Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

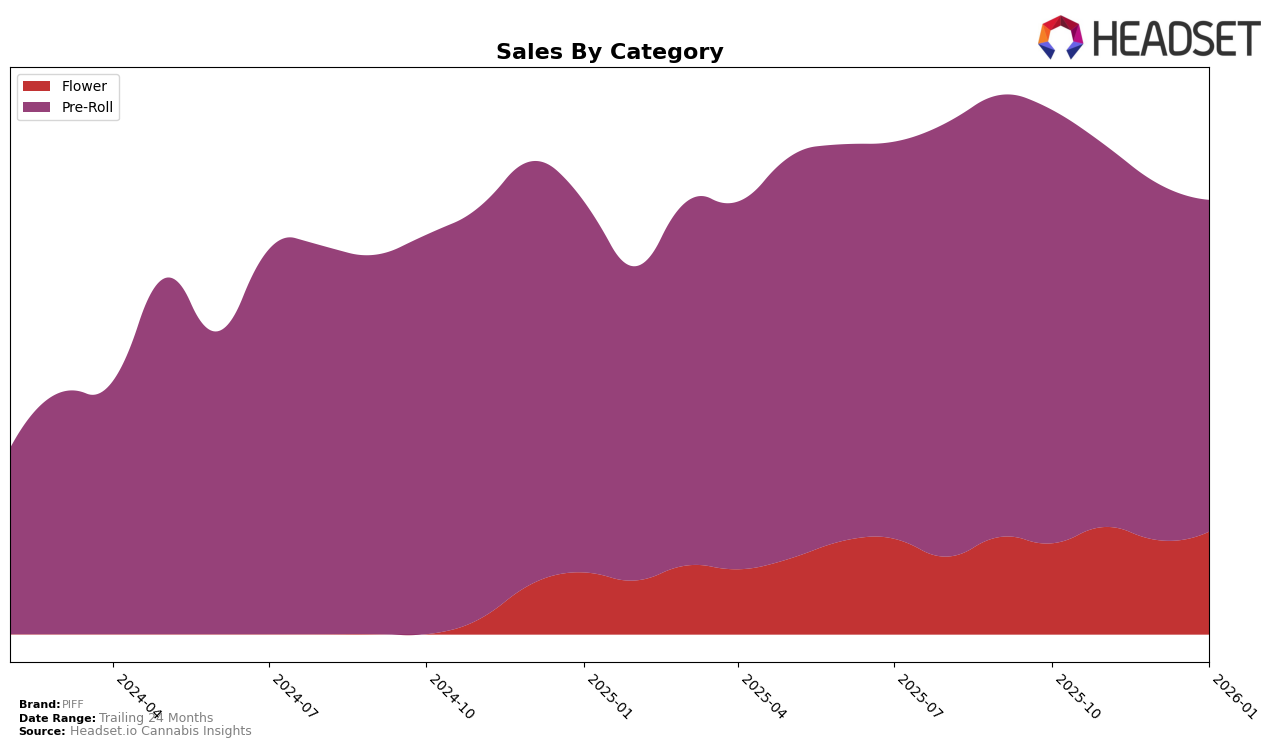

PIFF has demonstrated notable performance variations across different categories and provinces. In the Flower category within Alberta, the brand has seen fluctuations in its rankings, moving from 55th in October 2025 to 42nd by January 2026. This indicates a positive trajectory despite not breaking into the top 30 during this period. Meanwhile, in Ontario, PIFF has maintained a more stable position, consistently hovering around the mid-30s. Such stability in Ontario's Flower category suggests a steady consumer base, which contrasts with the more volatile performance in Alberta.

In the Pre-Roll category, PIFF's performance in Alberta has been relatively strong, consistently ranking within the top 20, although it hasn't broken into the top 15. This consistent placement is a positive indicator of its market presence. In Ontario, PIFF has shown impressive strength in the Pre-Roll category, maintaining a top 10 position throughout the observed months. Despite a slight dip in sales from October to January, PIFF's ability to hold a high ranking reflects robust consumer demand. The brand's performance across these provinces highlights its varying market strategies and consumer engagement levels in different regions.

Competitive Landscape

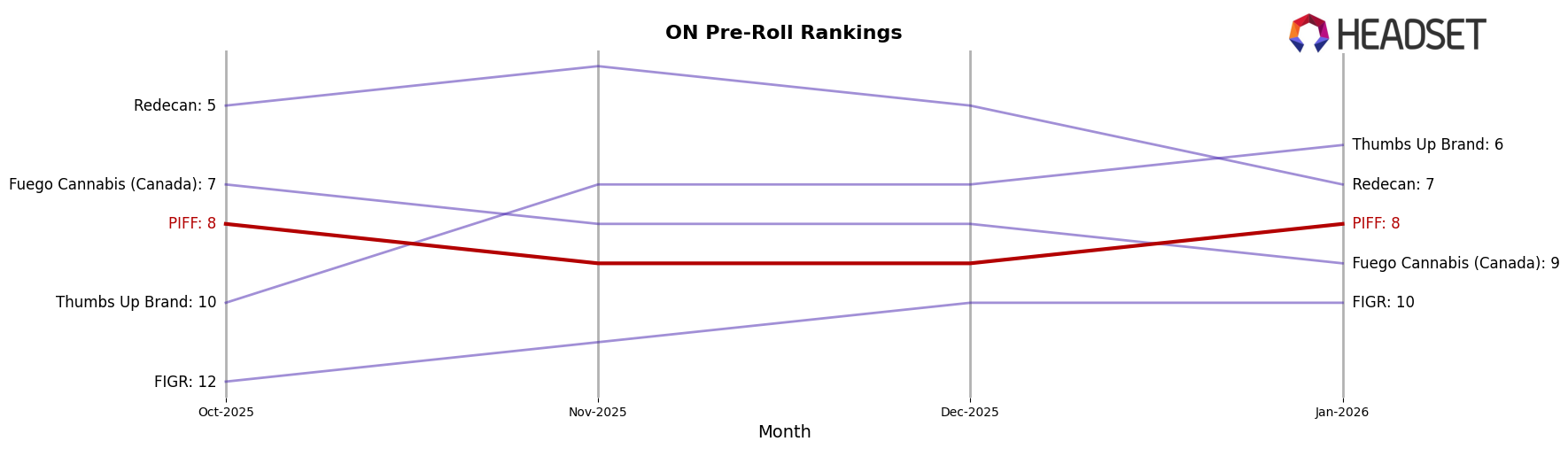

In the competitive landscape of the Pre-Roll category in Ontario, PIFF has experienced a relatively stable yet challenging position over the past few months. While PIFF maintained a consistent rank of 8th in October 2025 and January 2026, it saw a slight dip to 9th in November and December 2025. This fluctuation in rank is indicative of the competitive pressures from brands like Redecan, which consistently held higher positions, peaking at 4th in November 2025, and Thumbs Up Brand, which improved its rank from 10th in October 2025 to 6th by January 2026. Additionally, FIGR and Fuego Cannabis (Canada) have shown varying performances, with FIGR maintaining a steady 10th place in January 2026, and Fuego dropping to 9th. Despite these competitive dynamics, PIFF's sales trajectory indicates a decline, reflecting the need for strategic adjustments to regain momentum and improve its market position against these formidable competitors.

Notable Products

In January 2026, Maui Wowie Pre-Roll 2-Pack (2g) maintained its leadership position as the top-selling product from PIFF, despite a decline in sales to 39,951 units. Cali Kush Pre-Roll 2-Pack (2g) consistently held the second position, followed by Juicy Blunt (1g) in third place, both showing steady rankings over the past months. Panama Gold Pre-Roll 2-Pack (2g) improved its standing to fourth place, surpassing Dutchy Blunt (1g), which dropped to fifth. This shift in rankings highlights a notable increase in demand for Panama Gold compared to previous months. Overall, the top products have shown resilience in their rankings, although sales figures have generally decreased since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.