Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the Colorado market, Nuo has shown a consistent performance in the Tincture & Sublingual category, maintaining a strong presence within the top 5 rankings over the past few months. The brand improved its rank from 5th in October 2025 to 3rd in November and December 2025, before slightly dipping to 4th in January 2026. This upward trend in the latter part of 2025 indicates a positive reception and growing popularity among consumers. However, the slight decline in January suggests a need to monitor market dynamics closely to sustain its position. The sales figures reflect this trend, with a notable increase in November, although they slightly tapered off by January.

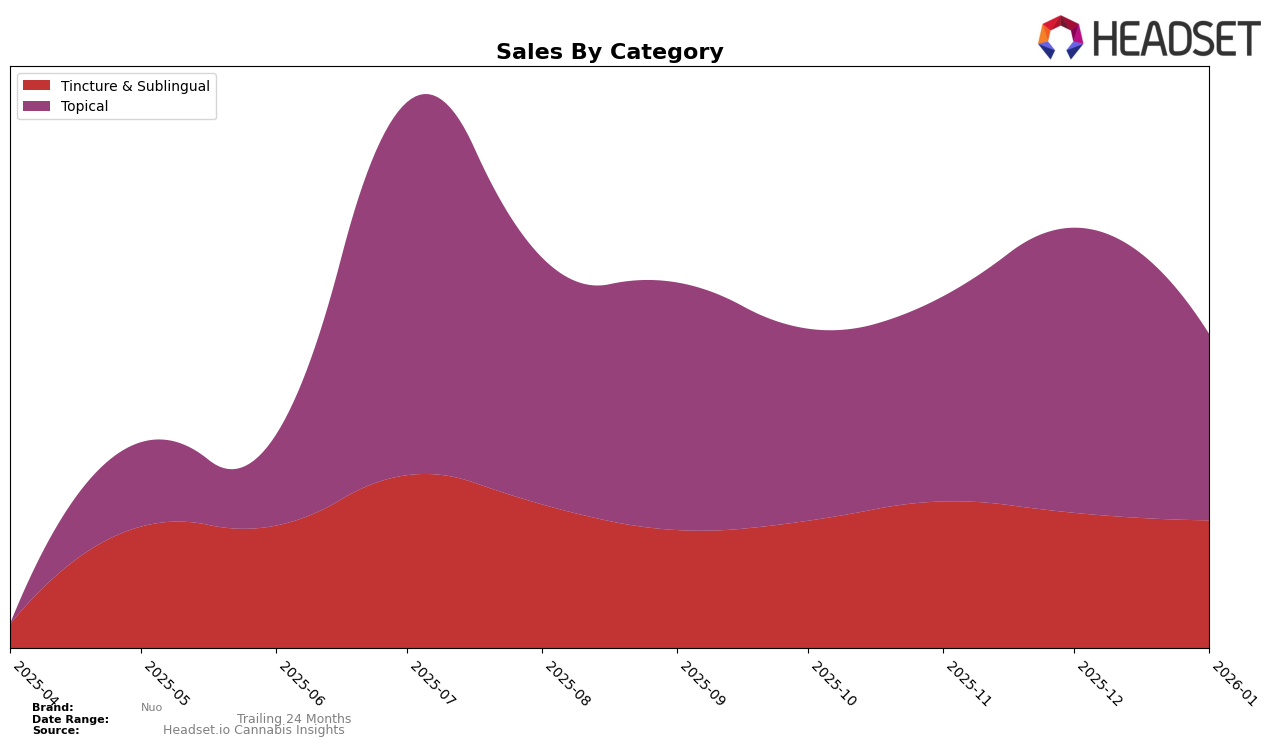

In contrast, Nuo's performance in the Topical category within Colorado has been relatively stable, maintaining a 6th place rank from October to December 2025, before slipping to 7th in January 2026. This consistency in the rankings suggests a steady demand for their topical products, though the drop in January could imply increased competition or a shift in consumer preferences. The sales figures for December 2025, however, show a significant spike, suggesting a potential seasonal demand or successful promotional activities. The brand's inability to break into the top 5 in this category may highlight areas for strategic improvement or innovation.

Competitive Landscape

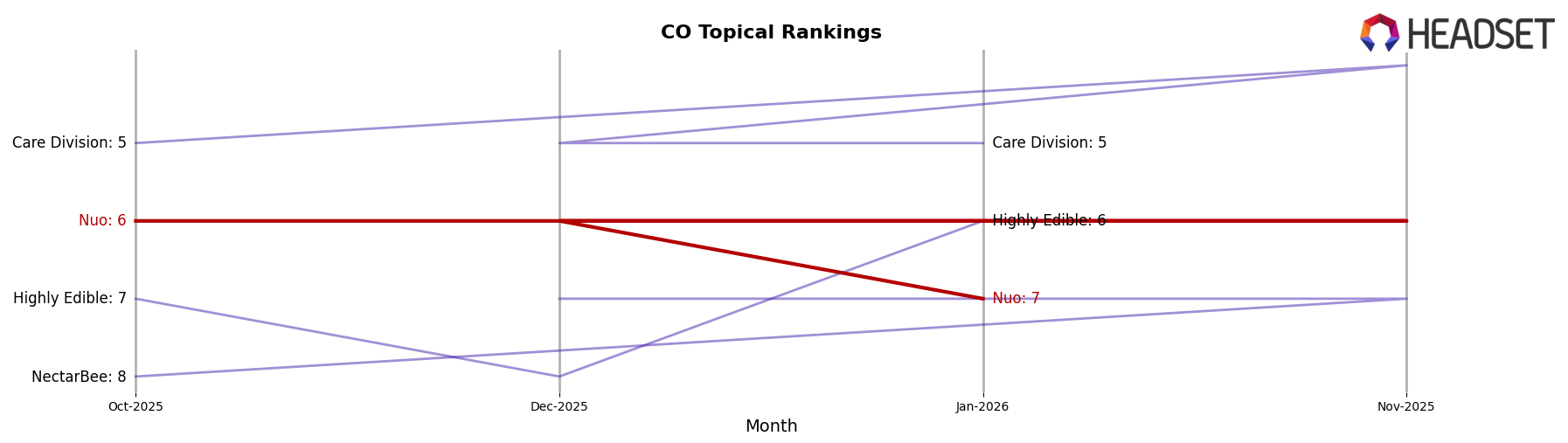

In the competitive landscape of the Topical category in Colorado, Nuo experienced a slight decline in rank from December 2025 to January 2026, moving from 6th to 7th place. This shift indicates increased competition, particularly from brands like Highly Edible, which improved its rank from 8th in December 2025 to 6th in January 2026, surpassing Nuo. Despite this, Nuo maintained a consistent rank of 6th place from October to December 2025, showcasing its resilience in the market. However, the sales figures suggest a downward trend for Nuo in January 2026, contrasting with the steady performance of Care Division, which consistently held the 5th rank throughout the observed period. Meanwhile, NectarBee did not rank in January 2026, suggesting a potential opportunity for Nuo to reclaim its position with strategic adjustments. These dynamics highlight the importance for Nuo to innovate and adapt to maintain its competitive edge in Colorado's topical market.

Notable Products

In January 2026, the top-performing product from Nuo was the CBD/THC 20:1 Relief Tincture (2000mg CBD, 100mg THC) in the Tincture & Sublingual category, maintaining its first-place rank from previous months with sales of 487 units. The CBD/CBN/THC 5:1:1 Sleep Tincture (500mg CBD, 100mg CBN, 100mg THC) also held steady in second place, although its sales decreased compared to previous months. Notably, the CBD/THC 1:1 Menthol Relief Cream (1000mg CBD, 1000mg THC) climbed to the second rank in January, matching the sales figures of the Sleep Tincture. The CBD/THC 1:1 Lavender Cream (1000mg CBD, 1000mg THC) moved up to third place, while the CBD/THC 1:1 Unscented Cream (1000mg CBD, 1000mg THC) rose to fourth, despite a decline in sales. Overall, the rankings saw some shifts, particularly among the topical products, reflecting changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.