Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

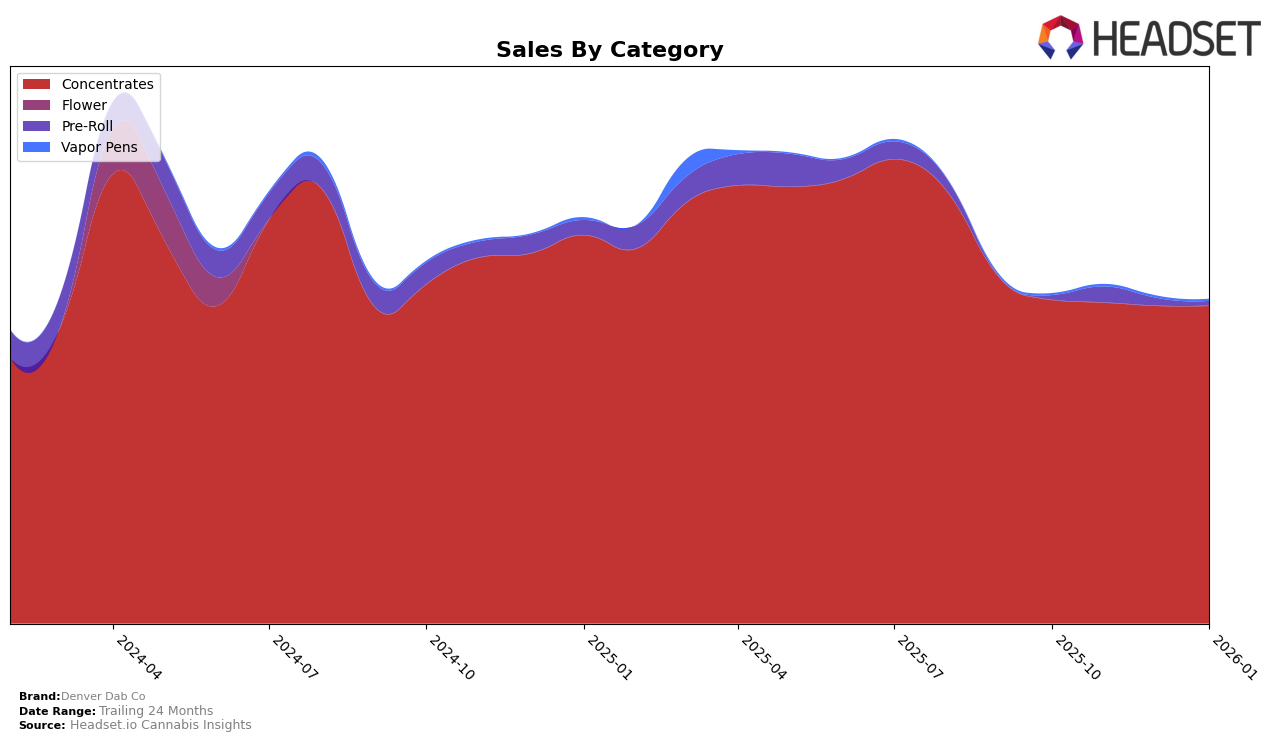

Denver Dab Co has demonstrated a consistent performance in the Concentrates category within Colorado, maintaining a stable presence in the top 10 from October 2025 through January 2026. Despite a slight dip to the 10th position in December, the brand quickly rebounded to the 8th spot by January, showcasing resilience in a competitive market. This stability is notable given the slight decline in sales figures over the months, suggesting that Denver Dab Co is effectively managing to retain its market share amidst fluctuating sales volumes. Such consistency in rankings indicates a strong brand presence and customer loyalty in the concentrates category.

In contrast, Denver Dab Co's performance in the Pre-Roll category in Colorado tells a different story. The brand was not ranked in the top 30 for October 2025, but by November, it managed to secure the 76th position. This indicates a potential area for growth and opportunity, as breaking into the top 100 could signify the beginning of a strategic push or an emerging interest in their pre-roll offerings. However, the absence of ranking data for the subsequent months suggests that maintaining momentum in this category might be challenging for the brand. This divergence in category performance highlights the varying levels of competition and consumer preferences within different product segments.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Denver Dab Co has maintained a steady presence, consistently ranking 8th in October, November, and January, with a slight dip to 10th in December 2025. This stability is notable given the fluctuating ranks of competitors like Concentrate Supply Co., which saw a significant rise from 15th in October to 9th in November, only to drop to 11th in December before regaining the 9th position in January. Similarly, Dabble Extracts experienced a similar pattern, moving from 11th to 10th, then to 12th, and back to 10th over the same period. Meanwhile, Billo demonstrated volatility, with a notable drop from 7th in October to 12th in November, before recovering to 7th by January. Sunshine Extracts consistently held the 6th position, indicating a strong market presence. Despite these fluctuations among competitors, Denver Dab Co's consistent ranking suggests a stable customer base and effective market strategies, although the brand's sales figures indicate a slight downward trend, which could be a point of concern if competitors continue to gain traction.

Notable Products

In January 2026, GG4 Wax (1g) emerged as the top-performing product for Denver Dab Co, leading the sales with a significant figure of 1089 units sold. Following closely, Super Glue Wax (1g) and Cloudy Daze Wax (1g) secured the second and third positions, respectively, with sales figures that illustrate their strong market presence. Gelato Sugar Wax (1g) and Orange Runtz Wax (1g) rounded out the top five, indicating a consistent preference for concentrates. Notably, these rankings represent a fresh entry for January, as no comparative rank data is available from the previous months. This suggests a potential shift in consumer preferences or successful marketing strategies implemented by Denver Dab Co.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.