Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

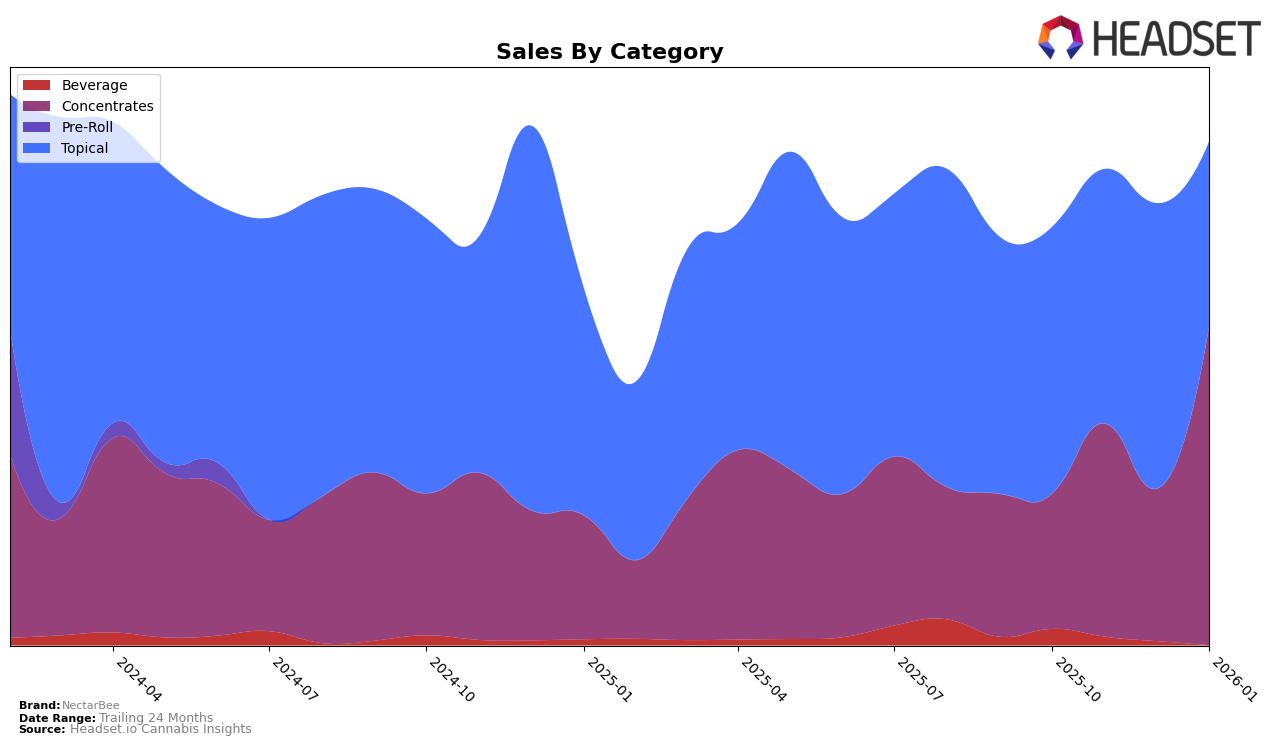

NectarBee, a prominent brand in the cannabis industry, has shown varied performance across different categories and states. In the Colorado concentrates market, NectarBee experienced a significant shift in its rankings. Notably, the brand was absent from the top 30 in October and December 2025, indicating a potential struggle in maintaining a consistent presence in this competitive category. However, by January 2026, NectarBee made a notable comeback, securing the 49th position, suggesting a positive turnaround in their strategy or consumer demand. This fluctuation highlights the challenges brands face in sustaining a strong foothold in dynamic markets.

In contrast, NectarBee's performance in the topical category in Colorado has been more stable. The brand consistently maintained a position within the top 10 from October to December 2025, ranking 8th and then 7th for two consecutive months. This stability indicates a strong consumer base and effective product offerings in the topical segment. However, it is worth noting that NectarBee's absence from the rankings in January 2026 suggests a sudden shift that could be attributed to various market factors or internal brand decisions. Such movements emphasize the importance of strategic planning and market adaptation to sustain growth across different product categories.

Competitive Landscape

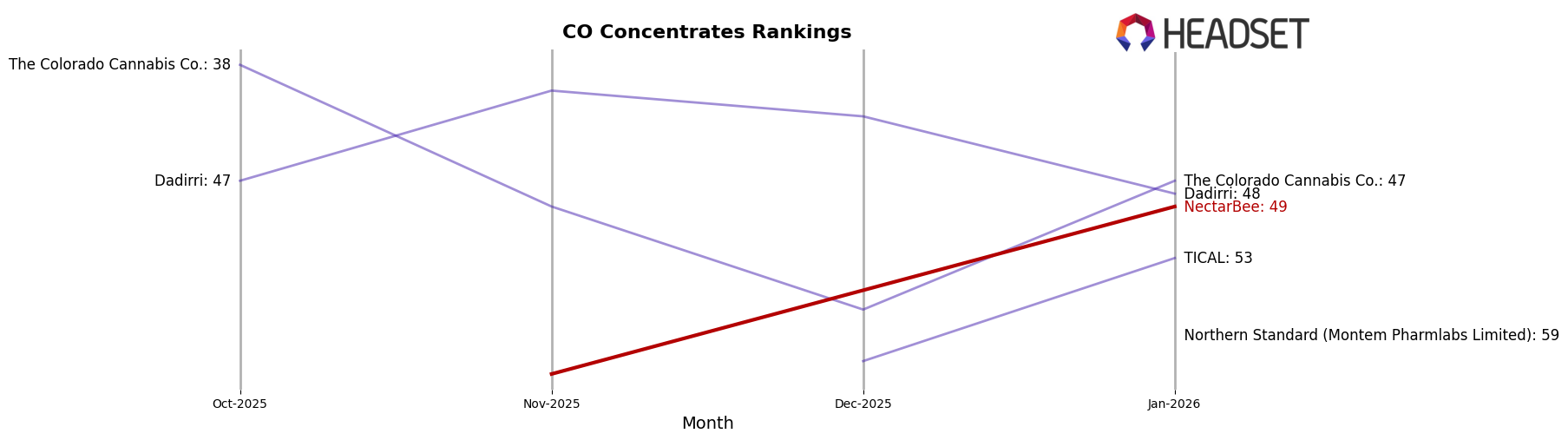

In the competitive landscape of the Colorado concentrates market, NectarBee has experienced fluctuating rankings, indicating a dynamic environment. Notably, NectarBee re-entered the top 20 in January 2026, securing the 49th position after being absent in October and December 2025. This resurgence suggests a positive trend in sales momentum, possibly driven by strategic adjustments or new product offerings. In comparison, The Colorado Cannabis Co. consistently remained outside the top 20, with a slight improvement from 57th in December 2025 to 47th in January 2026. Meanwhile, Dadirri maintained a relatively stable presence, albeit with a drop to 48th in January 2026, just below NectarBee. The entry of TICAL into the rankings in November 2025, climbing to 53rd by January 2026, highlights increasing competition. The absence of Northern Standard (Montem Pharmlabs Limited) from the top 20 until January 2026, when it ranked 59th, further underscores the competitive pressures in this market segment. These shifts suggest that while NectarBee faces strong competition, its recent ranking improvement could indicate a potential for increased market share if current strategies continue to yield positive results.

Notable Products

In January 2026, Pure Caviar (1g) from the Concentrates category maintained its top position as the best-selling product for NectarBee, with a notable sales figure of 1004 units. The CBD/THC 1:1 Heal Line Muscle Balm in the Topical category remained steady at the second position, despite a decrease in sales to 242 units. The CBD/THC 1:5 Heal Line Nerve Salve also in Topical, held its third place position, continuing the trend from the previous months. Ginger Ale from the Beverage category, which previously held the fourth rank, was not ranked in January 2026. Overall, the top three products have consistently held their positions since October 2025, indicating strong and stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.