Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

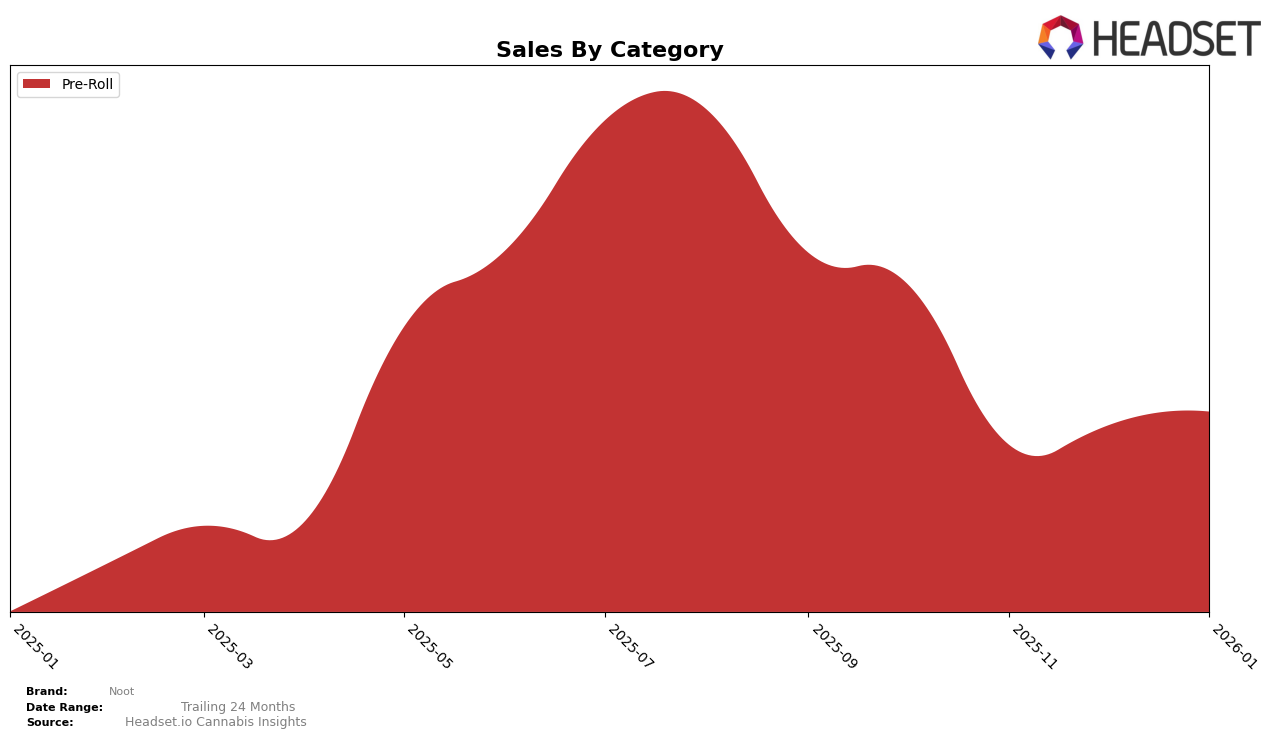

In the state of Colorado, Noot has shown a consistent presence in the Pre-Roll category over the past few months. Starting from October 2025, the brand was ranked 13th, but it experienced a decline in November, dropping to 20th place. However, Noot managed to recover slightly in December and January, ranking 19th and 18th, respectively. This indicates some volatility in their market position, yet the ability to remain within the top 20 suggests a stable consumer base. The sales figures for October 2025 were notably higher than in the following months, which could imply a seasonal or promotional peak during that time.

The absence of Noot from the top 30 in other states or categories could be a cause for concern, as it highlights potential limitations in their market reach or category dominance outside of Colorado's Pre-Roll sector. This could either indicate a strategic focus on a specific market or a need for broader expansion efforts to enhance brand visibility and competitiveness. Understanding the dynamics of these rankings could provide valuable insights into Noot's strategic priorities and areas for potential growth, especially as they navigate the competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll market, Noot has experienced notable fluctuations in its ranking and sales over the past few months. Starting from October 2025, Noot was ranked 13th but saw a decline to 20th in November, before slightly recovering to 19th in December and 18th in January 2026. This trend indicates a volatile position within the market, possibly due to competitive pressures. For instance, Stratos consistently maintained a higher rank than Noot, peaking at 16th in January 2026, which could suggest stronger brand loyalty or marketing strategies. Meanwhile, Fuego Farms (CO) also showed a downward trend, dropping from 14th to 19th, which may have provided Noot an opportunity to capture some of their market share. Natty Rems demonstrated a more stable trajectory, ending at 17th, just above Noot. These dynamics highlight the competitive pressures Noot faces, emphasizing the need for strategic adjustments to improve its market position and capitalize on potential opportunities within the Colorado pre-roll sector.

Notable Products

In January 2026, the top-performing product for Noot was the Hybrid Pre-Roll 6-Pack (3.5g), maintaining its number one rank consistently since November 2025, with a notable sales figure of 1498 units. The Sativa Blend Pre-Roll 6-Pack (3.5g) secured the second position, holding steady since November, despite a slight decrease in sales to 1187 units. The Indica Blend Pre-Roll 6-Pack (3.5g) remained in the third position, showing a recovery in sales with 1089 units sold. Peanut Butta Yum Pre-Roll 6-Pack (3.5g) and White 99 Pre-Roll 6-Pack (3.5g) both maintained their ranks at fourth and fifth respectively, with modest sales figures. This stability in rankings indicates a consistent preference for these products among consumers over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.