Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

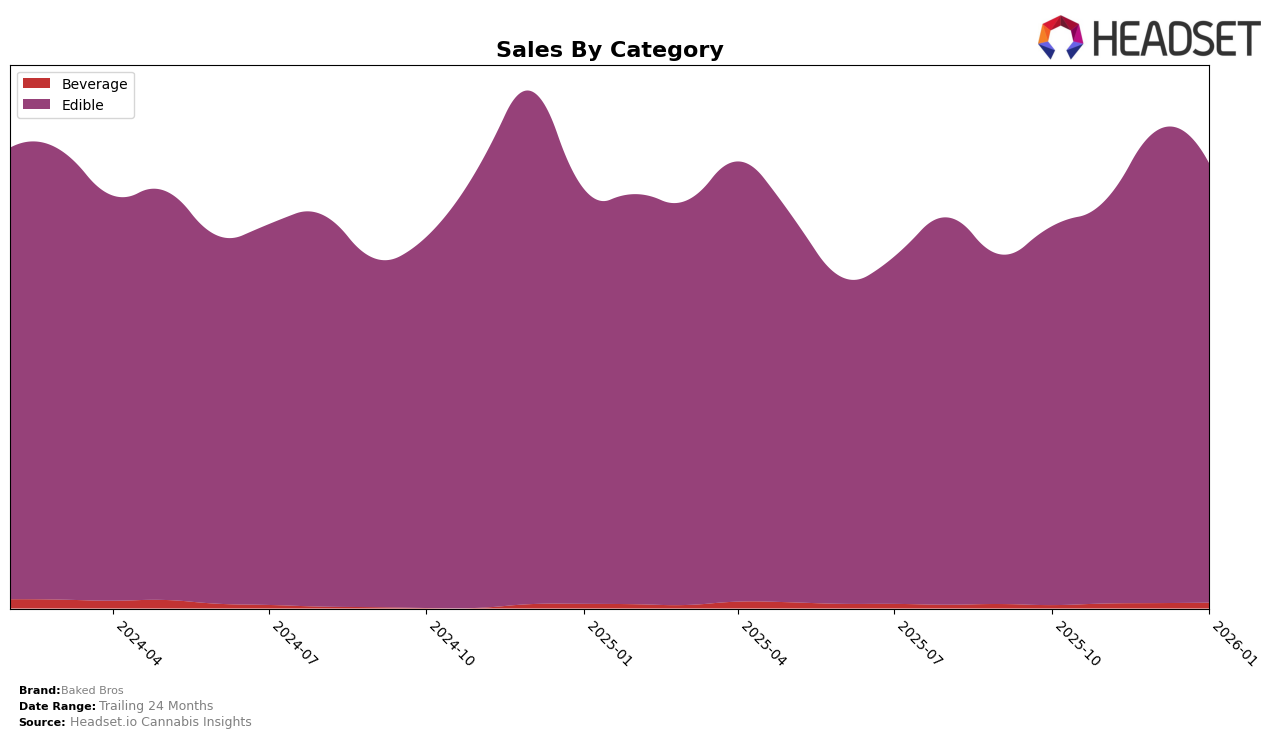

Baked Bros has consistently maintained a strong presence in the Arizona market, particularly within the Edible category. Over the four-month period from October 2025 to January 2026, the brand has consistently held the 4th position in this category. This stability in ranking suggests a strong consumer preference and a reliable product offering that resonates well with the local market. Despite the steady ranking, it's noteworthy that their sales figures have shown some fluctuation, peaking in December 2025 before experiencing a slight decline in January 2026. This peak in December could indicate a seasonal trend or successful marketing efforts during the holiday season.

In contrast, the absence of Baked Bros in the top 30 rankings in other states or categories highlights potential areas for growth or market entry. The brand's stronghold in Arizona could serve as a strategic base from which to expand into other states or diversify its product offerings to capture a wider audience. The lack of presence in other markets might be a concern for the brand's growth strategy, suggesting a need to evaluate market entry barriers or consumer preferences in those regions. This focused presence in Arizona could be a deliberate strategy to dominate the local market before scaling operations elsewhere.

Competitive Landscape

In the Arizona edible market, Baked Bros consistently maintained its position at rank 4 from October 2025 through January 2026, showcasing a stable presence amidst competitive dynamics. Despite not breaking into the top three, Baked Bros demonstrated robust sales growth, peaking in December 2025 with sales surpassing the million-dollar mark. This performance is noteworthy given the fierce competition from brands like OGEEZ, which held the second rank consistently with higher sales figures, and Gron / Grön, which maintained the third rank with similarly strong sales. Meanwhile, Wana and Smokiez Edibles fluctuated between ranks 5 and 6, indicating a competitive edge for Baked Bros in maintaining its rank. The consistent rank and increasing sales trajectory suggest that Baked Bros is effectively capturing consumer interest and could potentially climb higher with strategic marketing and product innovation.

Notable Products

In January 2026, the top-performing product from Baked Bros was Sleepy - CBD/THC 2:1 Blackberry Acai x Granddaddy Purple Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales of 19,251 units. Happy - CBD/CBC/THC 1:1:1 Jack Herer Pomegranate Nectarine Gummies 10-Pack held steady at the second position, showing consistent popularity over the months. Stoney - CBG/THC 1:1 OG Kush x Prickly Pear Lemonade Gummies 10-Pack also retained its third place, mirroring the stable demand seen in previous months. Unwind - THC/CBG/CBC/CBDV 2:2:1:1 Huckleberry Punch Gummies 10-Pack and Very Berry Live Hash Rosin Gummies 10-Pack continued to rank fourth and fifth respectively, without any changes in their standings since October 2025. Overall, the rankings of the top products remained unchanged, indicating a strong and consistent preference for these edible products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.