Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

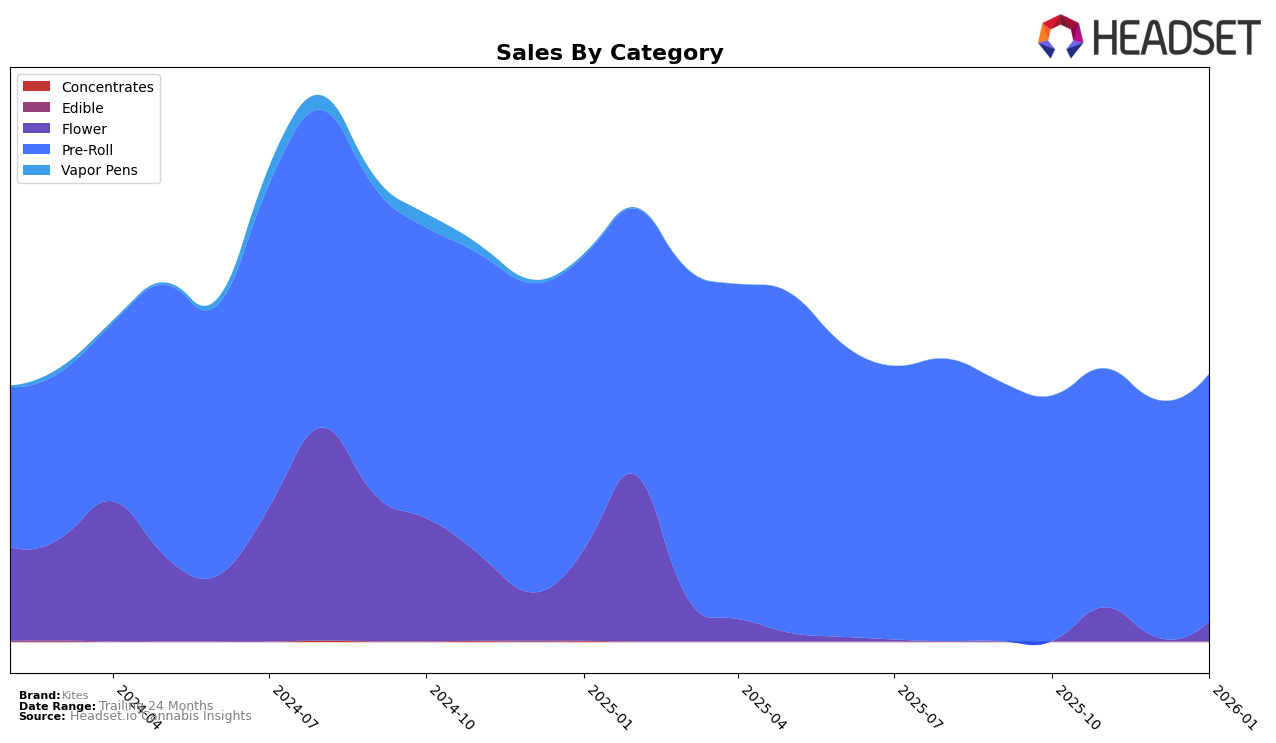

Kites has shown a consistent presence in the Pre-Roll category in Oregon. Over the span from October 2025 to January 2026, the brand maintained a notable position, with rankings fluctuating slightly between 12th and 15th place. In particular, Kites improved its rank from 14th in October to 12th in November, though it saw a slight dip back to 15th in December before recovering to 14th in January. This suggests a stable performance with a capacity for slight upward movement, indicating a resilient market presence in Oregon's competitive Pre-Roll category.

Despite the fluctuations in rankings, Kites' sales figures in Oregon reveal a more nuanced story. While the sales volume decreased marginally from October to December, with a small dip in November, it rebounded in January, surpassing the October sales figure. This rebound could suggest successful marketing strategies or product adjustments that resonated well with consumers. However, the absence of Kites in the top 30 brands in other states or categories during this period indicates potential areas for growth and expansion. Understanding the dynamics behind these figures could provide deeper insights into consumer preferences and competitive strategies in Oregon's cannabis market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Oregon, Kites experienced fluctuations in its rank over the months from October 2025 to January 2026, reflecting a dynamic market environment. Kites started at rank 14 in October 2025, improved to 12 in November, but then slipped to 15 in December before recovering slightly to 14 in January 2026. This pattern suggests that while Kites has a stable presence, it faces stiff competition from brands like Entourage Cannabis / CBDiscovery, which consistently improved its rank from 15 to 13 over the same period, and Cabana, which showed a similar recovery trend. Meanwhile, Dougie maintained a stronger position, consistently ranking higher than Kites, despite a dip in November. Kites' sales figures indicate a steady performance, with a notable increase in January 2026, suggesting resilience and potential for growth amidst competitive pressures.

Notable Products

In January 2026, the top-performing product from Kites was the Animal Planets Pre-Roll 10-Pack (5g), securing the number one rank with sales of 1074 units. Following closely was the Napali Legend #10 Pre-Roll 10-Pack (5g) at the second position. The Acai Gelato Pre-Roll 10-Pack (5g) ranked third, showing an improvement from its second position in December 2025. Sherb Breath #5 Pre-Roll 10-Pack (5g) held the fourth spot, while the Orange Apricot Mac Pre-Roll 10-Pack (5g) maintained its fifth position, consistent with its rank in October 2025. This indicates a stable preference for these pre-roll products among consumers, with slight shifts in rankings over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.