Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

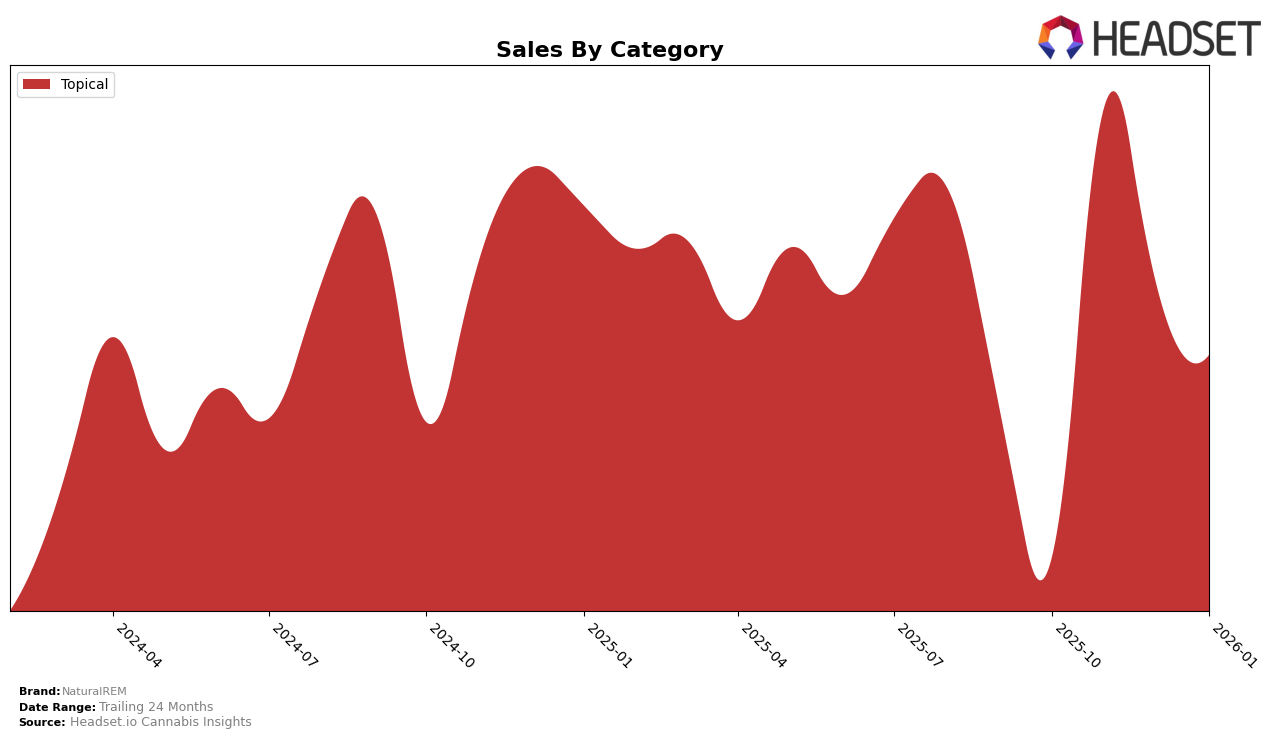

NaturalREM has shown a notable presence in the British Columbia market, particularly within the Topical category. In November 2025, the brand achieved a significant milestone by entering the top 10, ranking at 6th place. This is a substantial leap from October, where NaturalREM did not feature in the top 30, highlighting a strong upward trajectory. The absence of rankings for December 2025 and January 2026 suggests that the brand may have faced challenges in maintaining its position or that competition intensified, pushing them out of the top tier. Such fluctuations are crucial for understanding market dynamics and the competitive landscape in the region.

While specific sales figures for the latter months are not available, the initial sales data from October 2025, amounting to CAD 12,787, provides a baseline for assessing the brand's performance. The November ranking improvement indicates a potential increase in consumer interest or strategic marketing efforts that resonated with the audience in British Columbia. However, the lack of subsequent rankings in December and January may point to either a temporary surge in interest or operational challenges that need addressing to sustain market presence. Understanding these dynamics is essential for stakeholders looking to capitalize on or compete within the Topical category in this region.

Competitive Landscape

In the competitive landscape of topical cannabis products in British Columbia, NaturalREM has faced significant challenges in maintaining its market position. As of the latest data, NaturalREM did not rank in the top 20 brands from October 2025 through January 2026, indicating a potential decline in market presence compared to its competitors. Meanwhile, Wildflower has shown strong performance, consistently ranking within the top 5, peaking at 3rd place in November 2025. This suggests a robust consumer preference for Wildflower's offerings, which may be impacting NaturalREM's sales. Similarly, Nutra maintained a stable position, ranking 4th in November 2025 and sustaining its presence in the top 5 through January 2026. The consistent high rankings and sales figures of these competitors highlight the competitive pressure NaturalREM faces, emphasizing the need for strategic adjustments to regain market share and improve brand visibility in this category.

Notable Products

In January 2026, the CBD Extra Strength Relief Stick Roll On maintained its top position as the number one selling product for NaturalREM, despite a decrease in sales to 181 units. This product has consistently held the number one rank since October 2025. The CBD Massage Oil, which was ranked third in November 2025, did not appear in the top ranks for January 2026, indicating a possible decline in popularity or stock availability. The CBD/THC 1:1 Relief Full Spectrum Cream, previously ranked second from October to December 2025, was not ranked in January 2026, suggesting a significant drop in sales or a change in consumer preference. Overall, the data shows a strong performance for the CBD Extra Strength Relief Stick Roll On, while other products experienced shifts in their rankings and sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.