Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

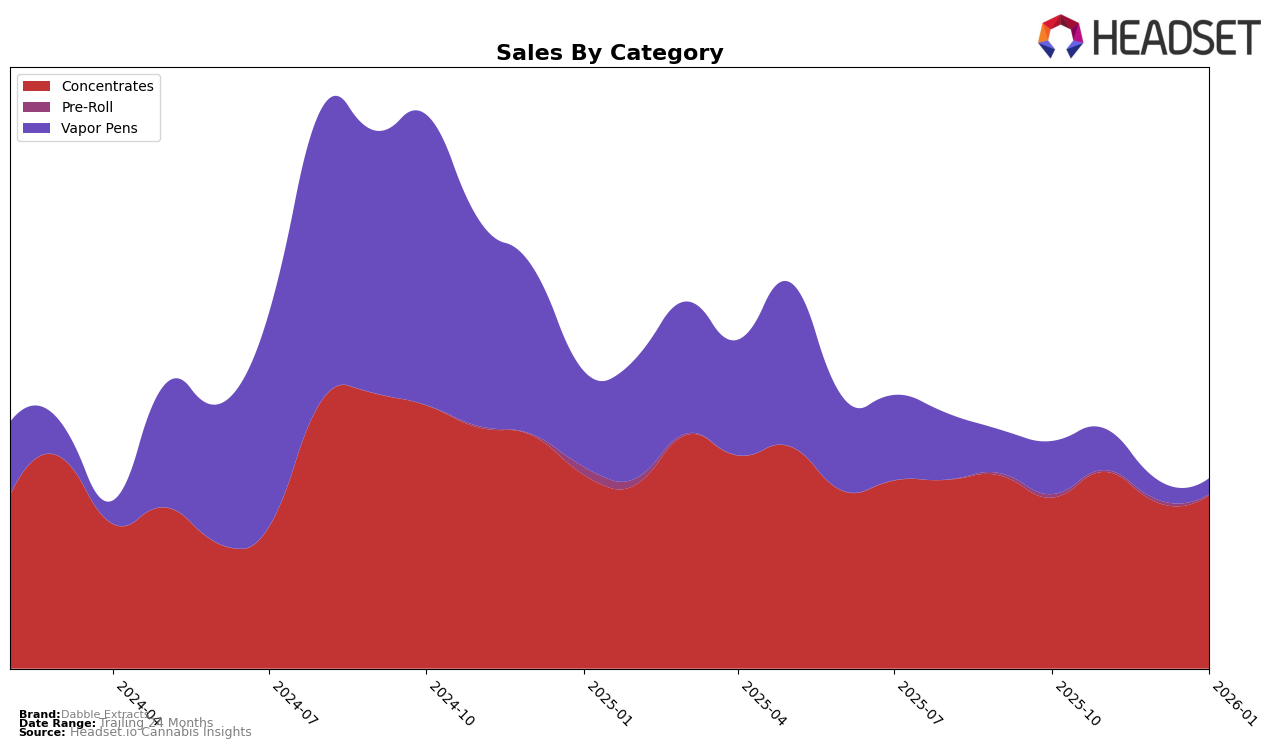

In the British Columbia market, Dabble Extracts has shown a fluctuating presence in the Concentrates category. Starting at rank 27 in October 2025, they fell out of the top 30 in December 2025, only to reappear at rank 36 by January 2026. This indicates a volatile performance, possibly influenced by market dynamics or competitive pressures. The brand's sales figures also reflect this instability, with a notable peak in November 2025 and a subsequent decline by January 2026. Such movements suggest that while Dabble Extracts can capture market attention, sustaining it remains a challenge in British Columbia.

In Colorado, Dabble Extracts has maintained a more consistent presence in the Concentrates category, consistently ranking within the top 15 from October 2025 to January 2026. This stability suggests a strong foothold in the market, with sales figures aligning with this consistent ranking. However, the Vapor Pens category tells a different story, with rankings slipping from 58 in October 2025 to 73 by January 2026. This decline in the Vapor Pens category could indicate shifting consumer preferences or increased competition. The contrasting performances across categories highlight the brand's varying strengths and challenges within the Colorado market.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Dabble Extracts has demonstrated a steady presence, maintaining a rank between 10th and 12th from October 2025 to January 2026. Despite facing stiff competition, Dabble Extracts' sales figures show resilience, particularly in November 2025, where it saw a notable increase, positioning it closely behind Concentrate Supply Co., which ranked 9th in both November and January. Meanwhile, Denver Dab Co consistently outperformed Dabble Extracts, maintaining a top 10 position throughout the period. However, Dabble Extracts outpaced Good Chemistry Nurseries, which started outside the top 20 in November but made significant gains by December and January. The fluctuating performance of LEIFFA, which dropped from 7th in November to 11th in January, highlights the dynamic nature of this market segment, offering opportunities for Dabble Extracts to capitalize on shifts in consumer preferences and competitive positioning.

Notable Products

In January 2026, Lazer Shatter (1g) emerged as the top-performing product for Dabble Extracts, climbing to the number one spot with notable sales of 1017 units. Berry Breath Sugar Wax (1g) maintained its consistent performance, ranking second for the second consecutive month. Miracle Alien Cookies Wax (1g) slipped from its peak position in December to third place, indicating a slight dip in sales momentum. Cake Pie Live Resin (1g) experienced a drop from its earlier rankings, settling in at fourth place. Double Diesel Live Resin (1g), once a top contender, continued its downward trend, ranking fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.