Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

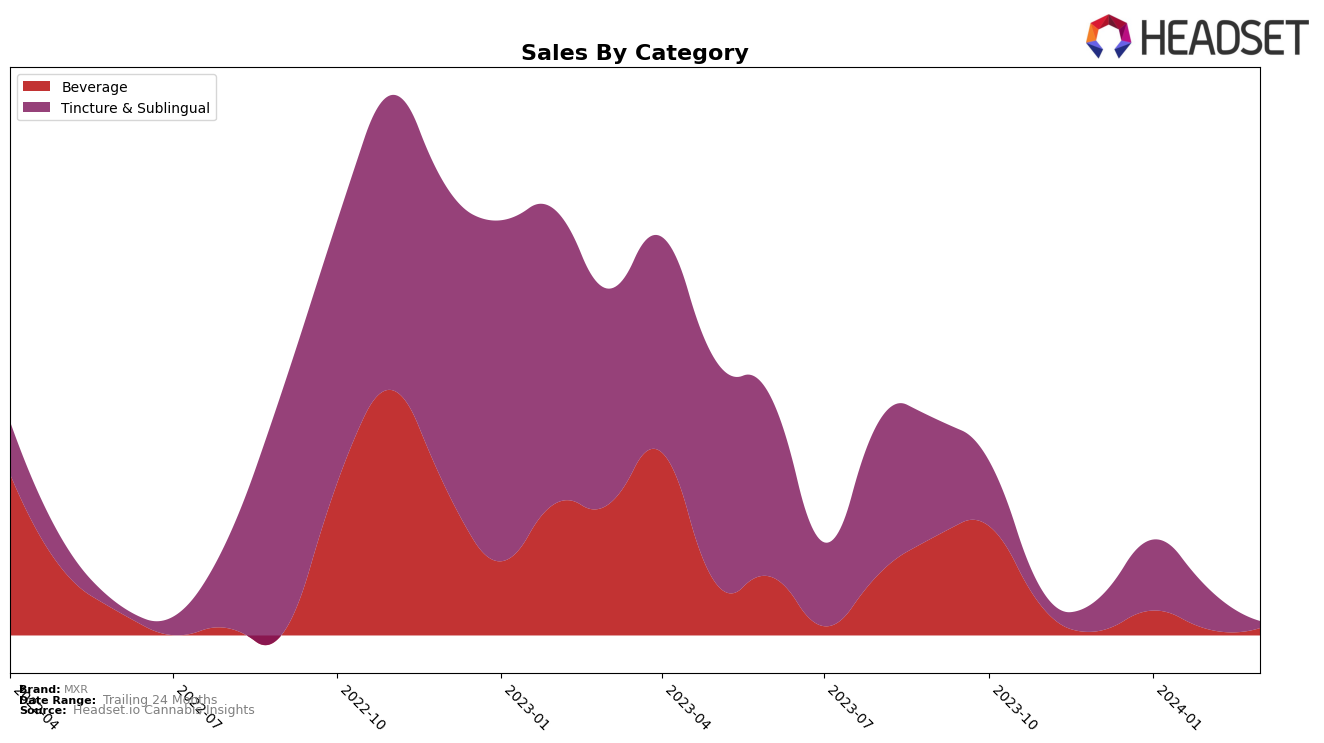

In Massachusetts, MXR has shown a notable presence across different cannabis product categories, particularly in Beverages and Tinctures & Sublinguals. For Beverages, MXR has maintained its position within the top 30 brands from December 2023 to March 2024, showing slight but consistent improvement in its rankings - moving from 28th in December to 25th in March. This upward trend, although modest, indicates a growing consumer preference for MXR's Beverage offerings in the state. However, the sales figures, peaking in January 2024 before a slight drop and then a small recovery, suggest a fluctuating demand that MXR needs to stabilize to enhance its market position further.

On the other hand, MXR's performance in the Tincture & Sublingual category tells a slightly different story. Starting strong at 11th in December 2023, the brand saw a significant jump to 8th place in January 2024, showcasing a peak in consumer interest and sales. This peak, highlighted by a notable increase in sales from December to January, indicates a robust market response to MXR's Tincture & Sublingual products. However, the subsequent drop to 15th place by March 2024 raises questions about the brand's ability to maintain its early momentum. This drop, especially in a category as competitive as Tinctures & Sublinguals, suggests that while MXR has the potential to capture and excite the market, maintaining consumer interest over time may be a challenge that requires strategic focus.

Competitive Landscape

In the competitive landscape of the beverage category in Massachusetts, MXR has shown a notable trajectory in terms of its rank and sales from December 2023 to March 2024. Starting at rank 28 in December, MXR experienced a slight improvement in its positioning, moving up to rank 25 by March 2024. This shift in rank is indicative of MXR's resilience and potential for growth amidst fierce competition. Notably, MXR has outperformed NectarBee in March, despite NectarBee's late entry into the top 20 rankings in March. However, MXR faces stiff competition from Ocean Breeze and Canna Drinks, which have also shown significant rank changes and sales volumes, with Ocean Breeze notably overtaking MXR by March. Green Monke, despite a significant drop in sales, remains a strong competitor due to its earlier top 20 presence. The dynamic shifts in rankings and sales among these brands underscore the volatile nature of the market and highlight the importance of strategic positioning and innovation for MXR to maintain and improve its market standing.

Notable Products

In March 2024, MXR saw the CBD/THC 1:1 Stir It Up Plasmic Cooler Stir It Up Drink Infuser leading the sales chart within the Beverage category, marking its ascent to the top position from the third rank in February, with notable sales figures reaching 21 units. Similarly, the CBD/THC 1:1 Stir It Up Plasmic Cooler Tincture shared the top spot, but within the Tincture & Sublingual category, maintaining its leading position from February. The THC/CBN 2:1 Sleep Tincture, previously a top performer in the Tincture & Sublingual category, did not make it to the March rankings, indicating a shift in consumer preference or availability issues. This shift underscores a dynamic market where product preferences can change significantly month over month. The sales figures and rankings highlight MXR's ability to cater to varied consumer tastes across different product categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.