Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

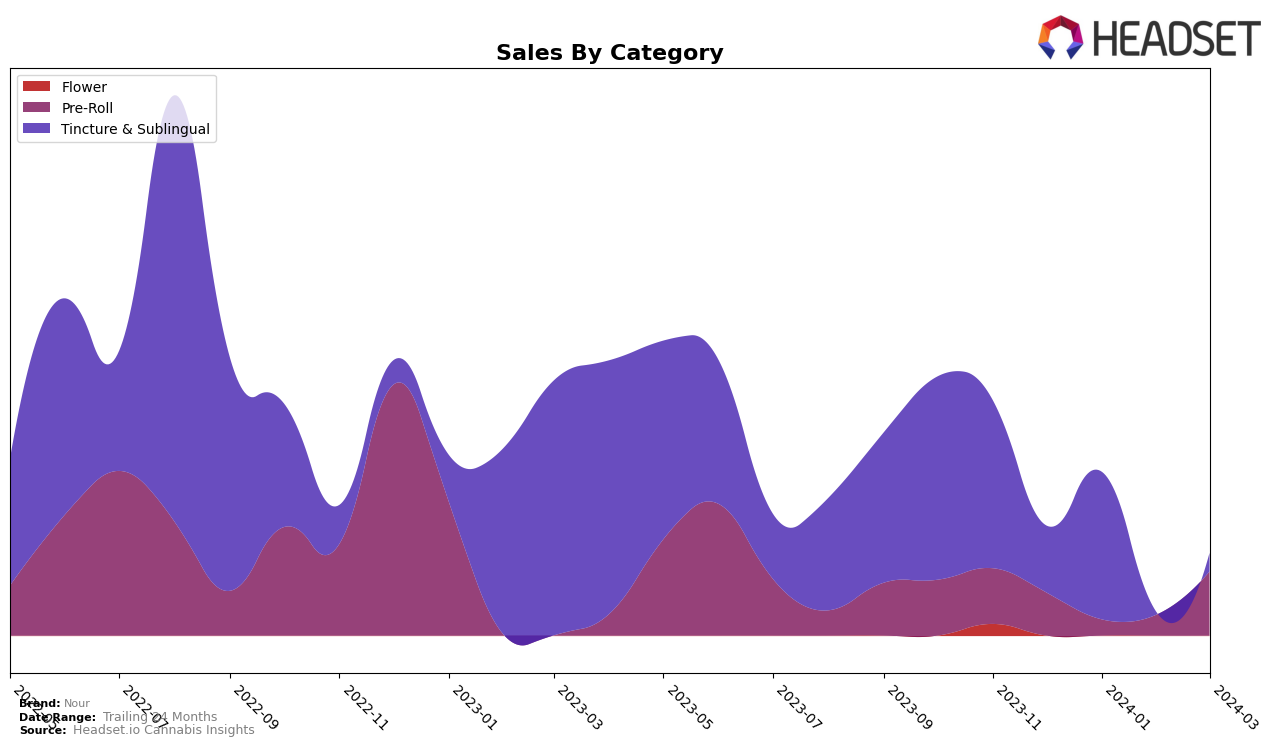

In the Nevada market, the cannabis brand Nour has shown a fluctuating performance in the Tincture & Sublingual category over the recent months. Starting from December 2023, Nour was ranked 17th which indicates a moderate position within the competitive landscape of Nevada's cannabis market. Impressively, in January 2024, the brand climbed up to the 13th rank, showing a significant improvement that could be attributed to strategic marketing efforts or product quality enhancements. However, it's noteworthy that Nour was not ranked in the top 30 brands for February 2024, which might raise concerns about its consistency in maintaining its market position. By March 2024, the brand made a comeback, albeit to the 16th rank, suggesting a recovery but still reflecting some volatility in its market performance. This rollercoaster performance is mirrored in their sales figures, with a notable peak in January 2024 at 3230.0 sales, followed by a drop in March 2024 sales to just 400.0.

Such a performance trajectory suggests that while Nour has the potential to climb the ranks within the Tincture & Sublingual category in Nevada, sustaining a strong market position remains a challenge. The absence from the top 30 brands in February 2024 particularly highlights a vulnerability that could be detrimental to the brand's overall market share and reputation. This inconsistency might be a point of concern for retailers and investors looking for stable and reliable brands to partner with. On the other hand, the ability of Nour to re-enter the rankings in March, even if at a lower position, indicates resilience and possibly an underlying strength that, if harnessed correctly, could lead to better stability and higher rankings in the future. The detailed sales and ranking movements provide valuable insights into the brand's performance dynamics, yet they also leave room for speculation on the strategies Nour could adopt to ensure more consistent growth and presence in the competitive Nevada cannabis market.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Nevada, Nour has experienced notable fluctuations in its ranking and sales over the recent months. Starting from December 2023, Nour held the 17th rank, which improved significantly to the 13th position by January 2024, showcasing a strong upward trajectory. However, it faced a setback as it did not rank in February 2024, before regaining some ground in March 2024 at the 16th position. This rollercoaster indicates a volatile market presence when compared to its competitors. For instance, TRYKE showed a gradual decline from 14th to 15th rank, while Vlasic Labs made a significant leap into the rankings in March 2024 at 14th place, directly competing with Nour. Roots and Just CBD had inconsistent appearances in the rankings, with Roots dropping out after December 2023 and Just CBD fluctuating in and out of the lower ranks. This competitive analysis highlights the challenges Nour faces in maintaining its market position amidst the dynamic shifts within the Tincture & Sublingual category in Nevada, suggesting a need for strategic adjustments to stabilize and improve its market standing.

Notable Products

In March 2024, Nour's top-performing product was the CBD Cake Berry Brulee Pre-Roll (1g) within the Pre-Roll category, maintaining its number one rank from February and showcasing a significant sales increase to 145 units. The CBD Premium Oil Tincture (1500mg CBD), categorized under Tincture & Sublingual, secured the second rank, showing a remarkable ranking recovery from previous months, although specific sales figures are not disclosed. Notably, other products such as the CBD Banana Bread Pre-Roll (1g) and Super Sour Space Candy Pre-Roll (1g) did not make the rankings for March, indicating a shift in consumer preferences or possibly stock issues. This month's analysis highlights Nour's ability to maintain and regain top positions in the market, with the CBD Cake Berry Brulee Pre-Roll (1g) leading the charge. The sales and ranking data suggest a dynamic market presence for Nour, with particular strength in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.