Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

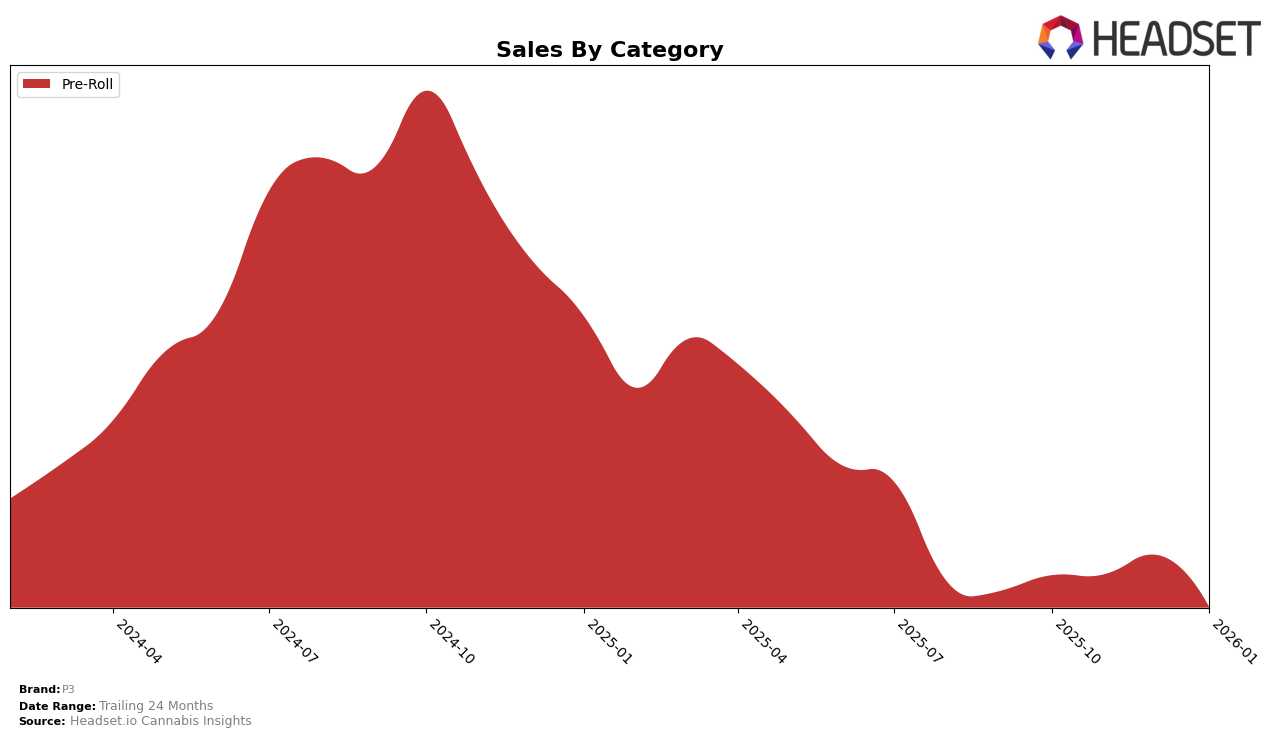

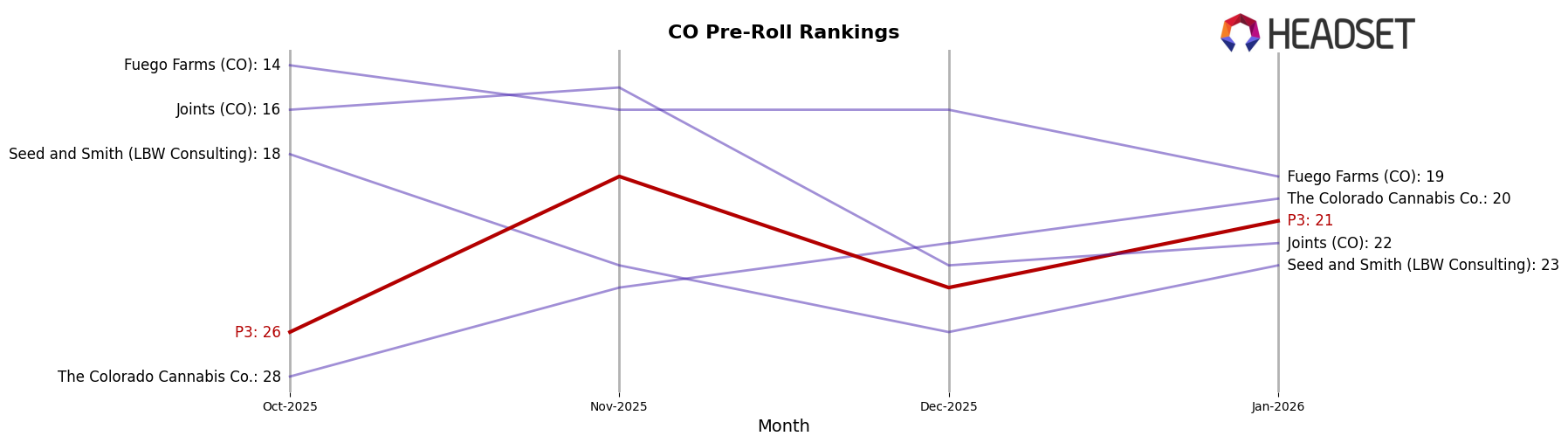

The performance of P3 in the Colorado pre-roll category shows a consistent presence within the top 30 brands over the last four months. Starting at the 26th position in October 2025, P3 improved its ranking to 19th in November before slightly slipping to 24th in December and recovering to 21st in January 2026. Such fluctuations suggest a dynamic market presence, possibly influenced by seasonal trends or competitive pressures. Despite these ranking changes, P3's sales in Colorado have remained relatively stable, with a slight peak in November. This indicates a resilient brand performance, maintaining consumer interest and market share in a competitive landscape.

In contrast, P3's performance in the Illinois and New York markets illustrates a different scenario. In Illinois, P3 failed to break into the top 30 rankings over the past four months, with positions ranging from 65th to 71st, indicating challenges in gaining a foothold in this market. Meanwhile, in New York, P3 also did not make it into the top 30, with rankings hovering in the high 80s. Despite not being in the top 30, New York showed an interesting sales increase in December, hinting at potential growth opportunities. These patterns highlight the varying degrees of market penetration P3 has achieved across states, suggesting targeted strategies may be needed to enhance their presence outside of Colorado.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, P3 has experienced fluctuating rankings from October 2025 to January 2026, indicating a dynamic market presence. Notably, P3 improved its rank from 26th in October to 19th in November, suggesting a positive reception during that period. However, the brand faced a slight decline to 24th in December before recovering to 21st in January. This volatility contrasts with competitors such as The Colorado Cannabis Co., which consistently improved its rank from 28th to 20th over the same period, and Fuego Farms (CO), which saw a downward trend from 14th to 19th. Meanwhile, Joints (CO) experienced a notable drop from 16th to 22nd, mirroring some of the challenges P3 faced. These shifts in ranking highlight the competitive pressures in the market, with P3 needing to strategize effectively to maintain and improve its position amidst fluctuating sales and competitive dynamics.

Notable Products

In January 2026, Wilson We Need More Mangoes Infused Pre-Roll (1g) emerged as the top-performing product for P3, leading the sales with 2043 units sold. Blueberry AK Limeade Infused Pre-Roll (1g) followed closely, securing the second position, showing a steady climb from its fourth place in December 2025. Choco Berry Chuck Infused Pre-Roll (1g) ranked third, dropping from its top position in October and November 2025. Sour Meltdown Infused Blunt (2g), which was previously the top product in December 2025, fell to fourth place. Loaded Banana Milkshake Infused Blunt (2g) rounded out the top five, experiencing a consistent decline in rank since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.