Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

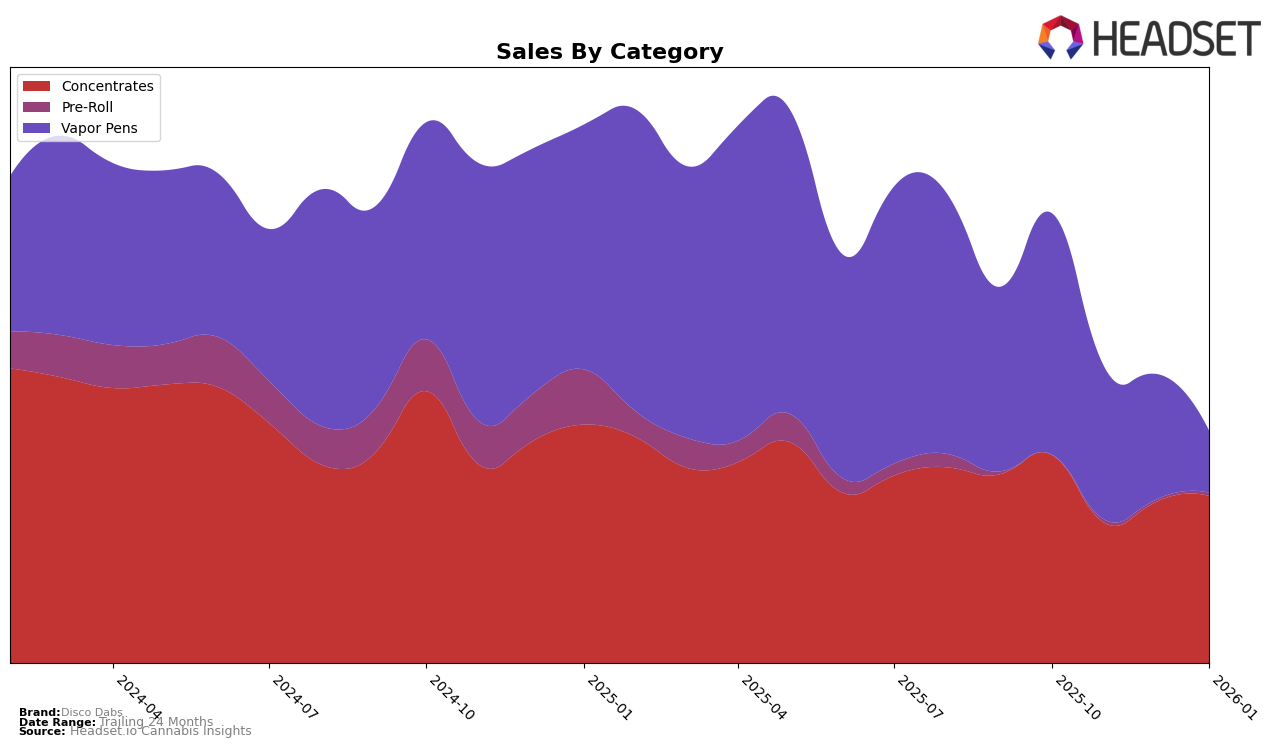

Disco Dabs has shown varying performance across different categories in Oregon. In the Concentrates category, the brand maintained a presence in the top 30, starting at rank 15 in October 2025, experiencing a dip to rank 22 in both November and December, and slightly improving to rank 20 by January 2026. This fluctuation suggests a competitive market environment, yet Disco Dabs managed to regain some ground after the initial decline. The sales figures reflect this movement, with a noticeable decrease from October to November, followed by a recovery in December and a slight dip in January.

In contrast, the Vapor Pens category presented a more challenging landscape for Disco Dabs in Oregon. Starting at rank 30 in October 2025, the brand fell out of the top 30 by November, December, and further dropped to rank 51 by January 2026. This downward trend indicates a significant struggle to maintain market share in this category, which is also evident in the declining sales figures over the same period. The brand's inability to stay within the top 30 after October highlights potential areas for improvement or increased competition in the Vapor Pens market.

Competitive Landscape

In the Oregon concentrates market, Disco Dabs has experienced fluctuating rankings over the past few months, indicating a competitive landscape. While Disco Dabs started strong in October 2025 with a rank of 15, it saw a dip to 22 in both November and December, before slightly recovering to 20 in January 2026. This volatility in rank suggests challenges in maintaining a consistent market position. Competitors like Farmers First and Higher Cultures have shown more stability, with Higher Cultures maintaining a consistent presence in the top 20. Notably, Mana Extracts has made significant strides, climbing from rank 62 in October to 22 in January, reflecting a strong upward trajectory in sales. This competitive pressure highlights the need for Disco Dabs to innovate and strengthen its market strategies to regain and sustain a higher rank.

Notable Products

In January 2026, the top-performing product from Disco Dabs was Lebanese Gold Hashish (1g) in the Concentrates category, maintaining its first-place rank from previous months with a notable sales figure of 798.0. Bubble Gump Shatter (1g) entered the rankings at the second position, showcasing strong sales performance. Polar Pop Shatter (1g) followed closely in third place, while Mystery Haze Shatter (1g) secured the fourth position. The Moonwalk x Cake Bomb Infused Pre-Roll (1g) made its debut at the fifth spot, indicating a promising entrance into the Pre-Roll category. This shift in rankings highlights new market dynamics and the growing popularity of shatter products in Disco Dabs' lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.