Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

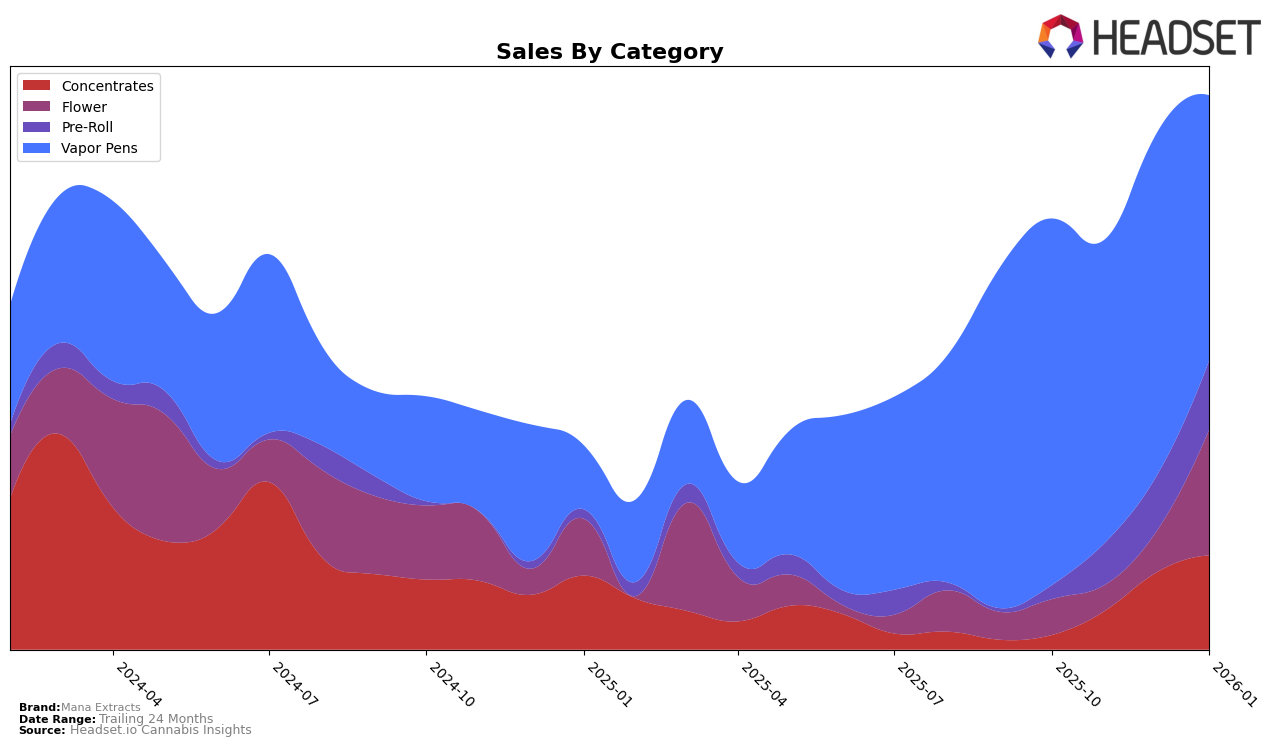

Mana Extracts has shown a notable upward trend in the Oregon concentrates category, climbing from a rank of 62 in October 2025 to 21 by January 2026. This ascent is indicative of a strong performance and growing popularity in this particular product line. Their sales in concentrates have also seen a substantial increase, reflecting consumer demand and potentially successful marketing strategies or product innovations. In contrast, the flower category did not see Mana Extracts in the top 30 rankings, which could suggest either a lower focus or competition from other brands in that segment.

In the pre-roll category, Mana Extracts has also improved its standing, moving from a rank of 86 in October 2025 to 39 in January 2026. This positive trajectory suggests a growing market presence, although it remains outside the top tier. Meanwhile, the vapor pens category saw a slight decline in rank from 21 to 26 over the same period, with sales figures reflecting a downward trend, possibly indicating increased competition or shifting consumer preferences. The absence of Mana Extracts in the top 30 for flower could be seen as a gap in their market strategy or an area for potential growth. For more details on their performance in Oregon, further analysis would be required.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Mana Extracts has experienced notable fluctuations in its market position over the past few months. Starting from a rank of 21 in October 2025, Mana Extracts saw a decline to rank 26 by January 2026. This downward trend in rank coincides with a decrease in sales from October's peak, indicating a potential challenge in maintaining market share. In contrast, Elysium Fields improved its rank from 23 in October to 24 in January, despite a slight dip in sales, suggesting a more stable presence in the market. Meanwhile, Kaprikorn showed a positive trend, climbing from rank 27 to 25, with a corresponding increase in sales. These dynamics highlight the competitive pressure on Mana Extracts, especially from brands like Willamette Valley Alchemy, which maintained a relatively stable rank, and Avitas, which showed slight improvements. For Mana Extracts, this competitive analysis underscores the need to strategize effectively to regain and sustain its market position amidst fluctuating sales and rankings.

Notable Products

In January 2026, Apples and Bananas (3.5g) emerged as the top-performing product for Mana Extracts, leading the sales with 2,797 units sold. Purple Push Pop (3.5g) followed closely in second place, while The Soap Infused Pre-Roll (1g) dropped to third, having previously held the top spot in November 2025. Guava Gelato (3.5g) secured the fourth position, maintaining a steady presence in the rankings. Mt Hood Magic Crumble Infused Pre-Roll (1g) rounded out the top five, showcasing a consistent demand for pre-roll products. These rankings highlight a strong preference for flower products in January, with notable movements in the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.