Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

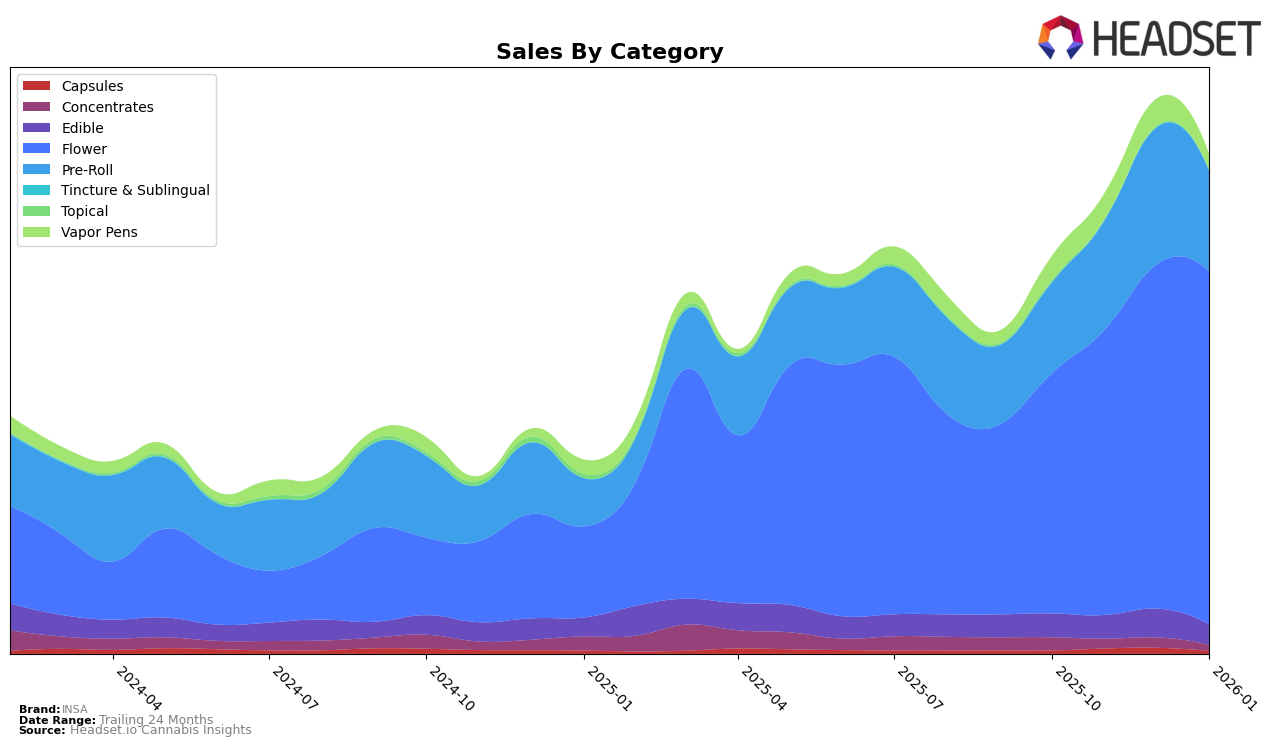

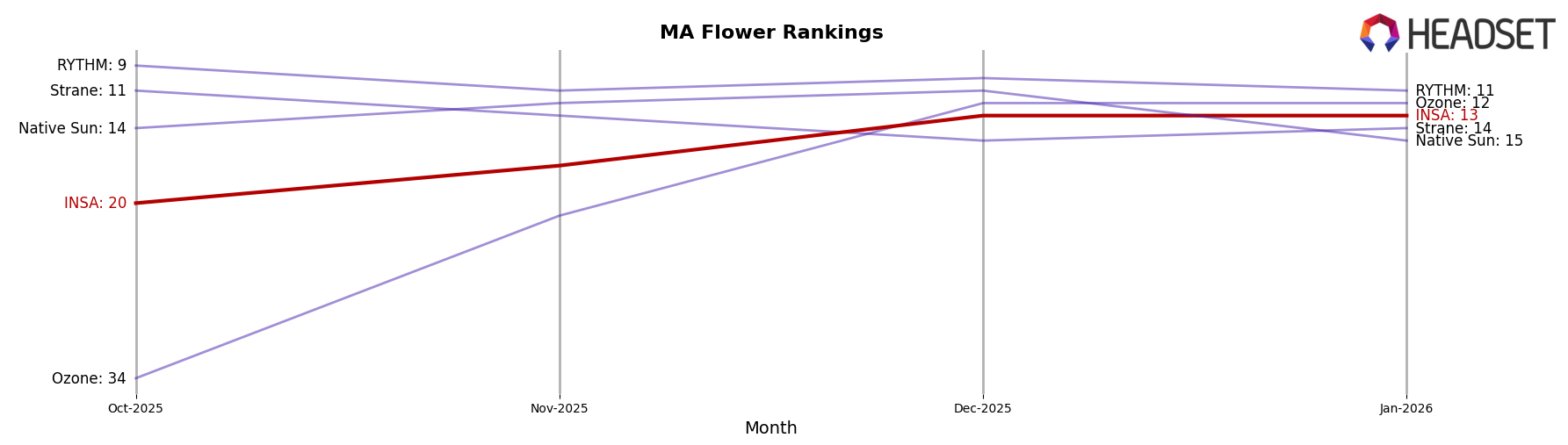

INSA's performance across different product categories in Massachusetts shows a dynamic landscape with notable shifts in rankings. In the Flower category, INSA has demonstrated a strong upward trend, moving from 20th place in October 2025 to securing the 13th position by December 2025 and maintaining it in January 2026. This consistent improvement highlights their growing prominence in the market. However, the Concentrates category tells a different story, as INSA fell out of the top 30 rankings after October 2025, indicating a potential area for strategic reassessment. Meanwhile, in Pre-Rolls, INSA experienced fluctuations, peaking at 23rd place in December 2025 before dropping to 27th in January 2026, suggesting a competitive environment that requires attention.

In the Edible category, INSA showed a slight improvement from 37th in October 2025 to 33rd in December, although it slipped back to 38th in January 2026. This volatility could be indicative of market challenges or shifts in consumer preferences. The Vapor Pens category presents a more challenging scenario for INSA, as they remained outside the top 30 throughout the observed months, with rankings around the mid-60s and even dropping to 74th in January 2026. This suggests that Vapor Pens might not be a strong suit for INSA in Massachusetts, potentially necessitating strategic pivots or increased marketing efforts to capture market share. Overall, while INSA has shown strength in certain categories like Flower, other areas may require strategic focus to enhance their market position.

Competitive Landscape

In the Massachusetts flower category, INSA has shown a notable upward trend in its rankings and sales over the past few months, suggesting a strengthening market presence. Starting from the 20th position in October 2025, INSA climbed to 13th by December 2025 and maintained this rank in January 2026. This improvement is accompanied by a consistent increase in sales, indicating a growing consumer preference for INSA products. In contrast, RYTHM, which started at 9th place in October, saw a slight decline, dropping to 11th by January 2026, with a downward sales trend. Similarly, Strane experienced a decline in rank and sales, moving from 11th to 14th over the same period. Meanwhile, Ozone made significant strides, jumping from 34th to 12th, indicating a competitive push in the market. However, Native Sun showed volatility, peaking at 11th in December before dropping to 15th in January. These dynamics highlight INSA's potential to capture more market share as competitors face challenges in maintaining their positions.

Notable Products

In January 2026, the top-performing product for INSA was the 22 Lemons Pre-Roll (1g), securing the first rank with a notable sales figure of 2104 units. The Face Melter Nitrobliterator Infused Pre-Roll (1g) followed closely in second place, dropping from its previous top rank in December 2025. The Peanut Butter Crunch Pre-Roll (1g) maintained its third position from the previous month. Triangle Pie Pre-Roll (1g) experienced a decline in rank, moving from second in December 2025 to fourth in January 2026. Lastly, the 22 Lemons Pre-Roll (0.5g) entered the rankings at fifth place, highlighting its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.