Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

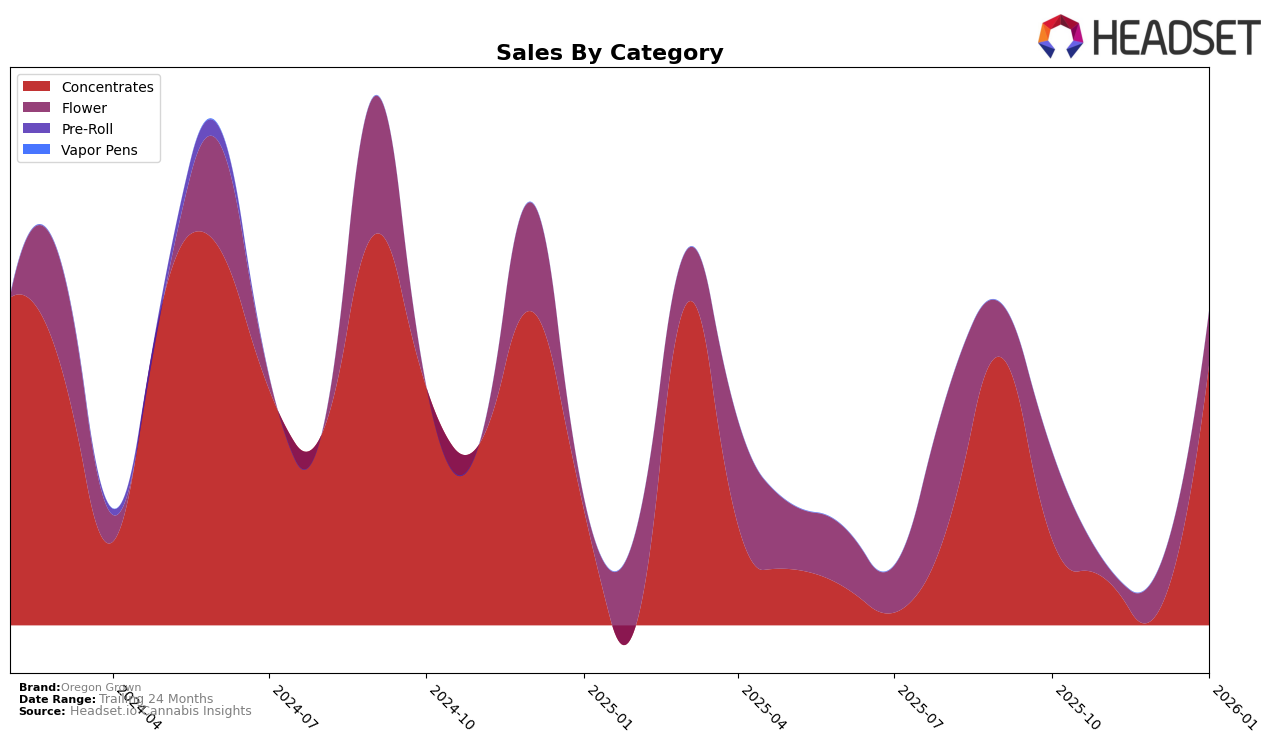

Oregon Grown's performance in the Concentrates category shows significant movement over recent months, particularly in Oregon. After not ranking in the top 30 for October, November, or December 2025, the brand made a notable leap to 30th position by January 2026. This rise indicates a strategic improvement or a shift in consumer preference towards their products, which could be a result of new product launches or enhanced distribution strategies. Such a jump from being unranked to entering the top 30 suggests that Oregon Grown is gaining traction and potentially increasing its market share in this category within the state.

The absence of rankings in the months leading up to January could be seen as a challenge, as it highlights periods where the brand did not make a significant impact in the competitive landscape of concentrates. However, the brand's ability to break into the top 30 in January is a positive indicator of growth and adaptation to market demands. This movement within Oregon suggests that Oregon Grown may have implemented effective strategies to enhance its visibility and appeal in the Concentrates category. The substantial increase in sales from October to January further supports this upward trend, hinting at potential future successes if the brand continues on this trajectory.

Competitive Landscape

In the Oregon concentrates market, Oregon Grown has experienced a notable shift in its competitive positioning. After not ranking in the top 20 from November to December 2025, the brand made a significant comeback in January 2026, securing the 30th position. This resurgence coincides with a substantial increase in sales, indicating a successful strategic adjustment or market response. In comparison, Eugreen Farms and Cannabis Nation INC have shown fluctuating ranks, with Cannabis Nation INC making a notable leap from 53rd to 32nd in January 2026. Meanwhile, Happy Cabbage Farms and Elysium Fields consistently maintained higher ranks, although both experienced a slight decline in January 2026. These dynamics suggest that while Oregon Grown is gaining momentum, it faces stiff competition from established brands that have maintained a stronger presence in the market.

Notable Products

In January 2026, Oregon Grown's top-performing product was Death Star Sugar Wax (2g) in the Concentrates category, achieving the number one rank with sales of 477 units. Following closely, Smashburger Sugar Wax (2g) and Wedding Cake Sugar Wax (2g) secured the second and third positions, respectively. Violet Fog Sugar (2g) ranked fourth, while Ghost Train Haze Sugar Sauce (2g) rounded out the top five, having previously held the fourth position in October and third in November 2025. Notably, Ghost Train Haze Sugar Sauce (2g) saw a drop from its earlier rankings, indicating a shift in consumer preference. Overall, the Concentrates category dominated the top rankings for Oregon Grown this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.