Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

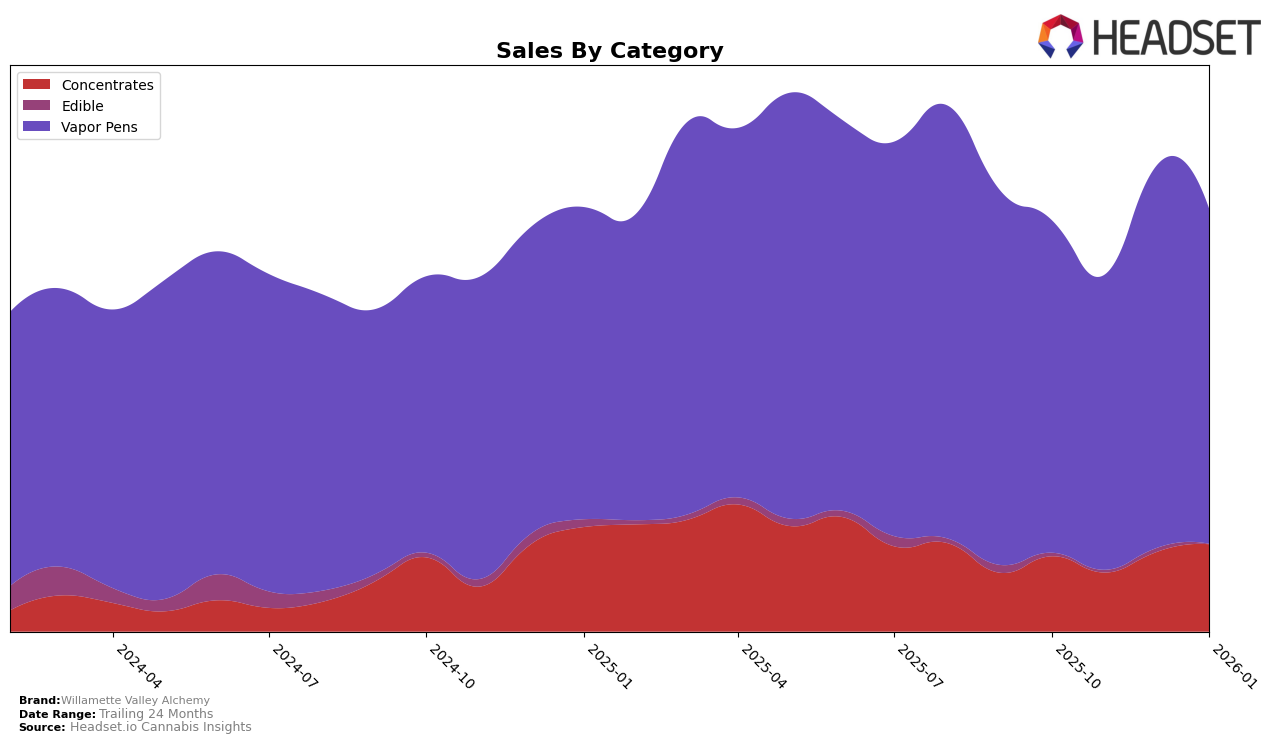

Willamette Valley Alchemy has shown a notable performance in the Oregon market, particularly in the Concentrates category. Despite not being in the top 30 brands at the start of the observed period, the brand made significant strides by climbing to the 25th position by January 2026. This upward movement is indicative of a robust strategy or possibly an increase in consumer demand for their products. The brand's sales in the Concentrates category reflect this positive trend, with a notable increase from $43,218 in November 2025 to $60,654 in January 2026, suggesting a successful holiday season or an effective marketing campaign during this period.

In contrast, the performance of Willamette Valley Alchemy in the Vapor Pens category in Oregon has been relatively stable, maintaining a presence within the top 30 brands throughout the observed months. The brand's ranking fluctuated slightly, peaking at 25th in October 2025 and slightly declining to 27th by January 2026. This stability, despite minor rank changes, indicates a steady consumer base for their vapor pen products. Although there was a fluctuation in sales figures, with a dip in November followed by a recovery in December, the overall sales figures suggest consistent consumer interest in their vapor pen offerings.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Willamette Valley Alchemy has experienced some fluctuations in its ranking over the past few months, moving from 25th in October 2025 to 27th by January 2026. Despite this slight decline, the brand's sales have shown resilience, with a notable increase in December 2025. This suggests a potential for recovery in market position. Competitors such as Mana Extracts and Kaprikorn have also seen changes, with Mana Extracts dropping from 21st to 26th and Kaprikorn rising from 27th to 25th in the same period. Meanwhile, Avitas and Orchid Essentials have maintained relatively stable positions, although Orchid Essentials showed a positive trend by improving its rank from 34th to 29th. These dynamics highlight the competitive pressures and opportunities for Willamette Valley Alchemy to leverage its sales growth into improved rankings in the coming months.

Notable Products

In January 2026, the top-performing product for Willamette Valley Alchemy was the Berry Cobbler Live Resin Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 491 units. Following closely, the Cookie Mintz Live Resin Cartridge (1g) secured the second position, showing a significant jump from fifth place in December 2025. The Ghost OG Liquid Cured Resin Cartridge (1g) entered the rankings for the first time, taking the third spot. Gary Poppins Cured Resin Badder (1g) also made a notable entry at fourth place in the Concentrates category. Lemon Apricot Enhanced Live Resin Cartridge (1g) rounded out the top five, although it dropped from fourth in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.