to improve its rank and sales in the coming months.

Notable Products

In January 2026, the Strawberry Gummy 10-Pack (2000mg) maintained its top position in the Edible category for Mom & Pop, with sales reaching 830 units. Following closely, Raspberry Gummies 10-Pack (2000mg) rose to second place, showing a significant increase from fourth in December 2025. Watermelon Gummy 10-Pack (2000mg) held steady in third place, consistent with its rank in the previous month. Mixed Berry Gummy 10-Pack (2000mg) saw a slight decline, moving down to fourth from second in December. Notably, the Dark Chocolate Bar (1000mg) entered the rankings for the first time, securing the fifth position in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.