Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

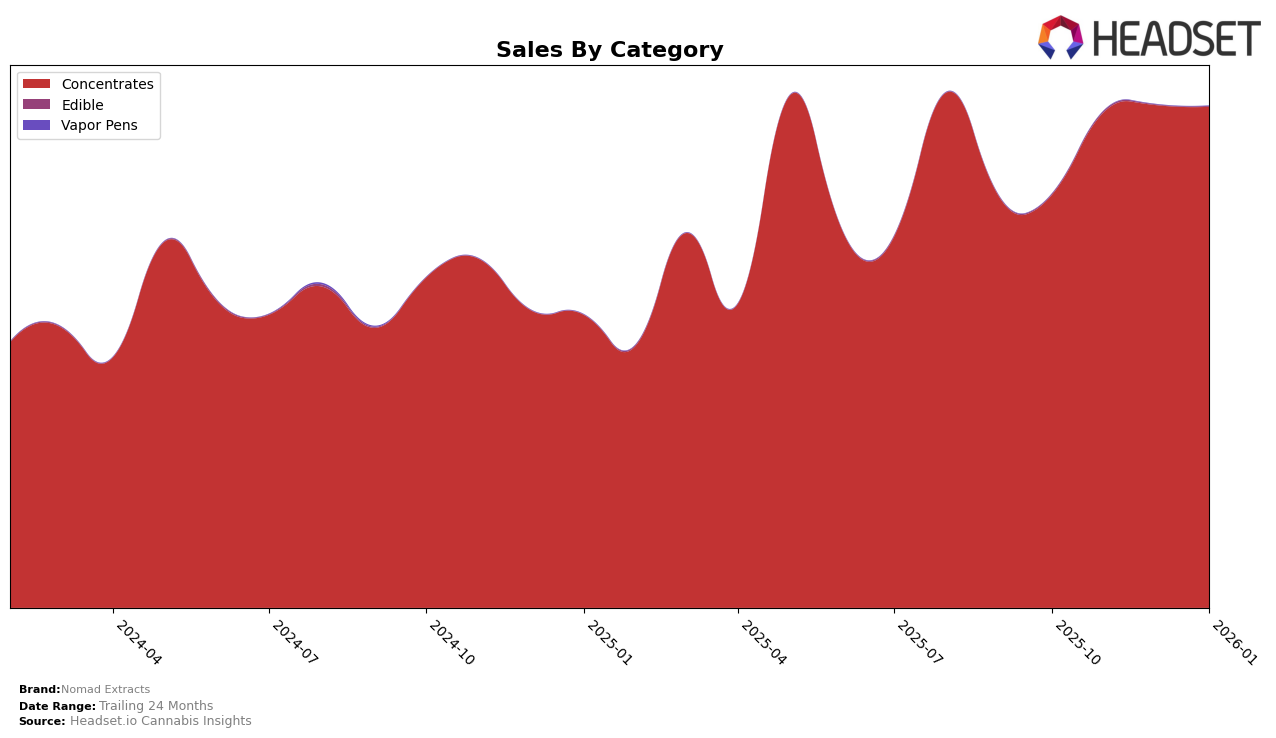

Nomad Extracts has demonstrated a consistent performance in the Concentrates category in Colorado, maintaining a steady third-place ranking from October 2025 through January 2026. This stability in ranking suggests a strong foothold in the market, reflecting both consumer loyalty and competitive product offerings. The sales figures, while not detailed here, indicate a positive trend over the months, underscoring the brand's ability to sustain its market position despite potential fluctuations in consumer demand or emerging competitors.

Interestingly, the data reveals that Nomad Extracts did not appear in the top 30 brands in any other state or category during the same period. This absence from other rankings could be interpreted in various ways. On the one hand, it highlights the brand's concentrated success in Colorado, but on the other hand, it might suggest opportunities for growth and expansion into new markets or product categories. Such insights could be crucial for stakeholders looking to strategize future market entries or to bolster their existing market presence.

Competitive Landscape

In the competitive landscape of Colorado's concentrates market, Nomad Extracts has maintained a consistent rank of 3rd place from October 2025 to January 2026. Despite this steady ranking, Nomad Extracts faces stiff competition from brands like Amber, which has consistently held the top position, and 710 Labs, which has secured the 2nd spot throughout the same period. Notably, Nomad Extracts experienced a significant increase in sales from October to November 2025, although it was still outpaced by the sales growth of 710 Labs in January 2026. Meanwhile, Green Dot Labs and Spectra have shown fluctuations in their rankings, with Spectra improving its position to 4th place in December 2025 and January 2026. This competitive environment highlights the need for Nomad Extracts to innovate and differentiate to capture more market share and potentially climb the ranks.

Notable Products

In January 2026, Willyz Wonkaz Sugar Wax (1g) emerged as the top-performing product for Nomad Extracts, climbing from second place in December to first place with sales of 1166 units. Ice Cream Cake Wax (1g) followed closely, dropping from the top position in December to second place with 1107 units sold. Cap Junkie Sugar Wax (1g) secured the third position, maintaining its rank from the previous month. Apricot Haze Sugar Wax (1g) fell from first place in December to fourth in January. Daily Grape Wax (1g) rounded out the top five, slipping from third place in December to fifth place in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.