Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

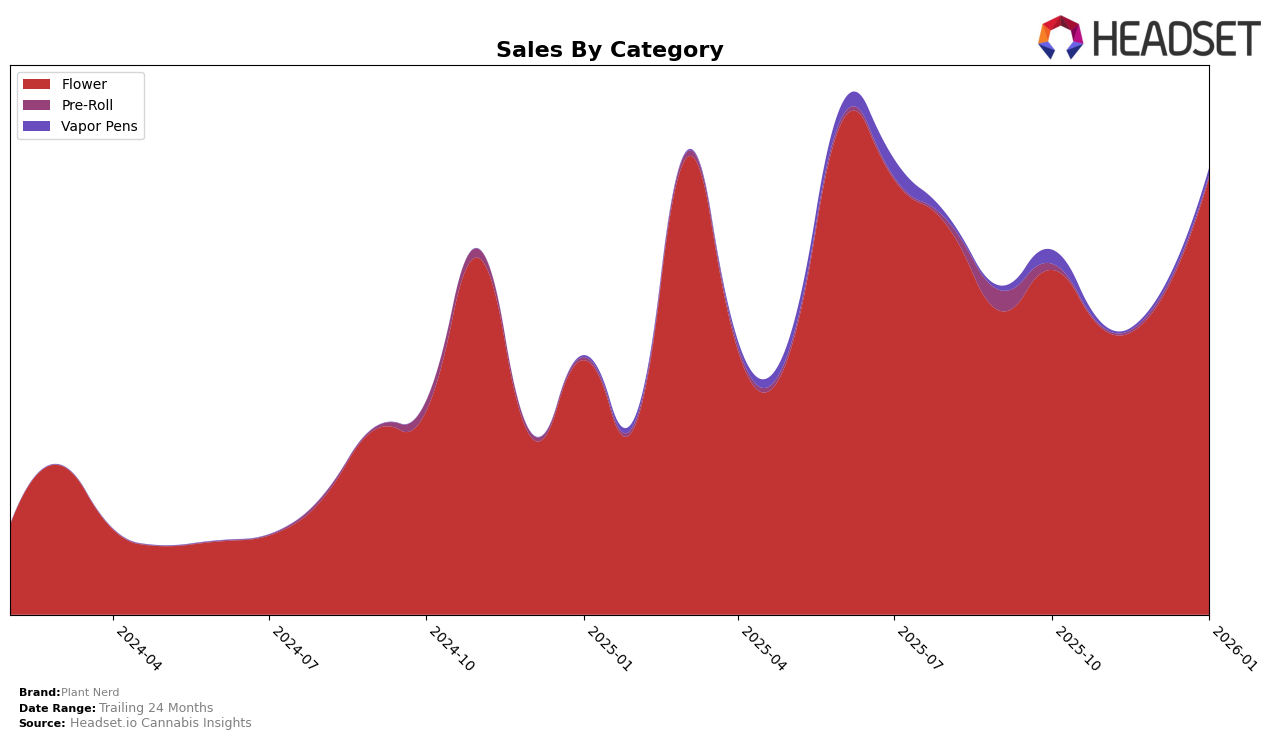

Plant Nerd has shown notable fluctuations in its performance across different categories and states, particularly in the Michigan market. In the Flower category, the brand started at rank 22 in October 2025 and experienced a slight decline to rank 26 in both November and December. However, by January 2026, Plant Nerd made a significant leap to rank 12, indicating a strong recovery and potential growth momentum in this category. This upward movement in the Flower category is a positive sign, especially considering the competitive nature of the market. It's also worth noting that while the brand's sales saw a dip in November, they rebounded in December and showed a strong increase in January, aligning with the improved ranking.

In contrast, Plant Nerd's performance in the Vapor Pens category in Michigan was less promising. The brand was ranked 97 in October 2025, and unfortunately, it did not appear in the top 30 rankings for the subsequent months, which suggests a struggle to maintain competitiveness in this category. This absence from the top rankings could indicate challenges in market penetration or consumer preference shifts. The lack of presence in the top 30 for consecutive months highlights a potential area for strategic reevaluation or increased marketing efforts to regain traction in the Vapor Pens segment. The contrasting performance across these categories offers a nuanced view of Plant Nerd's market dynamics in Michigan, suggesting areas of strength and opportunities for improvement.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Plant Nerd has experienced notable fluctuations in its market position, reflecting dynamic shifts in consumer preferences and competitive pressures. From October 2025 to January 2026, Plant Nerd's rank oscillated significantly, starting at 22nd, dipping to 26th in November and December, before rebounding to 12th in January. This recovery suggests a strategic adjustment or successful marketing campaign that resonated with consumers. In contrast, Grown Rogue consistently maintained a top 20 position, indicating stable consumer loyalty and possibly a strong brand presence. Meanwhile, Goldkine showcased a dramatic rise from 34th in November to 12th in December, suggesting a significant market intervention or product launch, though it slightly fell to 13th in January. Grip also showed a strong performance, climbing from 34th in October to consistently hold 11th place in December and January. Dubs & Dimes demonstrated a steady improvement, moving from 25th in October to 14th by January. The competitive dynamics indicate that while Plant Nerd has faced challenges, its recent upward trajectory in January could be a promising sign of regained market strength amidst fierce competition.

Notable Products

In January 2026, Cap Junky (Bulk) reclaimed its position as the top-performing product for Plant Nerd, with sales reaching 4,966 units. Ocean Air (Bulk) followed closely in second place, maintaining a strong presence since its peak in November 2025. Bubble Bath (Bulk) made a notable entrance into the rankings at third place, while The Soap (Bulk) held steady in fourth position across several months. Deep Fried Ice Cream (Bulk) slipped to fifth place after previously ranking second in November 2025. Overall, the rankings show that while some products have maintained consistent performance, others like Bubble Bath (Bulk) are emerging as strong contenders in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.