Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

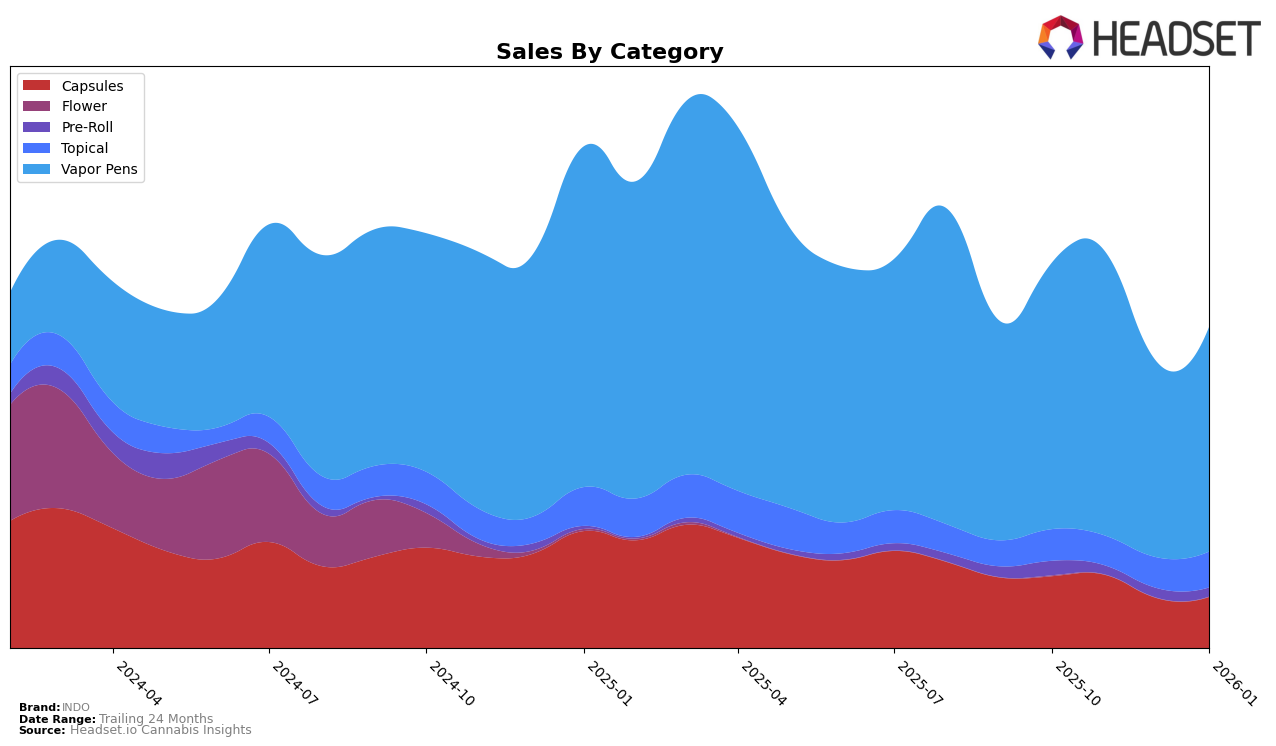

INDO has demonstrated varied performance across different product categories in Nevada. Notably, the brand has maintained a strong presence in the Capsules category, consistently ranking in the top two positions from October 2025 through January 2026. This stability suggests a solid consumer base and effective product offerings in this segment. Conversely, in the Pre-Roll category, INDO has not managed to break into the top 30, indicating potential challenges or competitive pressures in this space. The Topical category shows an upward trajectory, with the brand improving its rank from fourth to second place by January 2026, reflecting a positive reception and possibly increased consumer interest or strategic marketing efforts.

In the Vapor Pens category, INDO's rankings have shown some fluctuations, moving from 12th in October to 13th in both December 2025 and January 2026. Despite these changes, the category remains a significant revenue contributor, indicating a stable demand. The brand's ability to maintain a position within the top 15 suggests a competitive edge, although there might be room for improvement to climb higher in the rankings. The overall performance across these categories highlights INDO's strengths in certain segments while pointing to areas where further growth and market penetration could be beneficial.

Competitive Landscape

In the Nevada Vapor Pens category, INDO has experienced some fluctuations in its market position over the past few months. Starting from October 2025, INDO was ranked 12th, improved to 11th in November, but then dropped to 13th by December and maintained this position in January 2026. This indicates a competitive environment where brands like City Trees and Sauce Essentials have shown stronger performance. Notably, City Trees managed to surpass INDO in December with a rank of 7th, while Sauce Essentials consistently maintained a higher rank throughout the period. Meanwhile, Royalesque showed a volatile trend, briefly overtaking INDO in November and December before dropping to 15th in January. Interestingly, Bad Batch Extracts, which was not in the top 20 in October, climbed to 14th by January, indicating a potential emerging competitor. These dynamics suggest that while INDO remains a significant player, it faces stiff competition and must strategize to regain and maintain a higher rank in the Nevada Vapor Pens market.

Notable Products

In January 2026, the top-performing product for INDO was the CBD/CBN/THC 4:4:1 Jungle Stick IndoBalm (400mg CBD, 400mg CBN, 100mg THC) in the Topical category, which reclaimed its number one position after dropping to second in December 2025, with notable sales of 1582 units. The Strawberry Lemonade Botanical Terpene Distillate Disposable (1g) in the Vapor Pens category ranked second, falling from its top spot in November 2025. THC Maxtabs 2-Pack (200mg) made its debut in the rankings at third place, indicating a strong entry into the market. Super Silver Haze Distillate Disposable (1g) in the Vapor Pens category dropped to fourth place, while Ghost OG Botanical Terps Distillate Disposable (1g) maintained its fifth position consistently. These shifts highlight a dynamic market where new entries and seasonal preferences influence product rankings significantly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.