Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

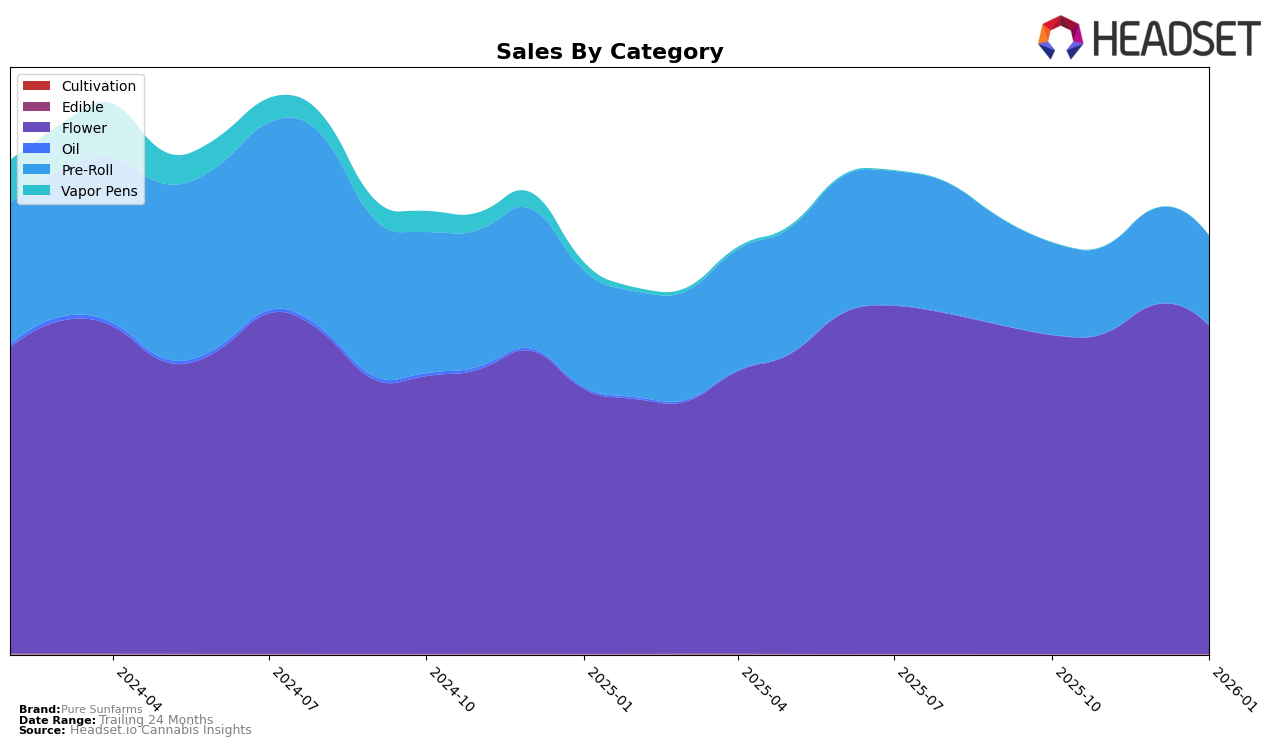

Pure Sunfarms has shown notable performance across various categories and provinces, particularly in the Flower category. In Alberta, the brand has consistently improved its ranking from fifth in October 2025 to second by January 2026, indicating a strong market presence and effective strategies in the Flower category. Similarly, in British Columbia, Pure Sunfarms climbed from tenth to fifth place by December 2025, maintaining this position into January 2026. This upward trajectory in the Flower category across these provinces suggests a growing consumer preference for their products. However, in Ontario, the brand has remained steady in the sixth position, which could indicate a saturated market or a need for more aggressive marketing strategies to climb higher in the rankings.

In contrast, Pure Sunfarms' performance in the Pre-Roll category presents a mixed picture. In Alberta, the brand's ranking in Pre-Rolls fluctuated, starting at 28th in October 2025, dropping out of the top 30 in November, but bouncing back to 23rd by January 2026. This volatility could reflect inconsistent consumer demand or supply chain challenges. Meanwhile, in British Columbia, Pure Sunfarms did not rank in the top 30 in October 2025 but managed to secure the 32nd position by December and maintained it into January 2026. This gradual entry into the top 30 suggests a slow but steady acceptance in the Pre-Roll category. In Ontario, the brand showed more stability, with rankings hovering between 15th and 18th, indicating a consistent consumer base for their Pre-Roll products. These insights highlight the brand's varying performance across categories and regions, pointing to potential areas for strategic focus and improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Pure Sunfarms has experienced a slight decline in its ranking, shifting from 5th place in October 2025 to 6th place from November 2025 through January 2026. This change in rank can be attributed to the consistent performance of competitors like Big Bag O' Buds, which maintained a steady 4th place ranking, and The Original Fraser Valley Weed Co., which improved from 6th to 5th place over the same period. Despite these shifts, Pure Sunfarms remains a strong contender, with sales figures closely trailing those of its competitors. Meanwhile, 3Saints has shown notable upward momentum, moving from 11th to 7th place, indicating a potential future challenge for Pure Sunfarms. The competitive dynamics in the Ontario Flower market suggest that while Pure Sunfarms is holding its ground, it faces increasing pressure from both established and emerging brands.

Notable Products

In January 2026, Pink Kush (3.5g) led the sales for Pure Sunfarms, maintaining its top rank from the previous three months, with a sales figure of 24,499. Pink Kush (7g) held steady in the second position, showing consistency in its performance from December 2025. The Pink Kush Pre-Roll 10-Pack (3g) dropped to third place, continuing its decline from the first position in October 2025. Additionally, the Pink Kush Pre-Roll 10-Pack (3.5g) remained in the fourth position, having been introduced in December 2025. The Pink Kush (28g) has consistently held the fifth rank since November 2025, indicating stable but lower sales compared to other product sizes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.