Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

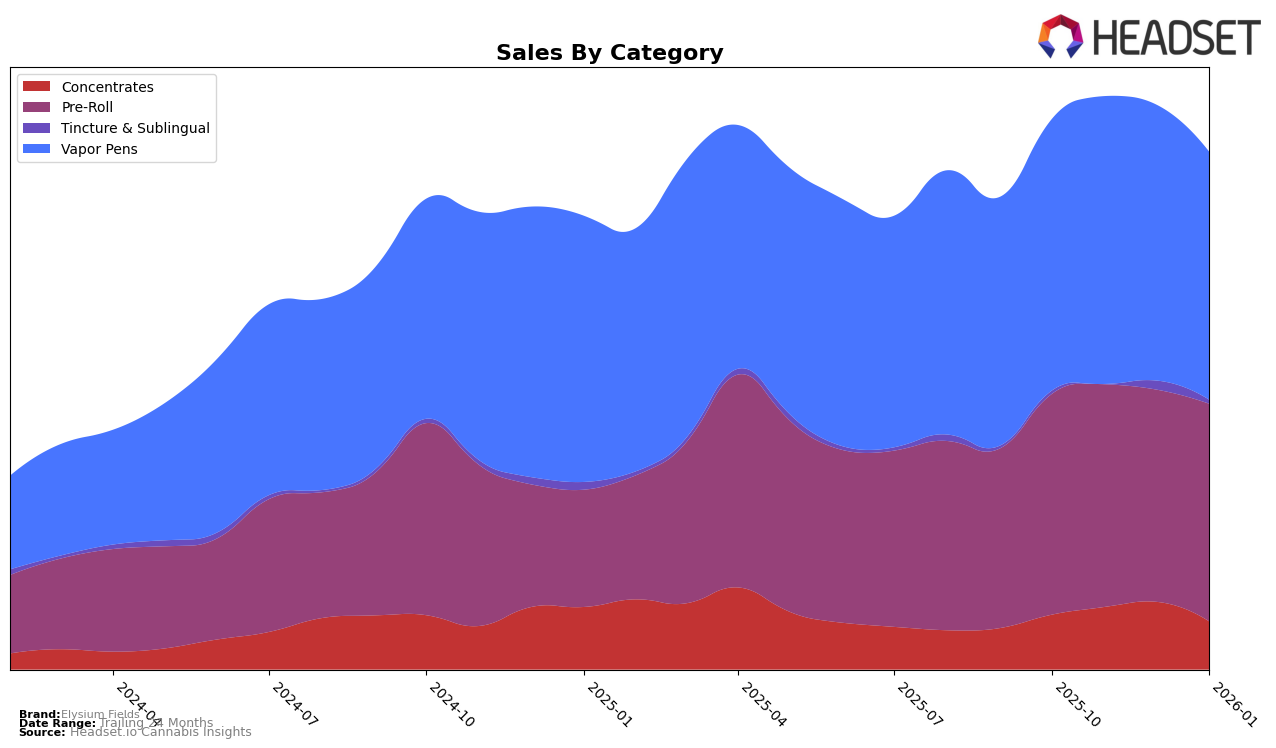

Elysium Fields has shown varied performance across different product categories in Oregon over the past few months. In the Concentrates category, the brand has experienced fluctuations, with their ranking moving from 29th in October 2025 to 24th in November and December, before dropping back to 29th in January 2026. This suggests a competitive market where Elysium Fields is maintaining a presence but facing challenges in sustaining upward momentum. Meanwhile, the Pre-Roll category has been a stable performer, consistently holding positions around 11th and 12th place, indicating a strong foothold in this segment. The Vapor Pens category also saw some shifts, with rankings ranging from 20th to 24th, reflecting some volatility but overall a solid presence in the market.

In the Tincture & Sublingual category, Elysium Fields re-entered the rankings in December 2025 at 13th place, before slipping slightly to 15th in January 2026. This re-entry into the top rankings could signal a strategic push or a response to market demand, though further data would be needed to confirm such trends. Notably, the absence of ranking data for October and November 2025 implies that Elysium Fields was not within the top 30 brands for this category during those months, which could be seen as an area of potential growth or concern. Overall, while Elysium Fields demonstrates strong performance in certain categories, the brand's ability to maintain and improve its ranking across all segments will be crucial for its continued success in the Oregon market.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Elysium Fields has shown a dynamic shift in its market position over the past few months. Starting from October 2025, Elysium Fields was ranked 23rd, but it improved to 20th in November, signifying a positive trend in sales performance. However, this momentum slightly waned as the brand slipped to 22nd in December and further to 24th by January 2026. Despite these fluctuations, Elysium Fields' sales figures remained relatively stable, contrasting with competitors like Mana Extracts, which consistently ranked lower and experienced a notable decline in sales. Meanwhile, Feel Goods maintained a higher rank than Elysium Fields in most months, although it also faced a drop in sales. Interestingly, Punch Bowl showed a significant improvement in January, surpassing Elysium Fields by climbing to 22nd place. These competitive dynamics highlight the volatile nature of the vapor pen market in Oregon and suggest that while Elysium Fields has maintained a competitive edge, there is a need for strategic adjustments to regain and sustain a higher ranking.

Notable Products

In January 2026, the top product from Elysium Fields was Birthday Cake Pre-Roll (1g) in the Pre-Roll category, reclaiming its number one position with sales of 3319 units. Deadhead OG Pre-Roll (1g) followed in second place, moving up from its third position in December 2025. Champaya Pre-Roll (1g) secured the third spot, having been the top product in December. Hawaiian Durban Pie Pre-Roll (1g) maintained its fourth place from December to January. Notably, Maui Melon Bubblegum Pre-Roll (1g) entered the rankings at fifth place in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.