Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

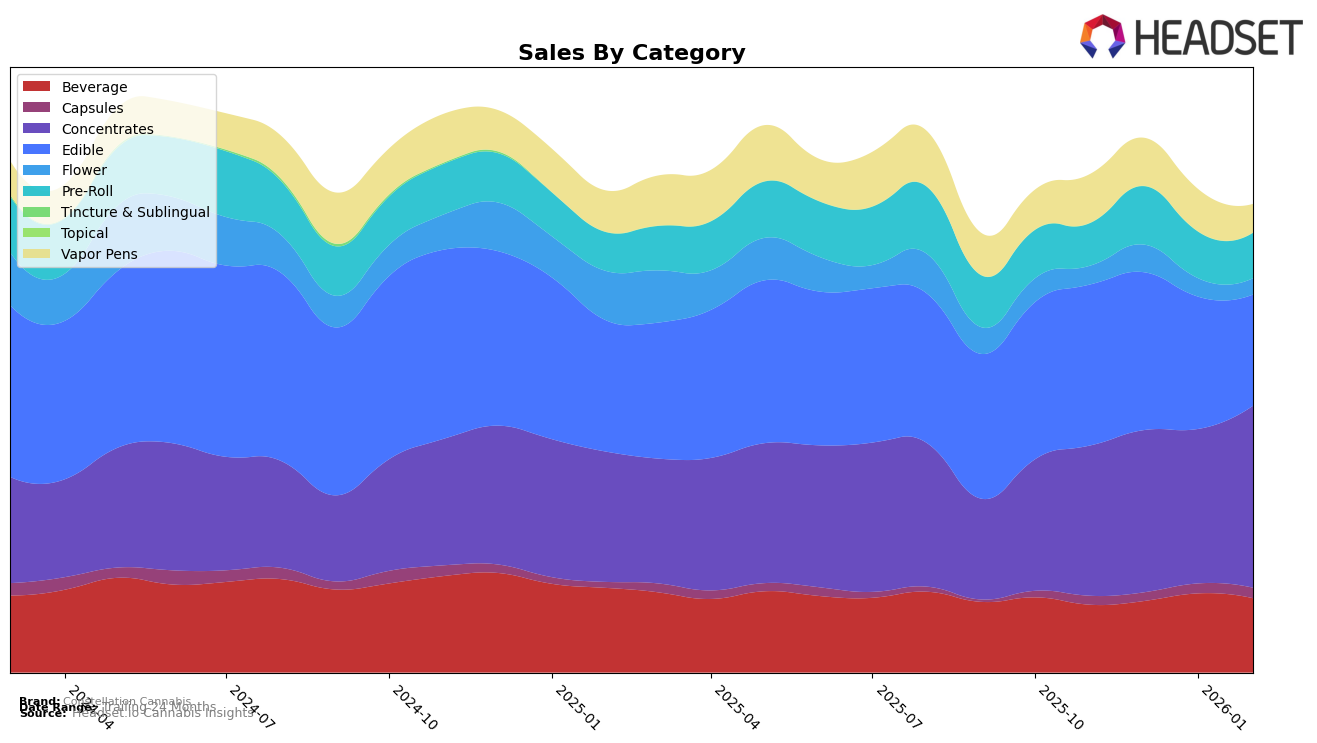

Constellation Cannabis has shown varied performance across different categories in Washington. In the Beverage category, the brand has maintained a relatively strong position with a consistent presence in the top 11, peaking at rank 8 in both January and February 2026. This indicates a stable demand for their beverage products. However, the Edible category tells a different story, with the brand slipping from a steady 15th position in the last quarter of 2025 to 16th in February 2026, suggesting a slight decline in consumer interest or increased competition. The most notable movement is in the Concentrates category, where Constellation Cannabis improved its rank from 6th in January to 3rd in February 2026, highlighting a significant gain in market share or consumer preference.

In contrast, the brand's performance in the Pre-Roll and Vapor Pens categories in Washington has been less impressive. The Pre-Roll category saw a moderate improvement from 71st in November 2025 to 56th by February 2026, indicating some positive traction, though still outside the top 30. Meanwhile, Vapor Pens have experienced a decline, dropping from 68th in November 2025 to 80th by February 2026, which could suggest a shift in consumer preferences or stronger competition. Interestingly, Constellation Cannabis made an entry into the top 30 in the Capsules category in February 2026, debuting at rank 4, which marks a promising development in that segment. This varied performance across categories highlights the dynamic nature of the cannabis market in Washington and the brand's ability to capture consumer interest in certain segments while facing challenges in others.

Competitive Landscape

In the competitive landscape of the Concentrates category in Washington, Constellation Cannabis has demonstrated notable resilience and growth. Over the period from November 2025 to February 2026, Constellation Cannabis improved its rank from 5th to 3rd, showcasing a strategic upward trajectory amidst strong competition. This improvement is particularly significant given the consistent dominance of Ooowee, which maintained the top position throughout, and Delectable Dabs, which held steady at 2nd place. Despite Dabstract experiencing a decline from 3rd to 4th place, Constellation Cannabis capitalized on this shift, enhancing its market position. Additionally, while Forbidden Farms showed a slight improvement in rank, Constellation Cannabis's sales growth trajectory was more pronounced, particularly in February 2026, where it saw a significant sales increase. This competitive analysis highlights Constellation Cannabis's strategic advancements in a dynamic market, positioning it as a formidable contender in the Washington Concentrates sector.

Notable Products

In February 2026, the top-performing product for Constellation Cannabis was the Moonshot - Blue Raspberry Nano Emulsified Hash Rosin Beverage, maintaining its number one rank for four consecutive months with sales of 2457 units. The Moonshot - Green Apple Nano Emulsified Hash Rosin Beverage held its position at rank two, consistent with its performance from January 2026. The Moonshot - Pineapple Nano Emulsified Hash Rosin Beverage entered the rankings for the first time at position three. The Gravity - CBG/CBD/THC 1:1:1 Watermelon Hash Rosin Gummies slipped to rank four, after previously being unranked in December 2025 and January 2026. Lastly, the Moonshot - Peach Mango Nano Emulsified Hash Rosin Beverage debuted at rank five, showcasing its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.