Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

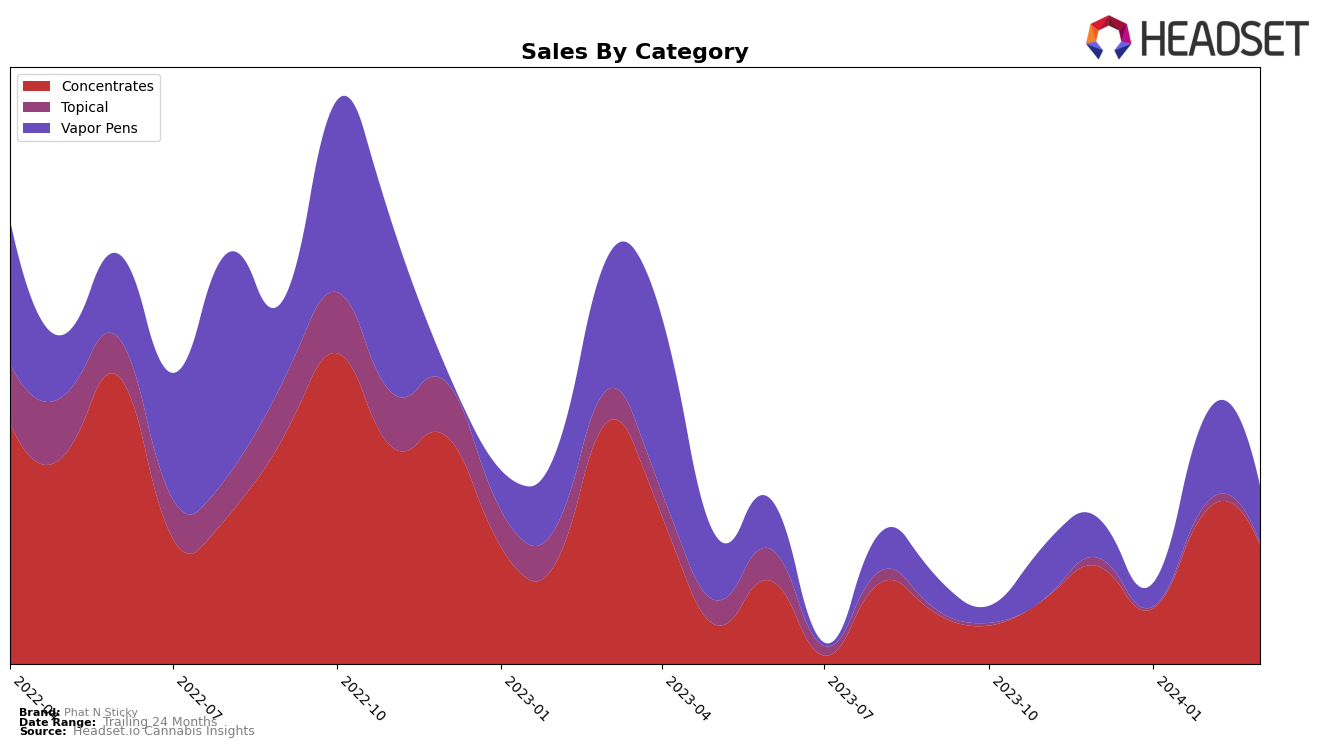

In the Topical category within Washington, Phat N Sticky has shown a fluctuating performance over the recent months. Notably, the brand ranked 25th in December 2023 but was absent from the top 30 brands in January 2024, which indicates a temporary setback in its market presence. However, it made a comeback in February 2024, securing the 24th position. This movement suggests a resilience in the brand's strategy, managing to regain some of its lost ground. The sales figures, with $169.0K in December 2023 dropping to $146.0K in February 2024, reflect this journey of recovery, despite the absence of sales data for January 2024 which could have provided more insight into the brand's mid-term performance.

Such a pattern of disappearance from the rankings, followed by a return, can be indicative of several factors including seasonal demand fluctuations, changes in consumer preferences, or even shifts in the brand's marketing or distribution strategies within Washington. For stakeholders and analysts, this presents an interesting case study on the resilience and adaptability of cannabis brands in a competitive market. While specific sales numbers for March 2024 were not disclosed, the observed trend of re-entry into the rankings posits a potentially positive outlook for Phat N Sticky, suggesting that despite challenges, there may be a solid foundation for growth or recovery. The absence of data for January 2024 leaves room for speculation on the strategies employed by Phat N Sticky to recapture its market position.

Competitive Landscape

In the competitive landscape of the Topical category within the Washington market, Phat N Sticky has experienced notable fluctuations in its ranking over the recent months, indicating a dynamic position amidst its competitors. Starting at rank 25 in December 2023, it momentarily disappeared from the top 20 in January 2024, only to reappear at rank 24 in February 2024. This rollercoaster in rankings suggests challenges in maintaining a consistent market presence against its competitors, such as INDO and Constellation Cannabis, with INDO showing a slight improvement moving from rank 22 in January to rank 23 in February, and Constellation Cannabis initially ranking higher at 23 in December 2023 but then not appearing in the top ranks thereafter. Notably, Wildflower entered the rankings at 24 in February 2024, directly competing with Phat N Sticky for market share. The absence of Phat N Sticky from the top ranks in January, followed by a lower rank return, alongside the fluctuating positions of its competitors, highlights the fiercely competitive nature of the Topical category in Washington, underscoring the importance of strategic marketing and product quality to gain and maintain market share.

Notable Products

In Mar-2024, Phat N Sticky's top-selling product was Kush Mintz Live Resin Icing (1g) within the Concentrates category, recording impressive sales figures of 53 units. Following closely, Gems N Juice - Hawaiian Golden Pineapple Live Resin (1g) also from the Concentrates category, ranked second after leading the sales in Feb-2024. The P-91 Live Resin Cartridge (1g) from the Vapor Pens category secured the third position, showing a steady increase in its ranking over the past months. Cow God Live Resin Wax (1g), another Concentrates category product, came in fourth, indicating a significant shift from its previous higher rankings. Lastly, the Golden Pineapple Live Resin Cartridge (Half Gram), within the Vapor Pens category, rounded out the top five, highlighting a consistent demand for vapor pen products alongside concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.