Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

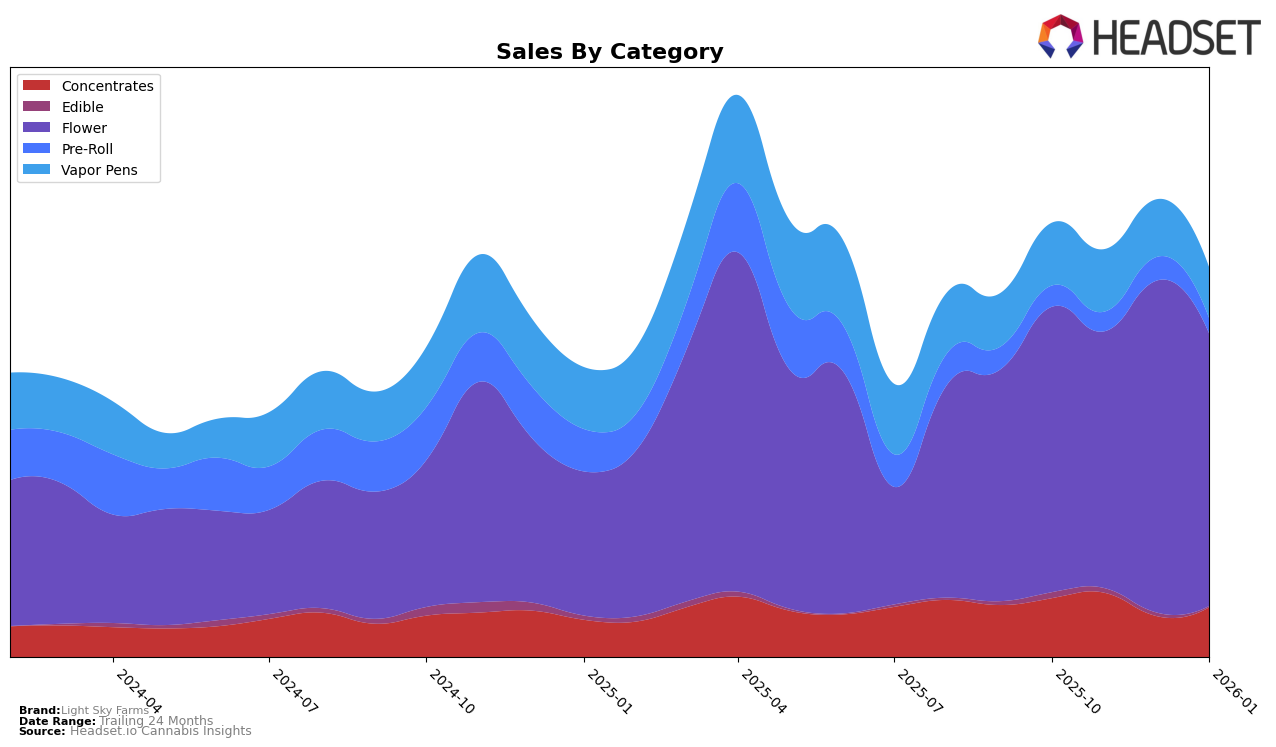

Light Sky Farms has shown a varied performance across different product categories in Michigan. In the Concentrates category, the brand experienced a dip in ranking from 18th in October 2025 to 37th by December 2025, before recovering to 29th in January 2026. This fluctuation suggests a volatile market position in Concentrates, potentially indicating competitive pressures or changes in consumer preferences. The Flower category, however, tells a different story, with Light Sky Farms achieving a notable improvement from 35th in November 2025 to 25th in December 2025, although it slightly dropped to 28th in January 2026. This upward movement in December could point to a successful strategy or product launch during that period.

In contrast, the Vapor Pens category has not been as favorable for Light Sky Farms in Michigan. The brand did not manage to break into the top 30 rankings, consistently placing in the 50s across the months analyzed. This consistent lower ranking suggests a potential area for growth or reevaluation, as the brand may not be meeting consumer expectations or facing strong competition from other brands. Despite these challenges, the overall sales in the Flower category, which reached over $962,000 in December 2025, highlight that Light Sky Farms maintains a strong presence in at least one significant segment of the Michigan market. This strength in Flower could provide a foundation for strategic expansion or innovation in other categories.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Light Sky Farms has shown a dynamic performance over the past few months. Starting from October 2025, Light Sky Farms was ranked 32nd, improving to 25th by December, but slightly dropping to 28th in January 2026. This fluctuation is notable when compared to competitors like North Cannabis Co., which consistently hovered around the 30th rank, and Six Labs, which made a significant leap from 78th in November to 27th in January. Meanwhile, Carbon maintained a stronger position, consistently ranking in the top 30, although it did see a drop from 18th in December to 26th in January. The entry of Glo Farms into the top 30 in January also adds pressure to the competitive environment. Despite these challenges, Light Sky Farms achieved a peak in sales in December, indicating a strong market presence and potential for growth amidst fluctuating ranks.

Notable Products

In January 2026, Donny Burger (14g) emerged as the top-performing product for Light Sky Farms, climbing from the second position in December 2025 to first place with notable sales of 6796 units. Titty Sprinkles (1g) dropped from its previous leading position in December 2025 to second place in January 2026. Perfect Triangle Smalls (Bulk) made a significant entry, securing the third spot in January without previous rankings in prior months. Meanwhile, Titty Sprinkles Smalls (1g) maintained a steady presence, ranking fourth, slightly down from third in November 2025. Lastly, Biscotti Live Resin Cartridge (0.5g) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.