Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

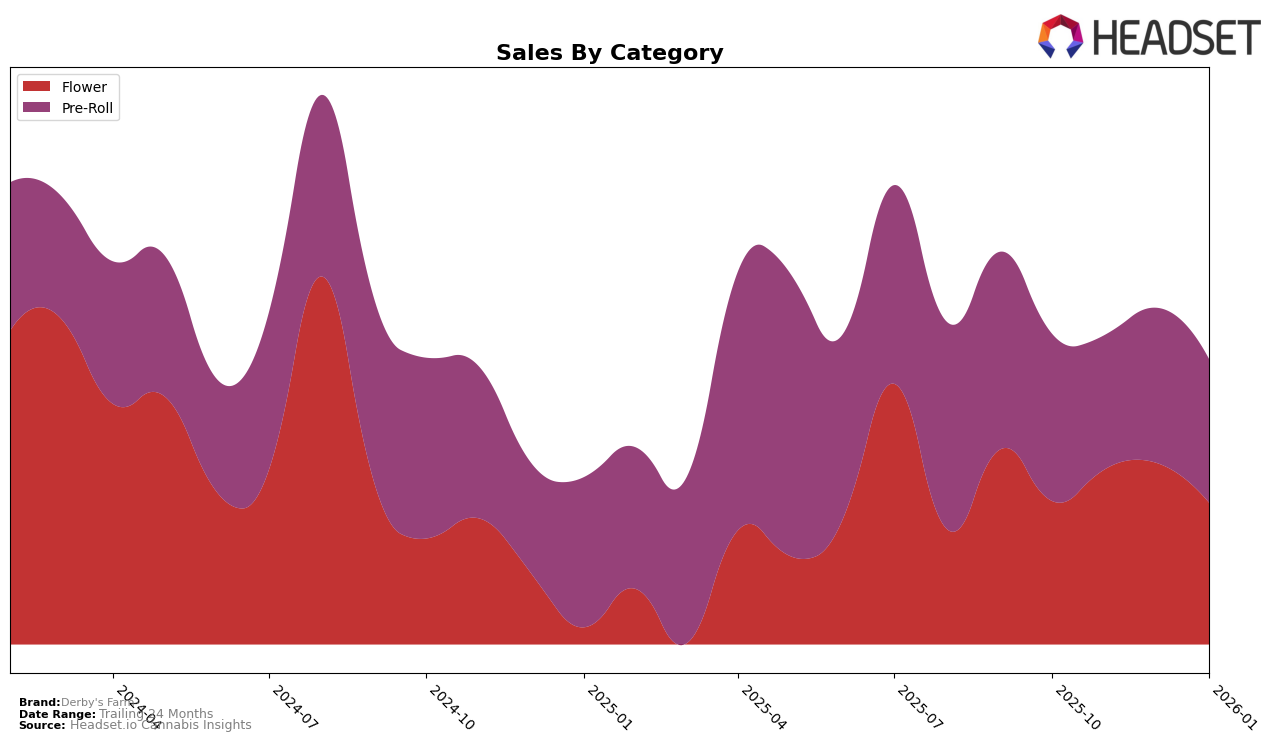

Derby's Farm has shown fluctuating performance in the Oregon market, particularly in the Flower category. Notably, the brand's ranking in this category dropped out of the top 30 in both October 2025 and January 2026, indicating a potential challenge in maintaining consistent market presence. However, during November and December 2025, Derby's Farm made a significant comeback by ranking 25th and 26th, respectively. This suggests that while the brand faces competitive pressures, it has the capacity to regain traction during certain periods. The sales figures in this category also reflect this volatility, with a peak in December 2025 followed by a decrease in January 2026.

In contrast, Derby's Farm has maintained a more stable performance in the Pre-Roll category within Oregon. The brand consistently ranked within the top 20 from October 2025 to January 2026, suggesting a stronger foothold in this segment. Despite a slight dip in sales from October to November 2025, the brand managed to recover and sustain its ranking throughout the subsequent months. This stability in the Pre-Roll category indicates a robust consumer base or effective market strategies that Derby's Farm might be leveraging to maintain its competitive edge in this particular product segment.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Derby's Farm has experienced some fluctuations in its market position from October 2025 to January 2026. Initially ranked 13th in October, Derby's Farm saw a slight decline in rank to 16th by January. Despite this, Derby's Farm maintained a relatively stable sales performance, with sales figures showing a slight dip in November but rebounding in December. Competitors such as Kites and Cabana have shown more consistent rankings, with Kites achieving a higher rank than Derby's Farm in three out of the four months and Cabana closely trailing. Notably, Drewby Doobie / Epic Flower improved its rank from 24th to 17th, indicating a potential rising competitor. These dynamics suggest that while Derby's Farm remains a strong contender, it faces increasing pressure from both established and emerging brands in the Oregon pre-roll market.

Notable Products

In January 2026, Derby's Farm saw Cherry Breath Bulk leading the sales as the top-performing product with a notable sales figure of 706 units. The Lemon Punch Cake Pre-Roll 10-Pack and Purple Drank Pre-Roll 10-Pack both shared the second position, each with 672 units sold. Forbidden Fruit 1g, which held the second position in December 2025, dropped to third place in January 2026 with sales of 648 units. Grandma's Cookies Pre-Roll 10-Pack secured the fourth rank, indicating a strong presence in the pre-roll category. Compared to December 2025, Forbidden Fruit experienced a slight decline in its ranking, while Cherry Breath Bulk maintained its top position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.