Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

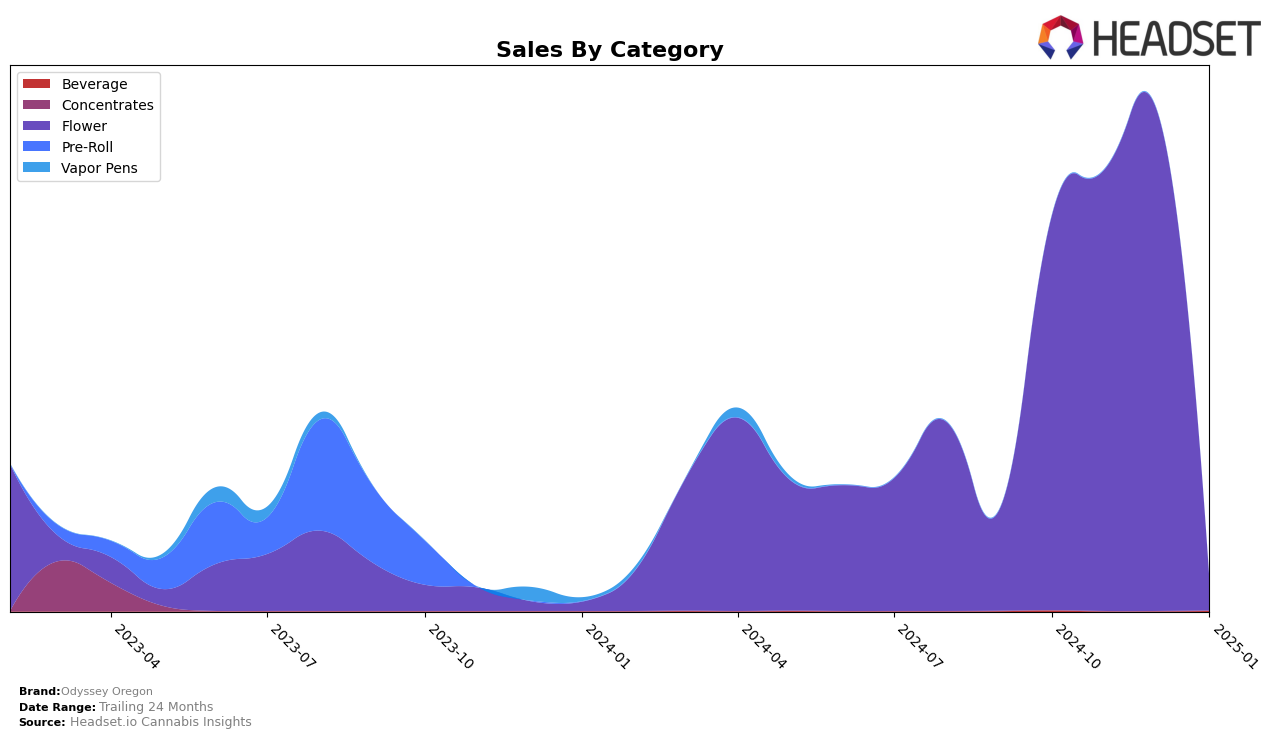

Odyssey Oregon's performance in the Flower category has shown some notable shifts over the months in the Oregon market. In October 2024, the brand did not rank among the top 30, indicating a challenging position in the competitive landscape. However, by November 2024, Odyssey Oregon made a significant leap to rank 100th, followed by an improvement to 86th place in December. This upward movement suggests a positive trend in consumer acceptance or strategic adjustments that began to pay off during the holiday season. Despite the lack of ranking data for January 2025, the absence might indicate a slip from the top 30, hinting at potential challenges or increased competition in the new year.

Sales figures for Odyssey Oregon in the Flower category reflect a growth trajectory, with sales rising from $56,710 in October to $64,456 in November. This increase aligns with the brand's improved ranking during the same period, suggesting effective market strategies or increased consumer demand. However, the absence of ranking data for January 2025 raises questions about the brand's momentum and whether it could sustain its growth amid market pressures. The lack of consistent top 30 rankings underscores the competitive nature of the market and the need for continued innovation and strategic positioning.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Odyssey Oregon has shown a notable improvement in its market position over recent months. After not ranking in October 2024, Odyssey Oregon entered the top 100 in November 2024 at rank 100 and improved further to rank 86 by December 2024. This upward trajectory indicates a positive reception and increasing sales momentum, contrasting with brands like Mana Extracts, which experienced a decline from rank 84 in October to 94 in November. Meanwhile, Derby's Farm saw a significant drop from rank 61 in December to 100 in January 2025, suggesting potential challenges that Odyssey Oregon could capitalize on. Additionally, Kites also experienced a drop in rank from 58 in October to 85 in November, further highlighting Odyssey Oregon's relative growth in this competitive market.

Notable Products

In January 2025, the top-performing product for Odyssey Oregon was Black Scottie (14g) in the Flower category, reclaiming its number one rank from October 2024 with sales of 189 units. Moby Dick Shake (28g) rose to the second position, showing a significant improvement from its fourth position in October 2024. Freedom Punch (14g) dropped to third place after leading in November and December 2024. Chernobyl (28g) maintained a consistent presence, ranking fourth in January 2025, slightly down from its third position in December 2024. Notably, Slurp Grape Drank Syrup (250mg THC, 1oz) entered the rankings for the first time in January 2025, securing the fifth spot in the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.